According to recent findings, the typical tenant's rental expense represents around 42% of their pre-tax earnings.

Sometimes, looking at statistics can leave you feeling like you've been hit hard, robbed of breath. Recently, Zumper published its 2024 Yearly Rental Report. One point from this report showed a significant portion of the country struggling with high average rent costs:

"In 2024, renters spent an average of 42% of their pre-tax income on housing, which is a significant increase from 35% in 2021, despite a majority believing rent should only consume 30% of income," Zumper stated.

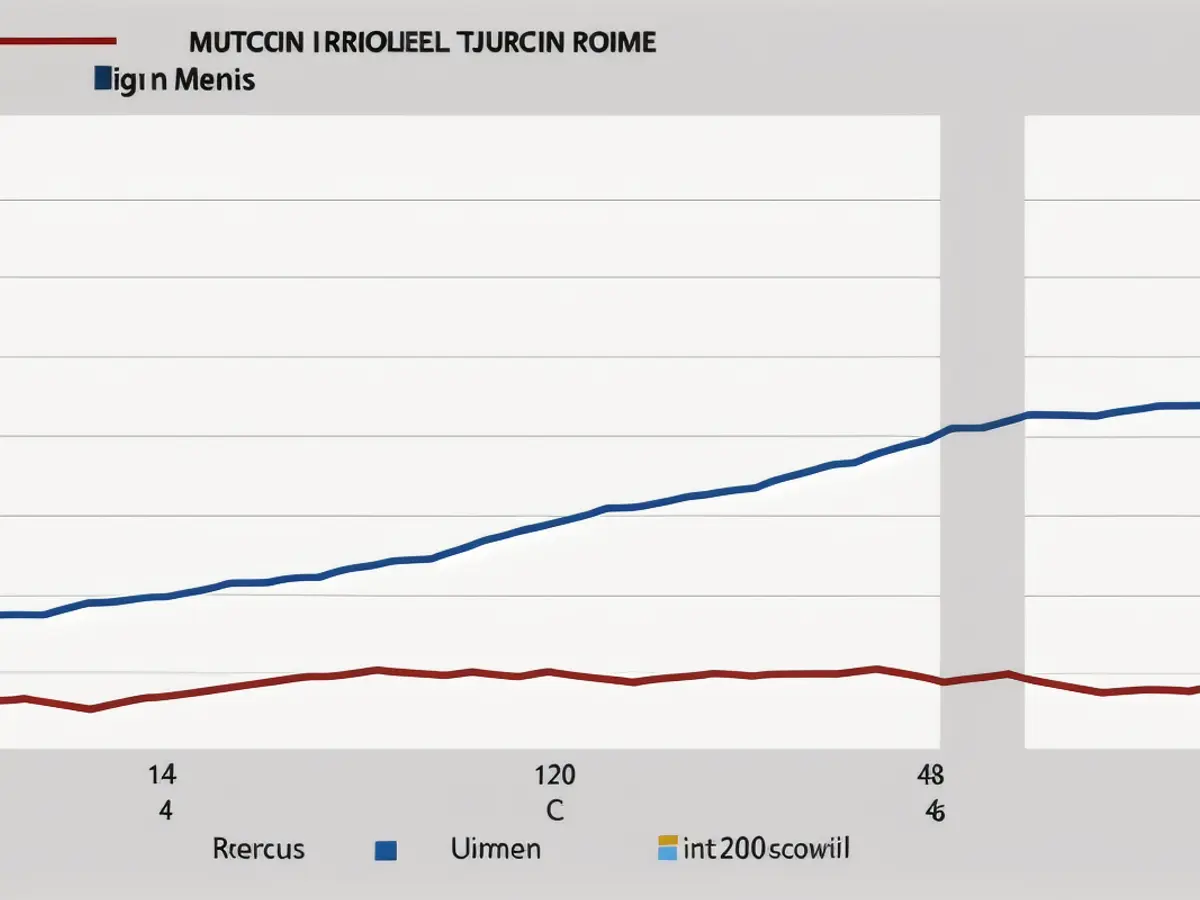

It's both shocking and disheartening. The divide between individuals' earnings and their rental expenses has never been as wide as a vast crevice. Here's a graph representing the Consumer Price Index of primary residence rent from the U.S. Bureau of Labor Statistics. The values from 1982 to 1984 serve as the basis for this comparison.

In January 2023, Moody's stated that for the first time in its 20-plus years of monitoring the ratio, the United States as a whole was considered "rent-burdened." This meant that the national average rent-to-income ratio showed average rents equal to or exceeding 30% of household income. Moody's, known mainly for financial risk analysis, attributed this to rising mortgage rates (which would further impact housing affordability due to escalating house prices). This situation forced many individuals and families to rent rather than build equity with predictable annual rent hikes.

"Rent demand skyrocketed as a result, leading to soaring rental rates," Moody's wrote. "As the gap between rent growth and income growth widens, American wallets face significant financial strain, as wage growth lags behind rent growth."

For additional clarity, here's a graph depicting the Consumer Price Index, a popular government measure of inflation for primary residence rent, and the median household income, adjusted for inflation, from 1984 to 2023.

If your household income isn't significantly above the median, and real income grows by 10% or more annually, it's challenging to make ends meet without a grueling fight. For reference, here's a graph showing how wages grow according to your position within the economic strata – whether you're at the 25th percentile, median, or 75th percentile.

Unsurprisingly, although more renters expressed confidence in the economy than the previous year, as reported by Zumper, only 50% said they were getting a good deal on rent. Compared to last year, this figure dropped from 53%. Given that the average means renters spend 42% of their income on housing, it's surprising that satisfaction levels aren't lower.

Though more renters were optimistic about the economy this year, according to Zumper, this only accounted for 18% compared to 11% the prior year. Looking at this figure another way, an overwhelming 82% of renters questioned have a negative outlook on the economy, and 67% believe the country is experiencing a recession. This isn't surprising given the challenges of meeting all living expenses when income is insufficient.

The Zumper survey polled 7,205 renters aged 18 or older from all 50 states and Washington, D.C. However, it's important to note that the questionnaire was distributed to "Zumper and PadMapper users in the United States, as well as being passed on to their family and friends," which means the results may not accurately represent the United States as a whole. Nonetheless, this is far from positive news.

Despite the increase in rent costs, many individuals are forced to prioritize rent payments over saving for personal finance, as they spend 42% of their pre-tax income on housing in 2024. This high rent-to-income ratio can put a significant financial strain on households, leaving little room for savings or other personal expenses.