Annual Inflation Rate Data Divided by Category and Geographical Location

Inflation has been a significant financial hurdle for Americans in the 2020s, influencing the recent presidential election. According to CBS News exit polls, a staggering 75% of voters reported experiencing moderate to severe hardship due to inflation within the past year.

Optimally, inflation should barely exist in an economy, serving as a sign of prosperity by most economists. The Federal Reserve aims for a long-term inflation rate of 2%, and for the vast majority of the previous 20 years, the U.S. inflation rate closely approximated this goal.

However, the inflation rate has exhibited notable fluctuations throughout this period. Inflation has impacted certain regions and types of expenses disproportionately. To gain a better understanding of inflation statistics over the last two decades, let's delve into the details. Data for inflation is derived from the Consumer Price Index (CPI). The CPI inflation rate measures the average change in urban consumer prices for goods and services annually.

Currently, the inflation rate is 3% as of January 2025, with core inflation (excluding food and energy) rising by 2.3% compared to the previous year. Over the 20-year duration from January 2005 to 2025, the average inflation rate was 2.6%. Although both figures are higher than the Fed's 2% target, they are not off by a significant margin. In times of scarcity or abundance, inflation rates may deviate from this norm.

Great Recession (2008-2009): Inflation plummeted during this period, going from 5.6% in July 2008 to a negative 2.1% the subsequent year. The housing market collapsed, banks tightened lending standards, and unemployment surged to 10%. Consumer borrowing and spending declined, causing a brief period of deflation.

0%-2% 10.7%

Global Pandemic (2020): Inflation rates fluctuated significantly during this period. From January to May 2020, inflation dropped from 2.5% to 0.1%, mainly due to lockdown measures and widespread economic uncertainty that prompted reduced discretionary spending. Consumers followed suit by restricting their nonessential expenditures.

However, by the following year, inflation was exceeding 9%, with June 2022 recording a peak of 9.1% - the highest rate in 41 years. A myriad of factors contributed to this surge, such as high demand for goods and services, supply chain disruptions, and the Russia-Ukraine war increasing energy and food costs.

2%-3% 13.8%

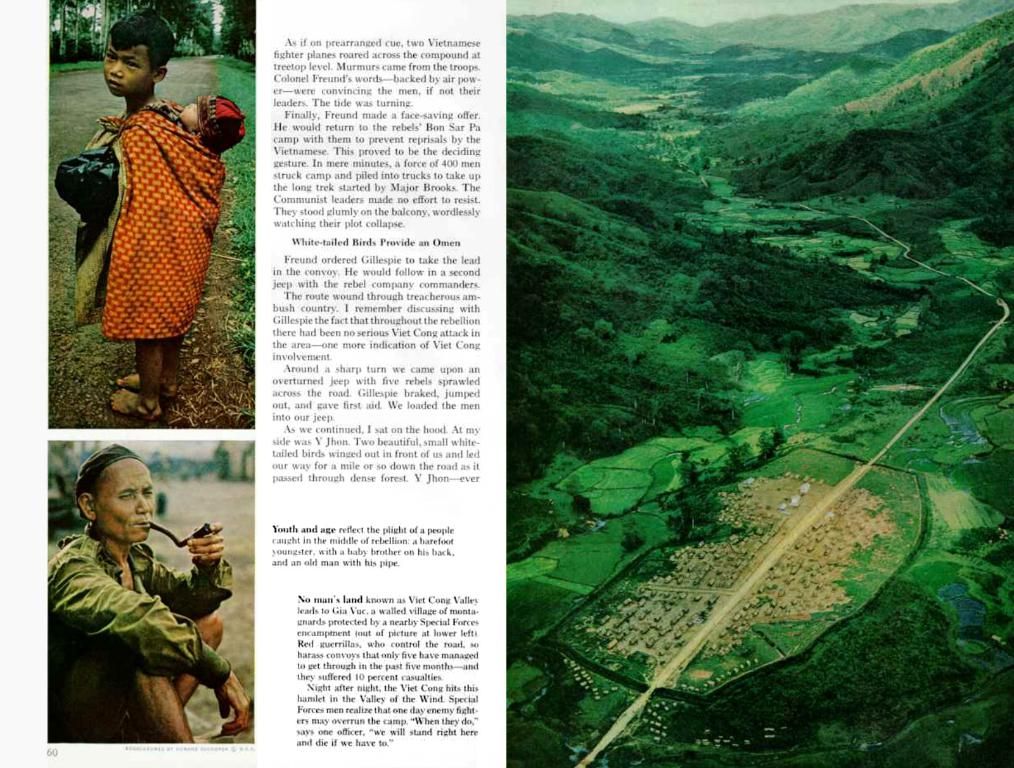

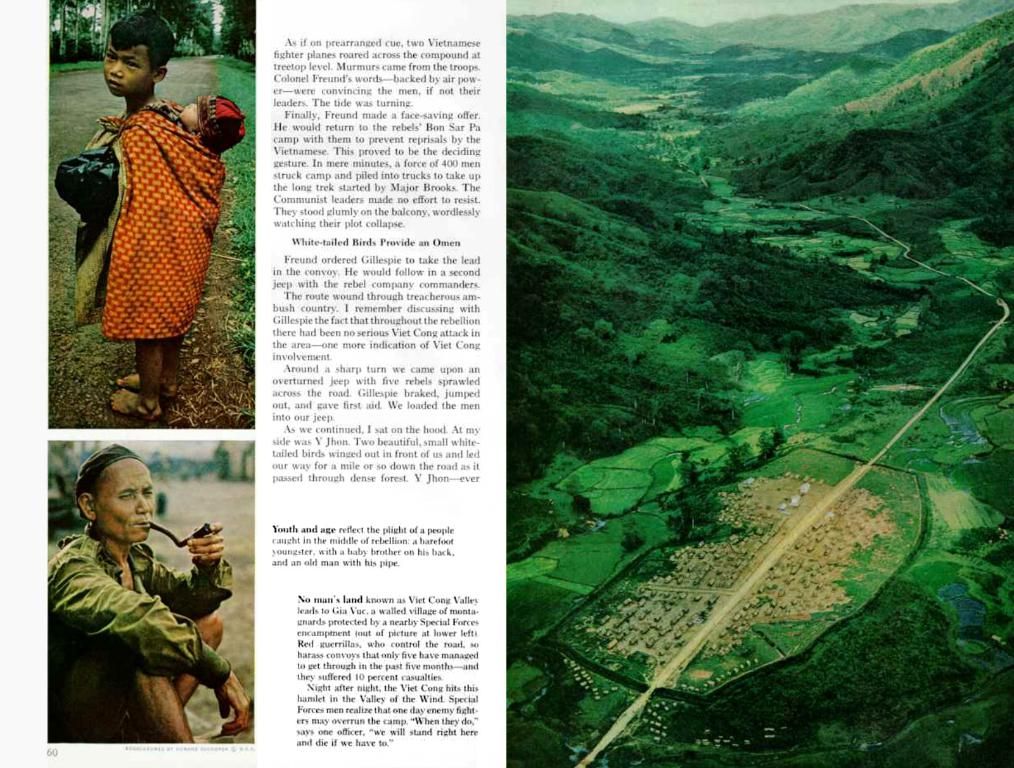

Regional Inflation: Although national and regional inflation rates are similar, certain areas may experience inflation disproportionately. For instance, from late 2013 to 2020, the West had an elevated inflation rate, often exceeding the national rate by 1% or more. In contrast, the South and Northeast regions had lower and higher inflation rates, respectively.

The primary driver of regional differences in inflation is housing prices. According to an analysis by the Federal Reserve Bank of Chicago, house prices significantly influenced regional inflation across the country.

3%-5% 8.5%

Category-Specific Inflation: Inflation varies significantly across different categories. For example, energy prices fluctuate based on oil prices, and food inflation varies due to transportation costs, grain prices, and droughts. Energy inflation experienced a significant swing during the Great Recession and the pandemic, while food inflation surged in 2022 and remained high through 2023.

2.4%

In conclusion, inflation continues to impact the U.S. economy, with a variety of external factors contributing to its fluctuations in recent years. To navigate these changing economic conditions, investors should evaluate inflation trends to determine optimal buying and selling opportunities. Keeping a keen eye on these trends is essential as they play a significant role in shaping stock values and overall financial health.

Over 5%

- Despite the 3% inflation rate as of January 2025, causing concern among many Americans, the average inflation rate over the past 20 years remains relatively close to the Federal Reserve's 2% target.

- CBS News exit polls revealed that an alarming 75% of voters in the recent presidential election reported experiencing moderate to severe hardship due to inflation within the past year.

- Research on inflation statistics over the last two decades has shown that certain regions and types of expenses have been disproportionately impacted, with the West region frequently exceeding the national inflation rate by 1% or more.

- To better understand how inflation impacts various categories, economic researchers often analyze data derived from the Consumer Price Index (CPI), which measures the average change in urban consumer prices for goods and services annually.