Banks continue to struggle with agricultural lending, despite initiatives like GIRSAL.

Banks in Ghana are still shying away from plunging into the agriculture sector, even with the presence of the Ghana Incentive-based Risk-sharing System for Agricultural Lending (GIRSAL), causing a constant tide of frustration among stakeholders in the agricultural value chain.

GIRSAL is designed to reduce the risk associated with agricultural financing for financial institutions by issuing agriculture credit guarantee instruments, enhancing the overall credit to agricultural and agribusiness sectors. However, the sector's players claim they are still wrestling with the age-old dilemma of rejection by financial institutions.

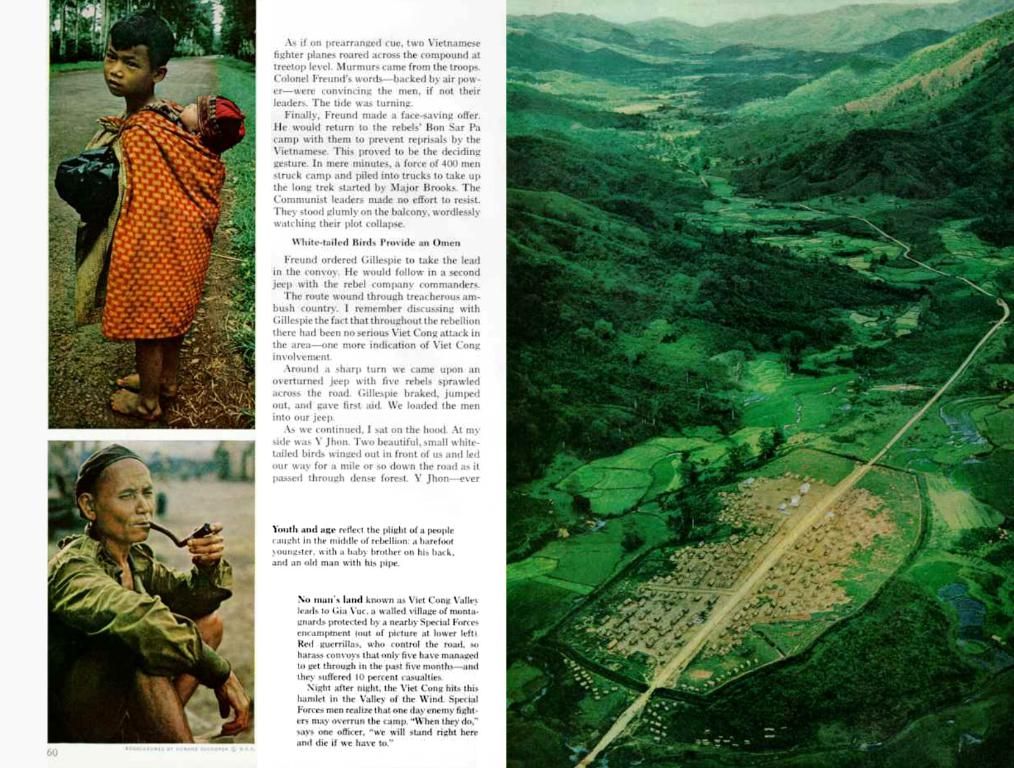

Emmanuel Darkey of EDarkey and Associates voiced his bitter experiences in procuring funding from banks to scale up his sweet-potato production and processing business. "Banks are a blight on the agriculture sector," he lamented, without naming any specific institutions. According to him, the cumbersome process, which can take up to three years of continual documentation and review, coupled with the banks' reluctance to fund agricultural ventures, contributes to the dwindling fortunes of the agriculture sector.

Similarly, Alfred Quaynor, representing Precision Solutions, a company specializing in spraying and monitoring agricultural crops using drones and technology tools, believes banks are yet to grasp the concept of agricultural financing.

"Most banks don't understand the nuances of agriculture financing. Instead, they view agricultural funding as they would any other business," he said, highlighting the need for banks to invest in individuals who have a comprehensive understanding of the industry's inner workings - agriculture finance specialists.

Like Mr. Darkey, he questioned the rationale behind the requirement of having a three-year track record to qualify for a facility, adding that startups in the sector need support to stay afloat during the initial years.

The stubborn narrative of banks not offering sufficient support to the agribusiness sector was a prevalent theme at the investment dialogue for select agribusinesses, investors, industry experts, and financial institutions. This raises questions about whether banks are fully leveraging the potential of GIRSAL.

Despite the perceived risk in lending to the agriculture sector in Ghana, agriculture represented 4.5 percent of total credit to the private sector according to a May 2020 Banking Sector report by the Bank of Ghana.

On the path forward, Mr. Quaynor advocated for a collaborative approach between policymakers, service providers, and all stakeholders. He emphasized the need for open dialogue, acknowledging that misunderstandings can arise if the parties involved don't have a clear perspective of each other's needs.

In essence, despite GIRSAL's attempt to reduce the risk associated with agricultural financing, banks in Ghana continue to exhibit caution when it comes to investing in agriculture. This is due to several factors, including risk perceptions, outdated financing models, and broader structural challenges within the sector[1][3][4][5].

[1] Aryeetey, J. K., & Oppong, K. O. (2020). Agriculture in Ghana: Challenges and the way forward. Ghanaian Chronicle.[2] Nouzier, B., & Rimbert, M. (2018). Agricultural financing in sub-Saharan Africa: Opportunities and challenges. International Food Policy Research Institute.[3] Swaniker, J. B. S. (2020). Transforming Africa's agriculture: Innovations that work. Wiley.[4] Kwamina, O., & Armah, F. K. (2020). Strengthening agricultural value chain finance in Ghana. CGAP.[5] Immokolee, M., & Mude, R., (2018). Financing Agri-Food SMEs in Africa: Challenges and Opportunities in Kenya, Rwanda and Uganda. The World Bank.

- Despite GIRSAL's efforts to mitigate the risk of agricultural financing, banks in Ghana continue to demonstrate reluctance towards investing in agriculture, due to factors such as risk perceptions, outdated financing models, and broader structural issues within the sector.

- Emmanuel Darkey, of EDarkey and Associates, expressed frustration at the difficulty of securing funding from banks for his sweet-potato production and processing business, suggesting that the lengthy and complicated process, along with banks' hesitance to fund agricultural ventures, is detrimental to the agriculture sector's growth.

- Alfred Quaynor, representing Precision Solutions, believes that banks lack a comprehensive understanding of agricultural financing, viewing it as they would any other business. He advocates for banks to invest in agriculture finance specialists to address this knowledge gap.

- In the investment dialogue for select agribusinesses, investors, experts, and financial institutions, the persistent narrative of insufficient support for the agribusiness sector from banks was a recurring topic, sparking questions about the full utilization of GIRSAL's potential.

- It's worth noting that, according to a May 2020 Banking Sector report by the Bank of Ghana, agriculture represented 4.5 percent of total credit to the private sector.

- Onward, Mr. Quaynor advocates for a collaborative approach between policymakers, service providers, and all stakeholders, emphasizing the importance of open dialogue to minimize misunderstandings and better understand each party's unique needs. This could potentially lead to more effective investments and support for the agriculture sector, ultimately benefitting the broader financial and business markets in Ghana.