BRICS, Trump, and Gold: Unveiling Factors That May Rouse Public Awareness (According to Andy Schectman)

In a series of insightful interviews, Andy Schectman, president of Miles Franklin Precious Metals, has been discussing the potential implications of global economic shifts, particularly in the context of the BRICS nations and their gold accumulation plans.

## BRICS and Gold Accumulation

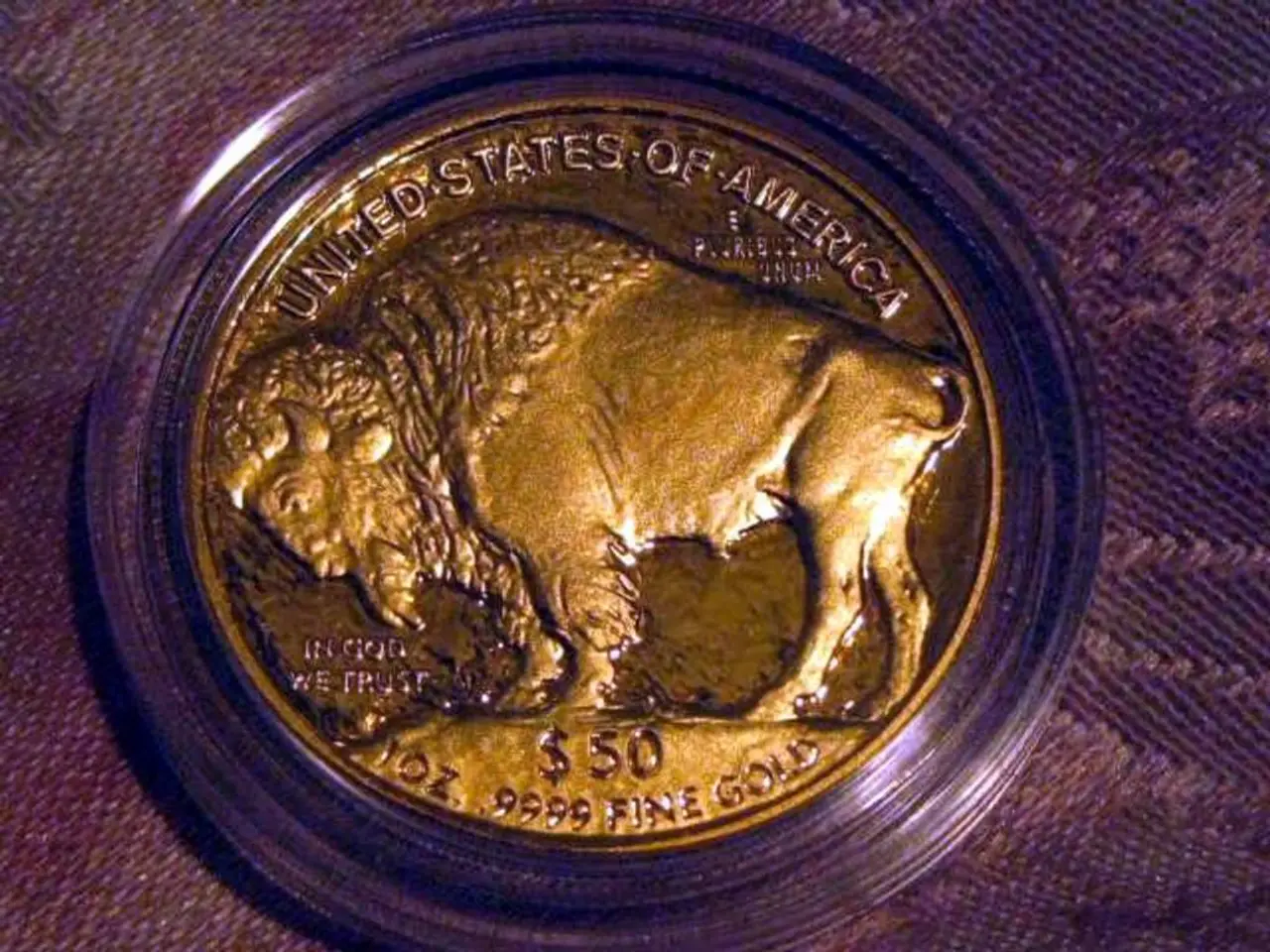

Schectman sees the BRICS nations as part of a broader reset in the global financial landscape. He suggests that gold plays a crucial role in this transition, with the potential for significant price increases. This perspective aligns with his belief in a global financial reset, which could see gold revalued substantially.

## Trigger for Increased Gold and Silver Buying

Schectman emphasizes the potential for a global financial reset, which could drive up interest in gold and silver. He highlights silver as particularly undervalued, with "asymmetrical" potential—meaning low downside and high upside. This suggests that any significant economic instability or shift in global currency dynamics could trigger increased buying of these metals.

## Impact of Donald Trump's Return

While there is no specific mention of how Donald Trump's return might affect BRICS' gold accumulation plans, Schectman does discuss the broader geopolitical context and potential tariffs imposed by Trump on BRICS nations, which could influence global economic dynamics.

## Conclusion

In summary, Schectman's predictions focus on the potential for a global financial reset and the importance of gold and silver in this context. However, specific links to Donald Trump's return and BRICS' gold strategies are not detailed in the current information. However, any significant geopolitical or economic shifts could potentially trigger increased interest in gold and silver across the globe.

Readers are encouraged to do their own due diligence, as the opinions expressed in the interviews do not reflect the opinions of the platform and do not constitute investment advice. The article does not guarantee the accuracy or thoroughness of the information reported in the interviews.

Charlotte McLeod, the author of the article, has no direct investment interest in any company mentioned. For updates from our organization, follow us on Twitter at @our_organization_Resource. A YouTube playlist of the Vancouver Resource Investment Conference is also available for viewing. The interview discusses Schectman's predictions for 2025 and investment positioning.

In line with Schectman's predictions for a global financial reset, he advocates that investors should consider allocating their business resources into assets like gold and silver, particularly silver, which he deems undervalued and capable of significant price increases. Moreover, should there be any geopolitical or economic shifts that influence financial landscapes, such as the BRICS nations' gold accumulation plans, this could trigger increased interest and investing in these precious metals.