Post-COVID Reboot: Germany Prepares to Bring Back 7-Year Government Securities

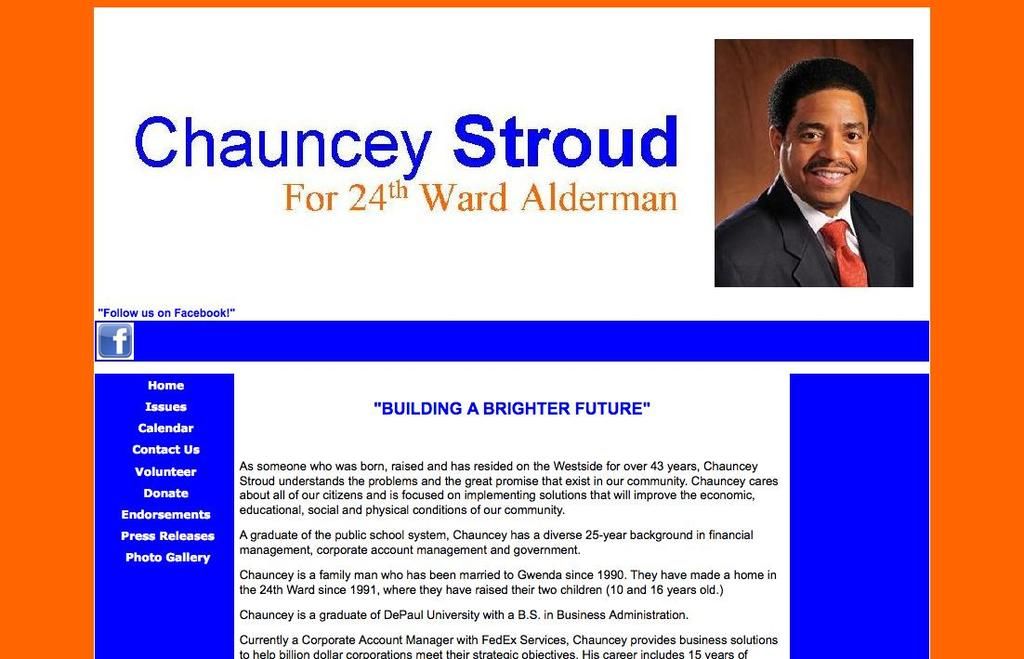

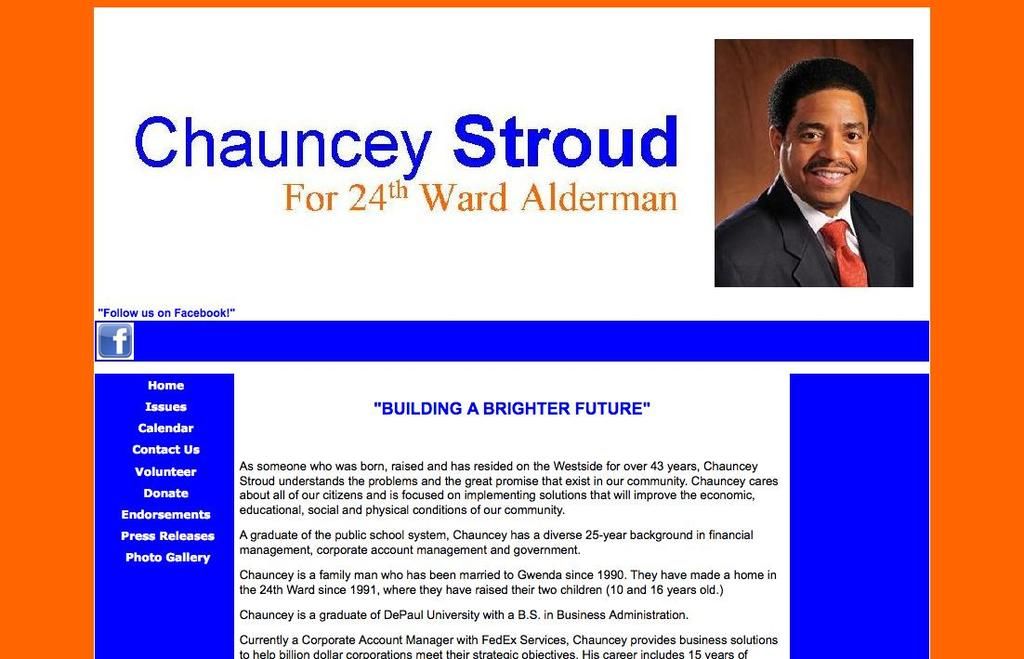

Contemporary Strategy of the Federal Government Includes Bringing Back Seven-Year Treasury Securities

Ready to cater to investors hunting for higher returns, the German Finance Agency is primed to re-launch seven-year government bonds. Aiming for a mid-year debut, these securities are a savvy choice for those seeking a slight premium over five-year bonds.

Following the government's plans to beef up investments in defense and infrastructure, they're looking at more borrowing. The German Finance Agency, in charge of handling bond sales, is gearing up for this increased debt load. To create some wiggle room, Germany's Parliament and Bundesrat recently tweaked the Basic Law.

Political Madness High Hopes for the Coalition Agreement "Expects an extended financing demand," stated Finance Agency Director Tammo Diemer.

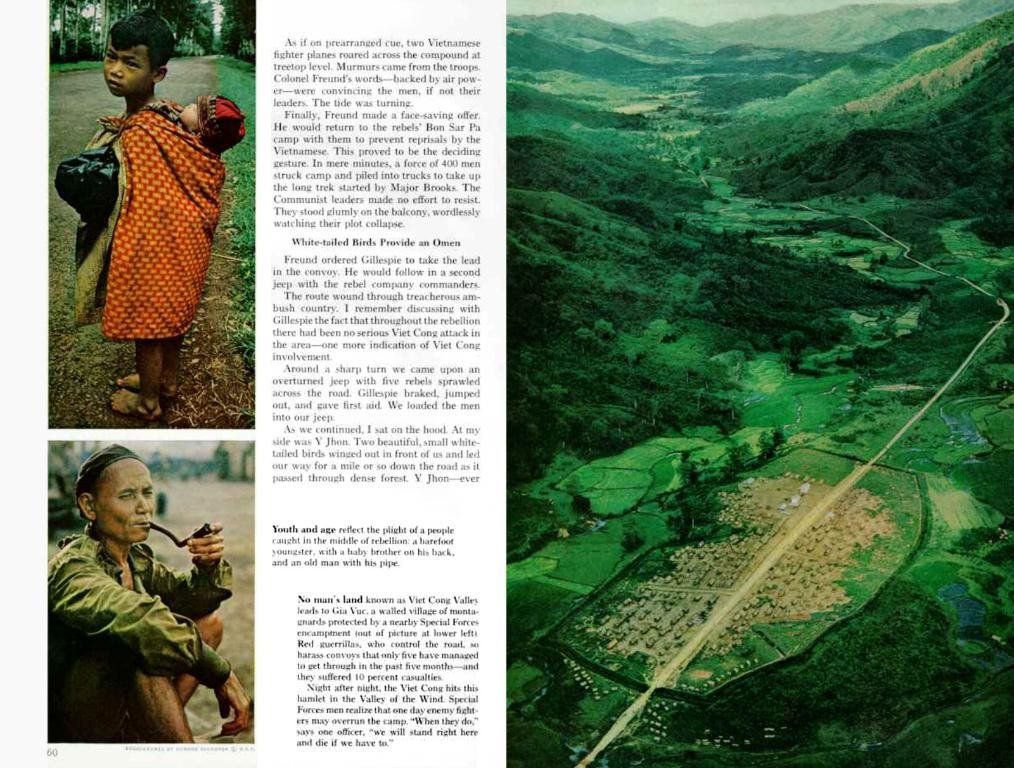

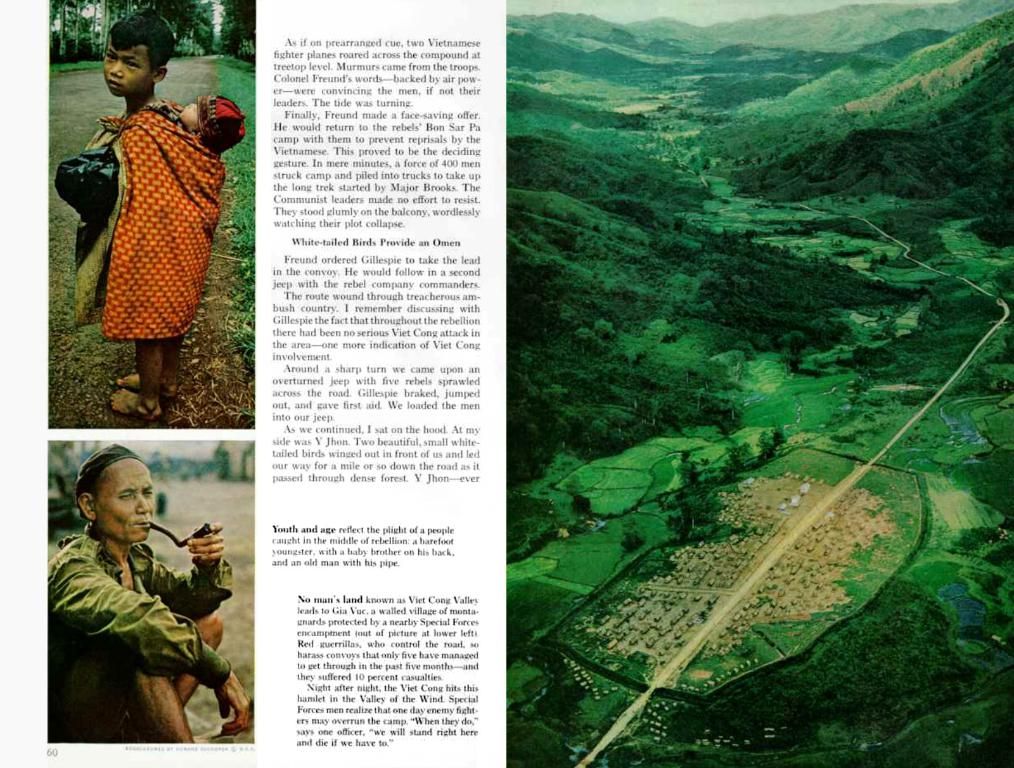

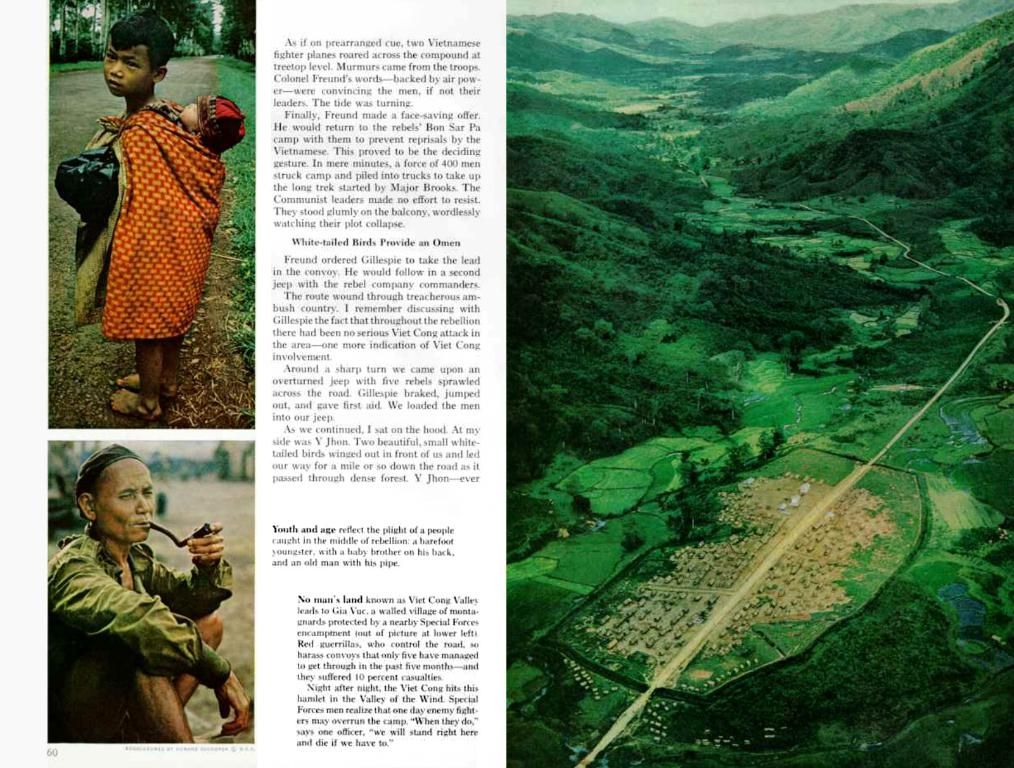

Amidst elevated financing needs, Germany aims to reinvest in its future. Back in 2020, seven-year bonds were introduced as a COVID-19 response measure, and they were sunset in 2024. Aside from the traditional five-year and 30-year bonds, Diemer hinted at exploring longer-term options, such as 50-year bonds.

International investors have appreciated the German government's financial relief packages. The political turbulence in the U.S. has pushed foreign investors to reconsider their Eurozone bond investments, gradually reducing their holdings. However, details about the specifics of the seven-year bond reintroduction for infrastructure and defense projects remains scant.

- Government Bonds

- Germany

- Fiscal Reforms

- Infrastructure Investments

- International Financing

Sources: ntv.de, mpa/dpa

Additional Notes:Germany has a current debt level above 60% of its GDP, requiring a seven-year adjustment period to reduce debt under EU fiscal rules. Ambitious fiscal reforms, including a €500 billion plan, may affect infrastructure investments, but the specific connection to seven-year bonds for infrastructure and defense projects isn't detailed in the search results.

- The reintroduction of seven-year government bonds in Germany is planned for mid-year, offering an attractive choice for investors seeking a slight premium over five-year bonds.

- In light of increased borrowing due to plans for defense and infrastructure investments, the German Finance Agency is preparing for a larger debt load, potentially relying on fiscal reforms for wiggle room.

3.Parallel to these financial adjustments, the German government is looking to extend its financing efforts towards vocational training, as part of its post-COVID reboot strategy.

- International investors are keeping a close eye on Germany's financial policies, with the potential for longer-term options like 50-year bonds under consideration during these economic shifts.

- The Community Policy and Bundestag/Bundesrat have recently made adjustments to the Basic Law, which may play a role in the finance and business decisions related to the general-news topic of seven-year government bonds.