"Critical factor looming over Bitcoin prices: A potential $482 billion trigger"

Unleashed: Bitcoin Soars Above $95,000 Amid Financial Turmoil

Bitcoin's price is breaking records, hitting a high of over $95,000 on Monday and holding steady. This impressive rally has been fueled by a couple of exciting developments.

Firstly, the recent optimism surrounding a potential trade deal between the United States and China has given a much-needed boost to Bitcoin and other cryptocurrencies.

Secondly, a surprising twist came when Trump signaled he wouldn't boot Jerome Powell from his post as the Federal Reserve Chairman. Trump's change of heart on tariffs and Powell's tenure is due to the chaos in the bond market, instigated by the fearsome bond vigilantes.

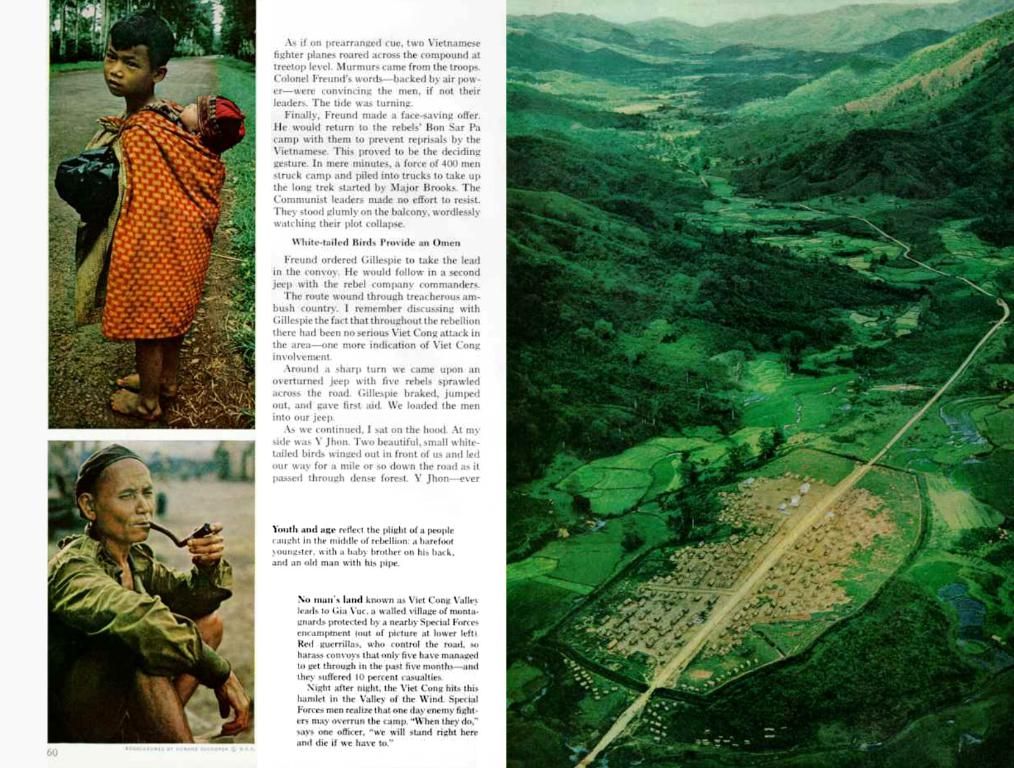

Now, here's a wildcard player in the game - if recent bank earnings are anything to go by, U.S. banks are sitting on massive unrealized losses, totaling a whopping $482 billion. These losses stem from longer-dated Treasury bonds that banks invested in during the era of rock-bottom interest rates.

Interest rates have skyrocketed from near zero during the pandemic to over 4% today. This dramatic increase has caused the value of existing fixed-income securities to drop, as they're no longer as attractive compared to freshly issued bonds boasting higher yields.

Some of the banks hit hardest by these unrealized losses are heavyweights such as Bank of America, Charles Schwab, JPMorgan Chase, and Wells Fargo. The challenges for these banks are twofold - they can't offload these bonds without incurring jaw-dropping losses that could slam their stock prices, and the Federal Reserve may struggle to lower interest rates as Trump has demanded. This could escalate inflation.

The possibility of one or more banks going the way of the failed First Republic Bank in 2023 looms large due to these colossal unrealized losses. The good news? Bitcoin could potentially benefit in this dicey scenario, as it becomes an increasingly sought-after safe-haven asset.

As one analyst succinctly put it: "Bitcoin is rapidly solidifying its role as a backup asset as trust in traditional collateral rises like smoke."

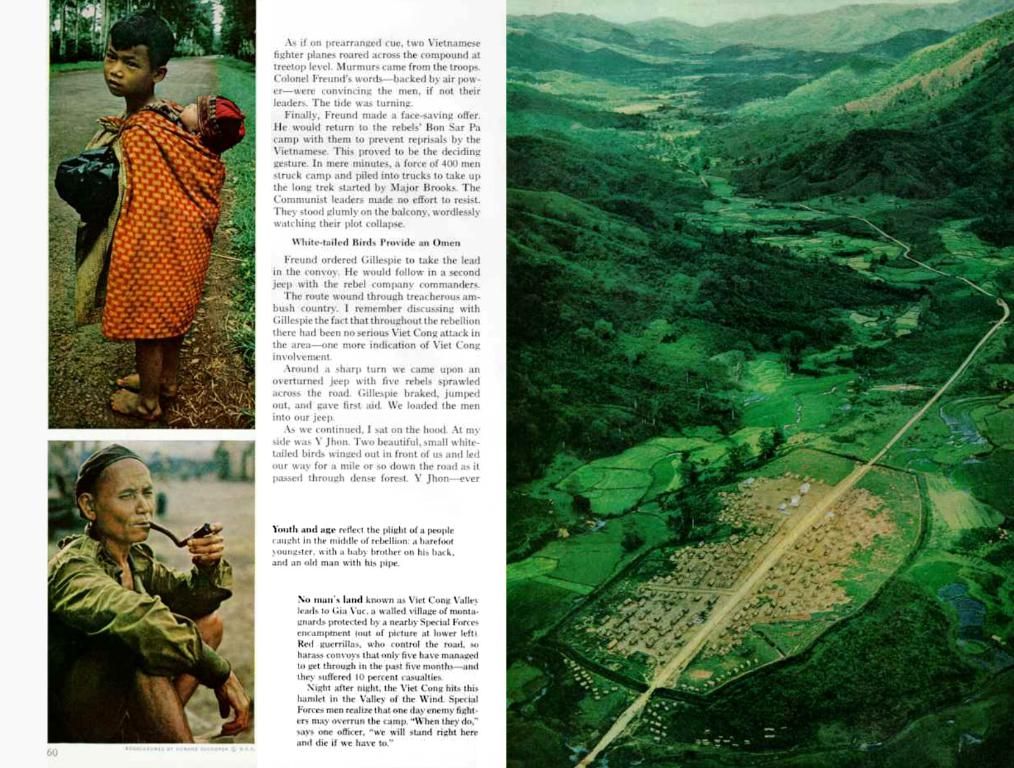

Bitcoin's Technichal Musings

The 3-day chart shows that Bitcoin's price has been rebounding over the past few days. It recently broke through a critical resistance level at $88,666, marking the neckline of the double-bottom pattern that materialized earlier this month.

Bitcoin has remained above the crucial resistance at $73,805, the upper boundary of the cup and handle pattern. It's also climbed above the 50-day and 100-day Exponential Moving Averages, which indicates the bulls are still firmly in charge.

So, what's next for the coin? Most likely, it's headed for the significant resistance at $100,000. Once it breaks through that, Bitcoin could blast its way to its all-time high of $109,300, followed by the cup and handle target of $122,000.

In other Bitcoin-related news, investment firm Strategy scooped up an additional 15,355 Bitcoins for $1.4 billion, boosting its total holding to a staggering 550,000 BTC.

- The price of Bitcoin reached over $95,000 and has remained steady, fueled by recent optimism about a potential trade deal between the US and China and Trump's decision to keep Jerome Powell as Federal Reserve Chairman.

- Unrealized losses in US banks, totaling $482 billion, stem from longer-dated Treasury bonds that banks invested in during the era of low interest rates.

- The banking sector faces challenges as bank stocks could suffer if these unrealized losses are realized, and the Federal Reserve may struggle to lower interest rates as demanded by Trump, potentially escalating inflation.

- One or more banks may face the fate of the failed First Republic Bank in 2023 due to these unrealized losses, making Bitcoin a potentially sought-after safe-haven asset.

- As Bitcoin's price has been rebounding, it recently broke through the critical resistance level at $88,666, marking the neckline of a double-bottom pattern.

- Bitcoin has climbed above the 50-day and 100-day Exponential Moving Averages, indicating the bulls are still in control, and it's likely headed for the significant resistance at $100,000.

- Investment firm Strategy has boosted its Bitcoin holdings to 550,000 BTC, worth over $17 billion at current prices, making it a likely player in the crypto market.

![Rest areas along highways offer minimal room for stationary trucks (Archive Photo) [Image]](/en/img/20250613133936_pexels-search-image-of-headline-text.jpeg)