Decline of 43% in Growth Company Offers Appealing Purchase Opportunity

There's never a poor moment to back a worthy corporation. There might be superior moments, but they don't pop up often - like when they're on sale or discounted due to temporary factors.

For instance, bargain hunters who are enthusiastic about growth investments should check out DraftKings (DKNG -1.60%) while its stock is still 43% lower than its all-time high. The company's experiencing some turbulence at the moment, but the long-term investment case remains compelling.

The development trend persists

DraftKings, of course, is the popular fantasy sports platform that moved into online sports betting after the Supreme Court lifted the nationwide ban on it in 2018.

As various states have legalized sports betting within their borders, DraftKings has entered these markets. It currently operates in 25 of the 38 states that allow sports betting in one form or another, as well as the District of Columbia. The remaining states are also moving towards legalization. The tax revenue that can be generated is simply too attractive for state legislatures to ignore.

This doesn't mean the company has always met expectations. Last quarter's revenue, for example, grew 39% year over year to nearly $1.1 billion, but it fell slightly short of analysts' consensus expectation of $1.11 billion. While its adjusted loss of $0.17 per share was better than the $0.18 per share loss Wall Street projected, DraftKings' per-user monthly revenue of $103 declined more sharply than expected from its prior-year result of $114.

However, there's a reason why DraftKings stock surged following the third-quarter report, despite the relatively disappointing results. The company still posted impressive sales growth and a significant decrease in losses. Its adjusted loss per share was virtually halved year over year, and while its revenue guidance for the coming year was only in line with analysts' expectations, that would still represent a top-line gain of about 30%.

The window of opportunity is narrowing

This past and projected growth raises the question: Why is DraftKings stock still 43% lower than its 2021 high? For that matter, what caused such a drastic shift in the stock between the latter half of 2021 and the first half of 2022? The bear market alone couldn't have been responsible for the entirety of the 85% decline the stock experienced.

At the heart of those extreme swings was timing. DraftKings went public in April 2020 in a pandemic-affected market environment that was very open to new opportunities. By then, the company was already making progress within the then-young sports-wagering market. But with much of the world in lockdown for the next couple of years due to COVID-19, the company saw exponential growth. The stock mirrored the same growth curve.

As could have been anticipated, however, reality eventually caught up. By the end of 2021, investors were starting to understand that the rapidly growing company was still in the red.

A turning point began in 2022 though. The dust began to settle. A few more states legalized online sports wagering. Then a few more. It became clearer to investors that it would take DraftKings several years to reach its full potential within each state-based market. Indeed, it's not clear when, or even if, its growth will start slowing down after DraftKings sets up shop. What's clear is that the stock's sellers overshot their target in 2022.

The growth in the user base, driven by the fact that the company remains operational in a state once its app is launched, has been pushing the stock back up since early 2023.

There's room and reason for DraftKings stock to keep rising

So where's the ceiling? It's still a long way off.

The American Gaming Association reports that 38 states now permit at least some form of sports betting. Not all of them allow it to be done online, and some of their laws and regulations aren't conducive to app-based betting like DraftKings offers. Nevertheless, the market for this type of gambling is still expanding due to increased consumer awareness and continued legalization efforts.

Market research firm Straits Research predicts the global online sports wagering industry will grow at an annualized pace of more than 11% through 2032. That forecast aligns with the outlook of Mordor Intelligence.

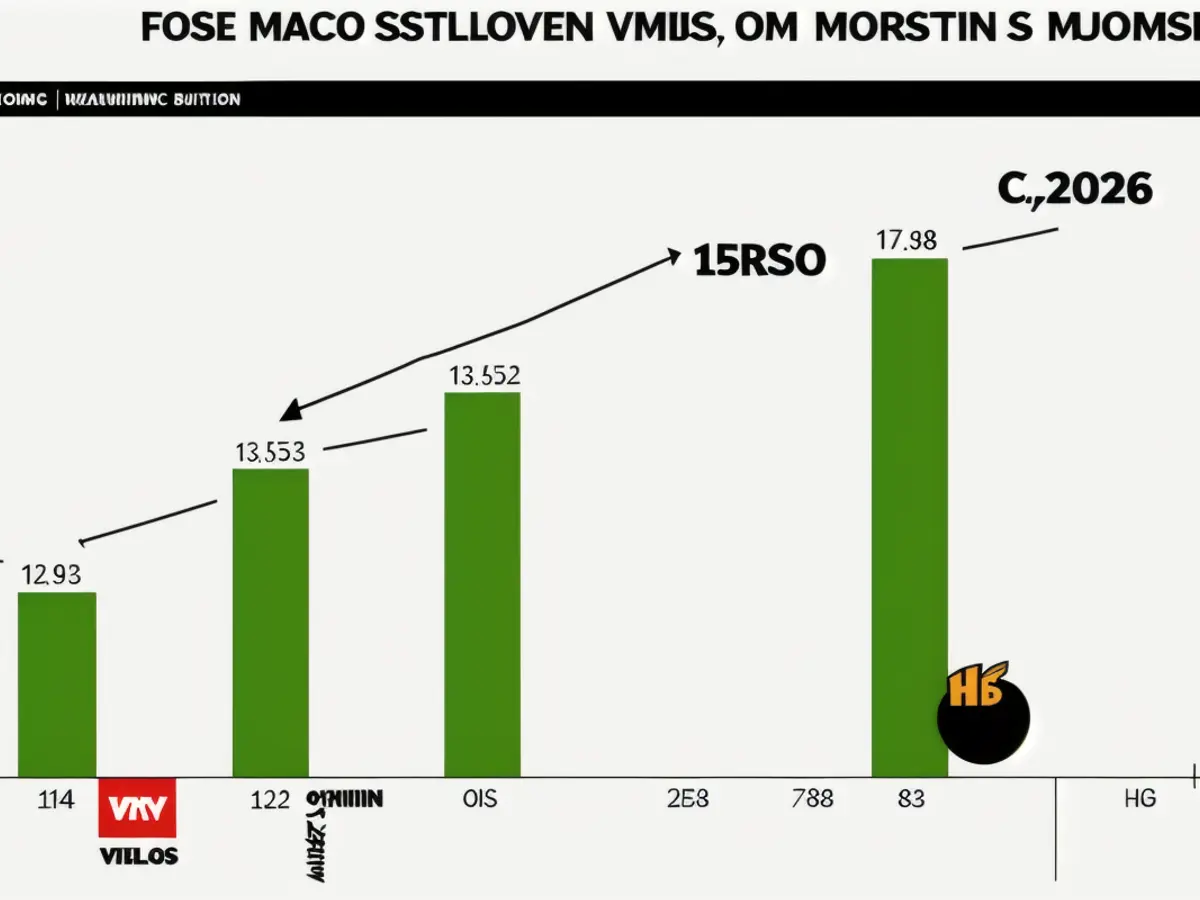

And U.S.-focused DraftKings fully expects to continue capitalizing on this growth. During its Investor Day presentation held in November 2023, the company suggested it would be doing $7.1 billion worth of annual business by 2028, and turning $2.1 billion of it into EBITDA.

For perspective, DraftKings expects its top line to be just under $5 billion this year, while adjusted EBITDA will be around $260 million. So, forget about last quarter's relatively modest numbers, take the broader investment signals, and realize why most investors are increasingly optimistic about this stock.

This might help: Despite this ticker's significant (if erratic) gains since early 2023, shares are still priced 20% below analysts' average price target of $50.80. Moreover, three-fourths of the analysts tracking this stock don't just rate it a buy, but a strong buy. That's not a bad foundation for starting a new position.

In terms of finance and investing, analysts believe DraftKings' stock has room to grow, as it is currently priced 20% below their average price target of $50.80. Furthermore, three-fourths of the analysts following the company have given it a strong buy rating.

Even with the recent growth in revenue and market expansion, DraftKings has still not reached its full potential in various state-based markets. This ongoing development trend, coupled with the expected growth of the global online sports wagering industry, provides a compelling investment case for those interested in the finance and money sectors.