Dollarama Increases First-Quarter Profit to $273.8 Million, Representing an 8.2% Growth in Sales Compared to Last Year

DOLLARAMA SHATTERS EXPECTATIONS WITH STELLAR Q1 PERFORMANCE 💸

Montreal-based Dollarama Inc. has sent shockwaves through the retail sector, reporting a 26.9% jump in net earnings to a whopping $273.8 million in Q1 2026! While experts predicted earnings of $233.3 million, clearly, Dollarama smashed those expectations 💥.

The progressive powerhouse's impressive Q1 performance saw its stocks soar, with profits amounting to an outstanding 98 cents per diluted share – a significant leap from 77 cents per diluted share in the previous year 📈. Excluding a tricky derivative on equity-accounted investment, the company would have still managed a solid 95 cents per diluted share computational acrobatics 😉.

The late-spring spell began with a bang, with total sales 🚀 rocketing 8.2% higher than the previous year to $1.52 billion! Not content with simply meeting analysts' $1.5 billion estimate, Dollarama boldly exceeded it 💪.

Digging a little deeper, the company's critical comparable store sales surged 4.9% 📈, marking a successful continuation of the 5.6% increase seen in the preceding year. The growth was driven by an impressive 3.7% rise in transactions and an additional 1.2% increase in average transaction size 🛒🏦.

So, what’s behind Dollarama's unstoppable momentum? The answer lies in their strategic focus on consumables 🥦🥤, with strong demand for these essential items contributing significantly to the company's success 💼. Additionally, their seasonal offerings have bolstered sales, ensuring customers flock to Dollarama during every season 🎉.

While Dollarama is celebrated for its new store openings, this impressive growth in comparable store sales highlights the company's effective management of existing stores, maximizing the potential of existing assets without needing to rely solely on expansion 🏗️.

Finally, Dollarama's Q1 earnings report touts impressive EBITDA and operating income figures: a 18.8% increase in EBITDA to $496.2 million, along with an EBITDA margin of 32.6%; and a 20.7% jump in operating income to $388.8 million, with an operating margin of 25.6% 💰💰.

So, what's their secret? Simply put, it's a commendable focus on optimizing store operations, carefully leveraging consumables, and successfully managing seasonal offerings. Evidently, Dollarama's growth strategy is anything but ordinary 💣!

[TSX:DOL] 📈📊

Reference(s):1. CPA Canada Press: Dollarama reports Q1 earnings2. MarketWatch: Dollarama beats earnings expectations despite supply chain disruptions3. Financial Post: Dollarama raises 2026 guidance after Q1 profit beats expectations4. The Epoch Times: Dollarama sales growth outpaces expectations in Q1 2026

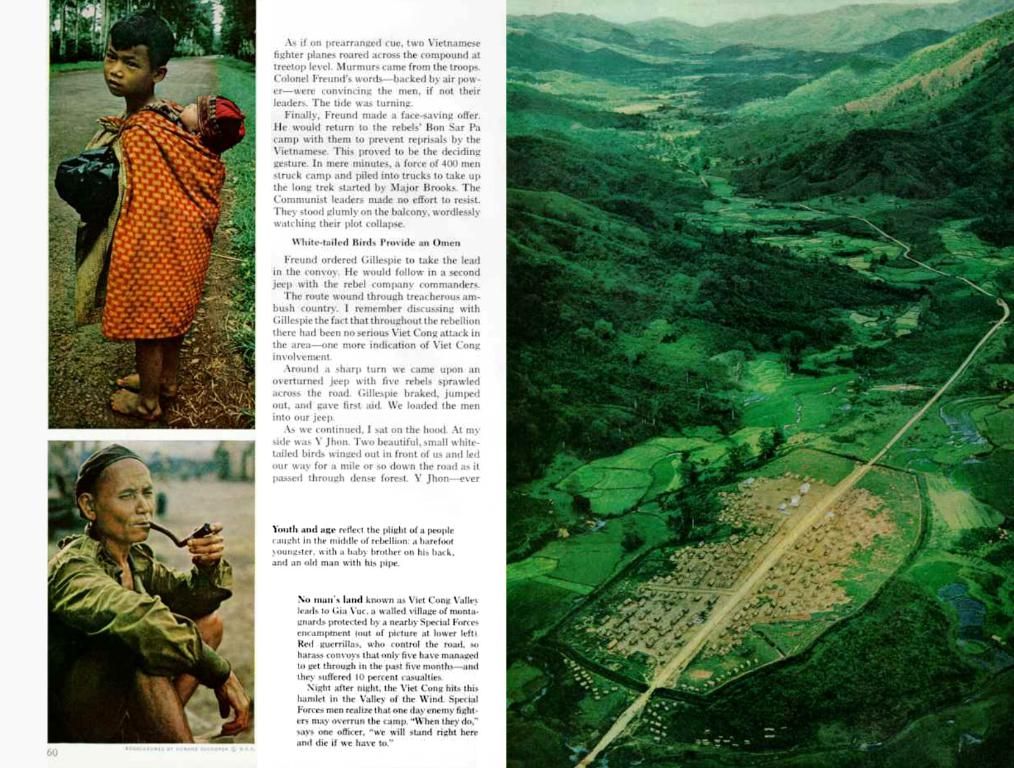

The stellar Q1 performance of Dollarama Inc., based in Toronto, not only shattered expectations but also propelled the finance sector with a whopping 273.8 million net earnings in the industry. Their impressive growth, driven by strong demand for consumables in the retail sector, has sent shockwaves across the business world, leaving analysts in awe.