Unraveling Misleading Promises: IRS Debt Reduction Scams

Exploring the Realities Behind Settlement Agreements and IRS Financial Obligations

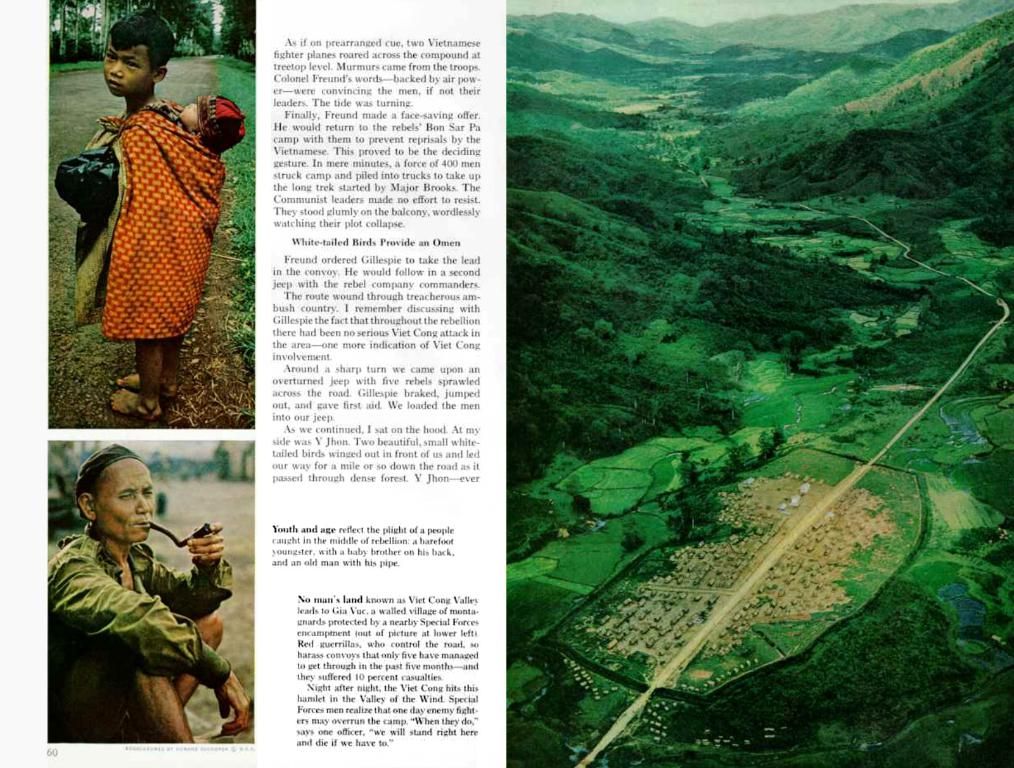

In the thick of financial struggles, it's natural to seek help when burdened with a substantial IRS debt. However, beware of the alluring, yet often misleading, promises that might entice you into paying hefty fees for questionable services. Every week, I encounter individuals misled by companies claiming their IRS debt can be miraculously reduced. Don't fall into this trap. Approach such claims with a healthy dose of skepticism and conduct thorough research before engaging with any service.

The IRS does offer certain programs to alleviate tax debt, like the offer in compromise. But subscribing to this misconception that your debt can magically disappear easily is prevalent. Companies advertising easy fixes frequently downplay the tough criteria and documents required to be eligible, using high-pressure sales tactics to create an illusion of urgency. Avoid being swayed by this manipulative approach, which often leads to unsuspecting individuals acting hastily without fully comprehending the implications or success chances.

To safeguard yourself from falling prey, verify the company's credentials, scrutinize reviews, and consult multiple sources before making a commitment. Reputable firms will provide an honest assessment of your situation, steer clear of exaggerated claims, and offer advice tailored to your specific circumstances.

Navigating the IRS Offer in Compromise Program

The legitimate term for significantly reducing your tax debt is an offer in compromise. This agreement allows taxpayers to settle their tax debt for less than the full amount owed, provided paying the total liability would result in financial hardship or exceed their means. Qualifying for this program isn't straightforward and requires careful consideration.

To start, complete IRS Form 656 and either Form 433-A (OIC) or 433-B (OIC) to provide a detailed financial report. Gather supporting documents, such as pay stubs, bank statements, and monthly expense records. Submit this information to support the assertion that you genuinely cannot meet your tax debt obligations.

The IRS evaluates your offer with stringent criteria in mind, including your income, living expenses, asset equity, and overall ability to pay. Also, they assess if accepting the offer is in the best interest of both parties.

One critical factor in the evaluation is your Reasonable Collection Potential (RCP), a measurement of your ability to pay. RCP considers your assets and future income. If the IRS believes you can pay more than what you propose, the offer will likely be denied.

Given the complexity of this process, it's often advisable to enlist help from a reliable firm with expertise in IRS negotiations. They can boost your chances of a successful offer in compromise, though it doesn't guarantee acceptance.

Utilize the IRS Qualifier Tool

The IRS provides a helpful tool on their website called the Offer in Compromise Pre-Qualifier. Accessible by searching for it on their site, this resource directs taxpayers through a series of questions, helping determine if they might meet the criteria for an offer in compromise. Provide essential financial details to answer these questions accurately. Though it doesn't guarantee IRS acceptance, it offers a tentative assessment based on the information provided. If your preliminary screening suggests eligibility, it can be a suitable sign to proceed with the formal application process.

Navigating the Application Process

Preparing for the application process requires attention to detail and meticulous preparation. Gather necessary documentation, including pay stubs, bank statements, and proof of monthly expenses. Complete IRS Form 656, which outlines your offer amount and reasoning, along with either Form 433-A (OIC) or 433-B (OIC) to detail your financial situation. Ensure all provided information is accurate and comprehensive to avoid delays or denials due to errors.

Upon submitting your forms and supporting documents, the IRS initiates a review process. They might request additional information. Responding promptly and accurately to these requests is crucial to avoiding complications. The IRS will scrutinize your income, expenses, and asset equity to determine if you can pay your tax debt in full or partially. They'll also assess if accepting your offer serves the best interests of both parties.

The lengthy review process – sometimes spanning several months to a year – requires patience and perseverance. Interim payments or fulfilling other requirements may be required while your offer is under consideration. Consulting professional help experienced in IRS negotiations can enhance your chances of a successful offer in compromise, but it does not guarantee acceptance.

Bear in mind that the offer in compromise is not an instant fix. Due to the rigid criteria, not every application will be accepted. However, thorough preparation and detailed documentation can improve your chances of a favorable outcome.

Factors Influencing Offer Approval

Several key factors influence if the IRS will approve your offer in compromise. These include the value of your assets, earning potential, and reasonable living expenses. Income source and stability, along with outstanding compliance history, can also impact consideration. Thorough, accurate documentation is crucial to present a compelling case to show the IRS that the offered amount is fair and reasonable.

Submitting an offer in compromise to settle your tax debt requires completing Form 656 and either Form 433-A (OIC) or 433-B (OIC) to provide financial details. Misleading companies may try to sell you on the notion that the process is easy and the criteria are minimal, but in reality, qualifying for an offer in compromise is challenging. To increase your chances of approval, it's essential to accurately report your income, living expenses, and asset equity, and demonstrate that accepting the proposed settlement is in the best interest of both parties. If your financial situation changes or you receive additional income while waiting for the IRS to review your offer, be sure to update your information to avoid any complications or denials.