US-China Trade Deal: A Tenuous Boost for Wall Street

Financial elites respond stoically to outlines of agreements with China

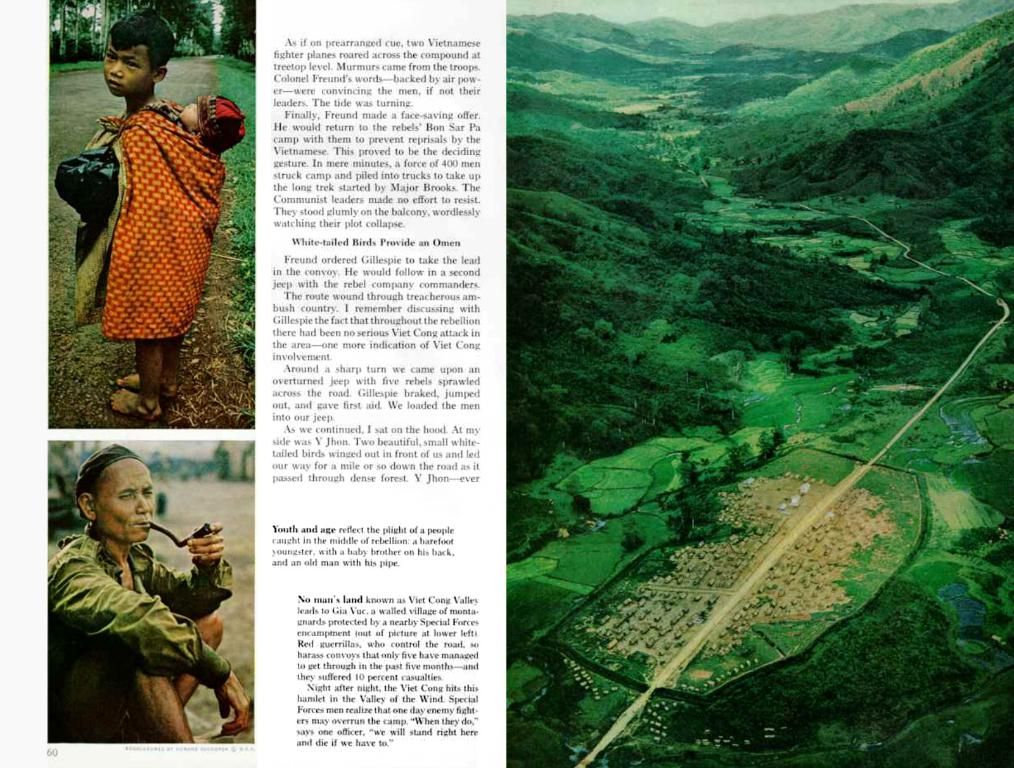

Talk about a rollercoaster ride! Wall Street witnessed a mixed bag of emotions on Wednesday as positive inflation data and a US-China trade framework agreement failed to ignite a major market surge. Disappointment reigned supreme as traders turned their eyes towards a potential weak framework ensuring no advancements beyond the Geneva agreement.

The Dow Jones Index clung onto 42,866 points, while the S&P-500 and Nasdaq indices slumped by 0.3% and 0.5% respectively. The two-day negotiations in London produced a mere framework agreement, causing fear among market observers.

Adding fuel to the fire, China allegedly held onto the threat of tightening rare earth exports once more. Word on the street is they're planning to limit the export licenses for rare earths to a mere six months.

US President Donald Trump fueled the confusion with his statements about the trade agreement. According to him, the deal still needs the green light from both him and his Chinese counterpart Xi Jinping. Confusion reigned when Trump stated, "We receive a total of 55 percent tariffs, China receives 10 percent."

Fears and uncertainties dominated as the lack of details in the agreement caused skepticism on Wall Street. To top it all off, the US appeals court confirmed Trump's reciprocal tariffs until the final clarification – another bomb dropped on the stock market.

In brighter news, the yield on ten-year US Treasury bonds took a nosedive by 6 basis points to 4.42 percent, all thanks to less-than-expected US consumer price increases in May – rate cut fantasies running wild. The yields plummeted with strong demand at a ten-year bond auction with a whopping $39 billion volume. Traders expressed optimism about US bonds, deeming it another passed acid test for confidence.

However, this rate cut euphoria and plummeting bond yields took a toll on the almighty dollar, with the Dollar Index losing 0.4 percent, sending the euro soaring to levels not seen for nearly a week. The gold price also inched up by 0.8 percent, egged on by the falling dollar and interest rate outlook.

Tesla managed to close with a narrow gain, giving up substantial earnings during the day. Tesla CEO Elon Musk's recent diatribes against Trump seem to have eased concerns about potential retaliation against Musk's companies, Tesla and SpaceX. Musk also announced the long-awaited robot taxi service would debut on June 22.

Meanwhile, Meta Platforms dipped by 1.2 percent, involved in advanced talks to invest around $14 billion in Scale AI and considering hiring the startup's CEO to lead AI development. Lockheed Martin tumbled 4.2 percent, as reports emerged of the US Air Force ordering significantly fewer F-35 fighter jets in 2024.

GameStop, the beloved video game retailer, continued to struggle despite posting profits in the quarter. The "meme stock's" stock price took a dive of 5.4 percent. General Motors cruised ahead by 1.9 percent, dedicating $4 billion to boost production in the US, thereby reducing exposure to tariffs. First Solar jumped by 2 percent after being upgraded to "Buy" by Jefferies. Starbucks' former CEO, Howard Schultz, lent his support to the coffee chain's turnaround plan, sending its stock soaring 4.4 percent.

Source: ntv.de, ino/DJ

Enrichment Data:

Overall:The US-China trade agreement has reached a preliminary stage, often referred to as a "framework" or "handshake agreement."

Key Points of the Agreement:

- Tariffs: The deal includes provisions for the US to impose a total of 55% tariffs, while China will bear 10% tariffs.

- Rare Earths and Semiconductors: The agreement includes provisions for China to supply rare earths and full magnets, with export licenses issued based on "reasonable needs."

- Educational Exchanges: The deal also includes provisions for Chinese students to use US colleges and universities.

Impact on Wall Street:The impact of this trade agreement on Wall Street is mixed and speculative at this stage. The announcement of a potential deal has generally been positive for markets, as any progress in reducing trade tensions between the US and China can boost investor confidence. However, the lack of concrete details and China's cautious stance may temper enthusiasm. Wall Street is likely to remain cautious until the final approval and implementation of the agreement are confirmed.

Key Points to Watch:

- Market Volatility: The markets may experience volatility as investors await the final details and implementation of the deal.

- Sectoral Impact: Industries reliant on rare earths and semiconductors could see significant benefits if the agreement leads to more stable supply chains.

- Global Economic Impact: Reduced trade tensions could have broader positive effects on global economic growth, benefiting Wall Street in the long term.

The US-China trade deal, while positive for markets, has left Wall Street with a sense of cautious anticipation, as details remain sparse and potential changes in rare earth exports could impact various industries. The agreement's impact on finance, businesses, and politics, as well as general-news, is substantial, with potential effects on employment policies and community policies, particularly in sectors reliant on rare earths and semiconductors. As Wall Street monitors the situation closely, market volatility is expected as investors await the final approval and implementation of the trade agreement.