Smoothing Over Trade Rough Patches: Chinese-American Talks Ahead

Firm Handshake Encounter

London, here we come! China and the USA are set to hash things out in the British capital, with both sides expecting a deal on China's export restrictions on rare earths. Economist Kevin Hassett, a top advisor to US President Donald Trump, is optimistic about the meeting, stating, "I expect it to be a brief, firm handshake."

The crux of the negotiations won't revolve around mutual tariffs but China's control of 90% of the global market for rare earths. The US government hopes that China will ease these export restrictions after reaching an agreement. In return, the US would also relax its export controls.

The repercussions of the trade dispute are evident in new numbers from China's customs department: trade between the two economic giants took a significant hit in May.

The Championship Dance

While the talks in London could stretch into Tuesday, it's confirmed that China will be represented by Vice-Premier He Lifeng. US Treasury Secretary Steve Mnuchin was initially slated to join the discussions, but reports suggest John Taylor, Assistant to the President for Economic Policy, will take his place instead.

According to Trump, the talks will primarily focus on refining the existing trade agreement, but a major focus will likely be on China's export controls on raw materials and the US restrictions on selling key technology to China.

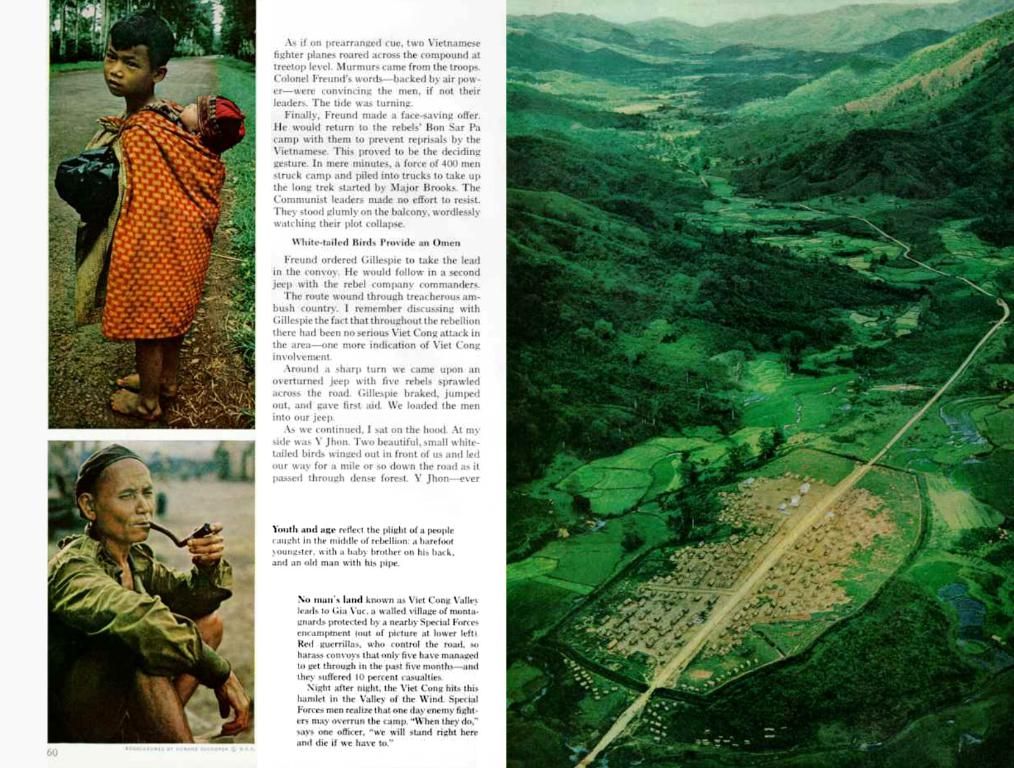

Scorecard: The Numbers

China's customs authority report shows that exports and imports in trade with the US plummeted in May, following a similar trend in April. Exports plunged by 34.5%, while imports dropped by 18.1% compared to the same period last year. However, China was still able to increase its exports to regions like Germany, partially offsetting the loss.

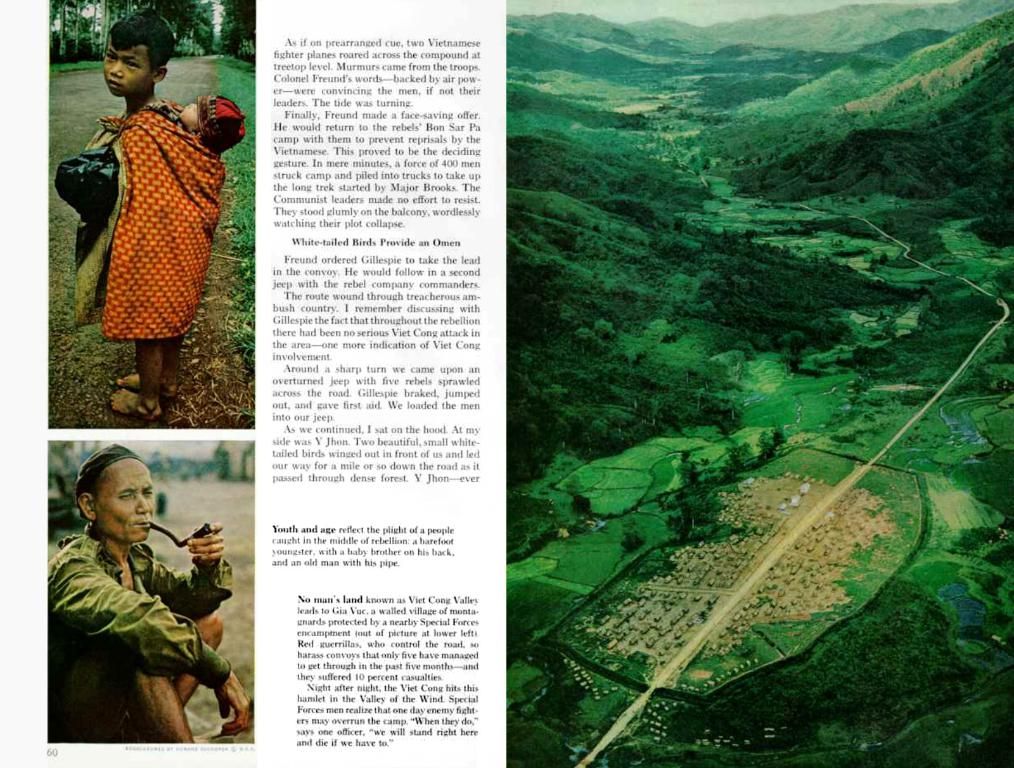

On the Docket

Notably, the first talks since the escalation of the trade dispute took place in Geneva in mid-May. Both parties agreed to significantly reduce tariffs for 90 days. But the US had raised tariffs on goods from China to up to 145% in April, while China countered with tariffs of up to 125% on US imports and imposed export controls, including on certain rare earths.

These elements are crucial to various industries, such as electric motors and sensors, and China's dominance of the market has raised global concerns whenever it imposes restrictions. Moreover, China might also address the US restrictions on the sale of key technology products to China, a sensitive topic given China's dependence on foreign countries for certain computer chips and aviation components.

Ring the Golden Bell?

Trump and Xi Jinping agreed to the meeting in a phone call. However, Trump's spokeswoman, Karoline Leavitt, stated on US television that China must comply with the terms of the agreement to pave the way for a more comprehensive deal.

While China reacted cautiously after the phone call, urging the US to adhere to the mutual agreements, China's Ministry of Commerce has expressed the need for the US to withdraw any negative measures against the country before further discussions progress.

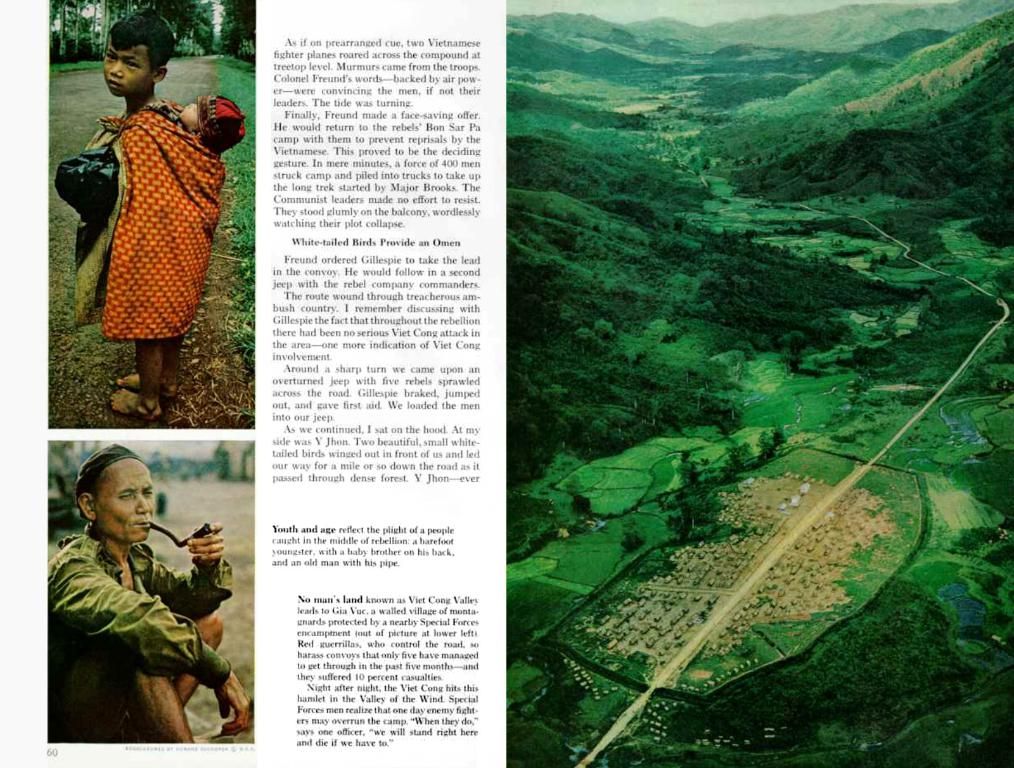

The Tug-of-War on the Global Economy

The ongoing trade conflict between the two powers keeps the global economy on edge. Trump's aggressive trade policies against China have been a constant factor since he took office. Despite the Geneva agreement, tensions have risen again, and deep-seated issues remain unresolved.

The US imports substantially more goods than it exports, while China drives its economic growth with exports and relatively low import levels due to weak domestic demand. Trump aims to close the trade deficit by implementing higher tariffs and bolstering domestic production. However, many economists warn that additional US tariffs could lead to higher prices and slower growth in the long run.

Trump vs China: The Trade Deficit Battle

In 2024, according to official figures, the US exported goods worth approximately 143 billion US dollars to China, while receiving goods worth 439 billion dollars. This accounts for a trade deficit of around 300 billion dollars.

Trump has frequently used the term "tariffs" in his lexicon. He has imposed, threatened, or announced numerous additional import duties, including a new 10% tariff on nearly all imports and higher tariffs on imports from various countries. These measures also impact significant trading partners like China and the EU.

Headlines from Hamm

- Football Club Hamm-Westfalen after the Relegation

- Hamm Citizenship Boom

The finance sector will be closely monitoring the trade discussions between China and the US, as both nations look to refine their existing trade agreement and address China's export controls on raw materials and US restrictions on selling key technology.

Politics will play a significant role in these negotiations, as both the US and China navigate their positions on global-news issues like the trade deficit and China's control of the rare earths market. Businesses dependant on raw materials and key technology are watching these talks with great interest.