Trade Squabbles: The US-China Feud Heats Up

Forceful Handclasp Encounter

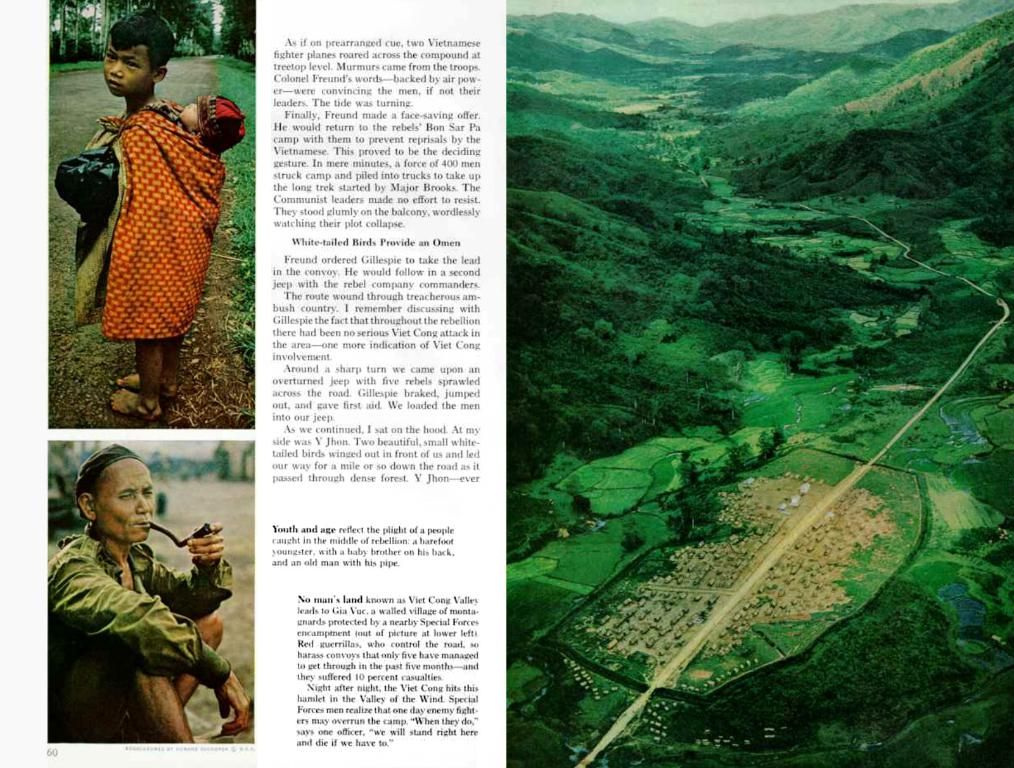

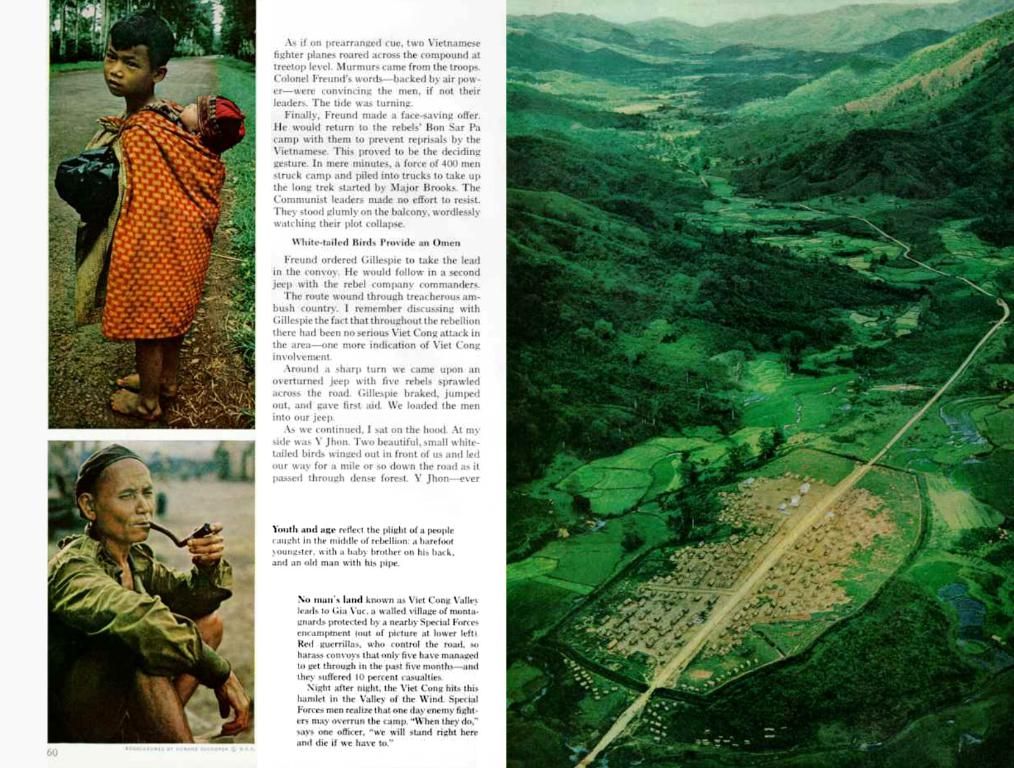

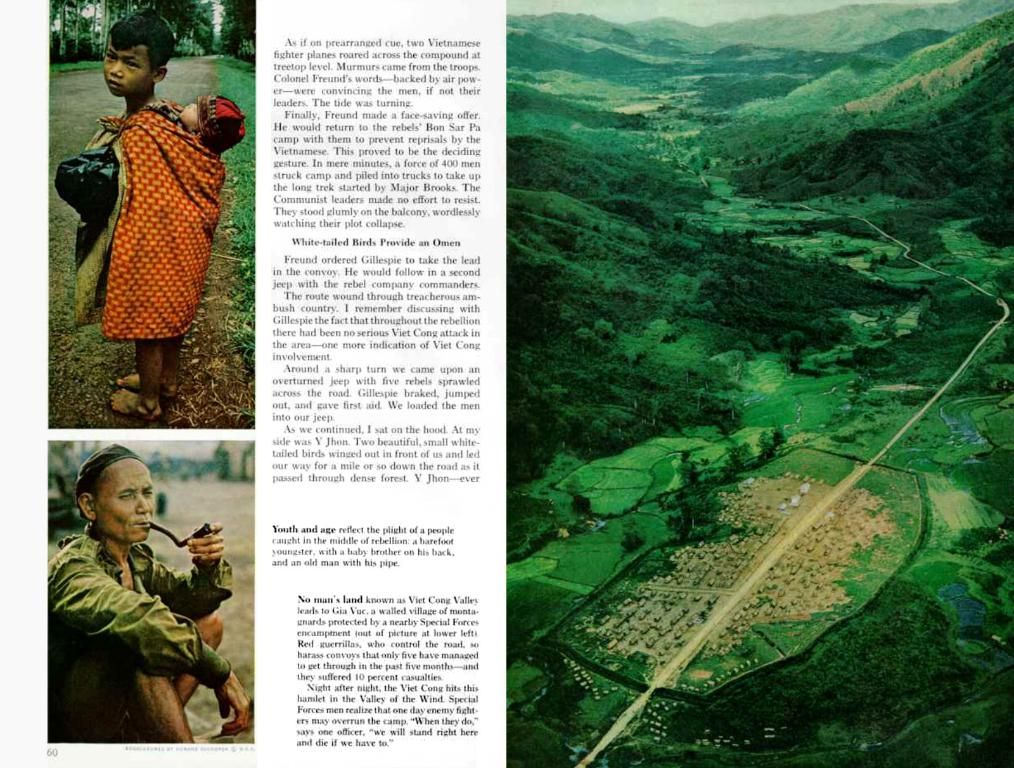

London/Beijing (dpa) - The US and China are locking horns again, this time in good ol' London, as their representatives gather for another round of trade talks. Economic advisor to US President Donald Trump, Kevin Hassett, is feeling chipper about a swift resolution. "I'm betting on a short meeting with a solid handshake," he told CNBC.

What's on the menu this time? Not your average tariff discussion, but the meaty issue of China's restrictions on rare earth exports. Hassett hopes they'll hammer out a substantial agreement. China commands nearly 90% of the global market for these precious minerals, crucial for tech and energy industries. The US administration is expecting Beijing to lift export restrictions post-agreement, in exchange for some relaxed export controls from the US.

The trade spat's effects are already showing in China's new customs records: trade between these global economic giants took a nose-dive in May.

Who's Talking to Whom and About What?

It's not set in stone whether the London talks will continue beyond Tuesday, but China's sending Vice-Premier He Lifeng. Initially, US President Donald Trump had announced US Treasury Secretary Steve Mnuchin would be part of the US team.

According to Trump, the conversations are about ironing out the details of their joint trade agreement. But export controls on raw materials and restricting high-tech tech sales to China are likely to take center stage.

Trade's Twists and Turns

Chinese officials report a significant slump in both exports and imports to the US in May, mirroring April's decline. In May, exports to the US dropped by 34.5% compared to May 2024, while imports dipped by 18.1%. Despite this, China's economy managed to boost exports in May thanks to increased trade with other regions, like Germany.

The Agenda: What's up for Discussion?

The US and China held their initial discussions since the escalation of the trade dispute in Geneva in mid-May. At that time, both sides agreed to a temporary reduction in tariffs for 90 days. US President Trump had increased tariffs on Chinese goods to a staggering 145% in April. China retaliated with tariffs of up to 125% on US imports and imposed export controls, including on certain rare earths.

These materials are vital for industries such as electronics, automobiles, aerospace, and medical equipment. China dominates the global market for these materials, which have raised concerns among companies worldwide. China might also bring up US restrictions on the sale of important technology products to China, an issue crucial for China's economic health, as they are still dependent on foreign suppliers for computer chips and aerospace components.

The Green Light: A Phone Call Precedes the Meeting

US President Trump and Chinese President Xi Jinping agreed to the meeting after their phone call. Trump's spokeswoman Karoline Leavitt stated in US television that China must honor its side of the agreement, paving the way for a more comprehensive deal. However, China reminded the US to stick to the mutual agreements of the deal, and demanded that the US side objectively evaluate the progress achieved and withdraw its negative measures against China.

The Unsettling Impact: World Economy's Roller-coaster Ride

The trade conflict between these titans shows no signs of abating, with Trump pursuing a hardline trade policy against China since he took office. Despite the agreement for a tariff truce reached in Geneva, the rhetoric has grown sharper again, and the underlying disagreements haven't been resolved.

The US imports far more goods than it exports, while China drives its economy with exports. Trump aims to eliminate the trade deficit by imposing higher tariffs and boosting domestic production. However, many economists caution that Trump's additional import duties in the US are likely to lead to higher prices and slower growth in the long run.

Trump's Burden: The Persistent Trade Deficit with China

In 2024, according to official figures, the US exported goods worth around 143 billion US dollars to China, while goods worth 439 billion dollars came from China to the US. This results in a trade deficit of almost 300 billion dollars.

Trump has frequently used the term "tariffs" in his lexicon, announcing, threatening, or implementing numerous additional import duties. Besides a new 10% tariff on almost all imports, he has also announced specific, higher tariffs on imports from many countries, affecting major trading partners such as China and the EU.

The US-China trade talks in London might conclude sooner rather than later with a handshake, as economic advisor Kevin Hassett expects (Kevin Hassett). In the event of a favorable agreement, China may consider relaxing export restrictions on rare earth minerals, crucial for the finance sector and various businesses (China commands nearly 90% of the global market for these precious minerals, crucial for tech and energy industries). Despite the potential resolution, there's a chance that export controls on raw materials and high-tech tech sales to China could still be a contentious issue (Trade's Twists and Turns).