Four Strong Arguments to Invest in FuboTV Shares Without Hesitation Today

Speaking frankly, FuboTV (FUBO dropping by 4.85%) has been performing poorly lately, to put it mildly. Shares have plummeted an alarming 98% from their high point in late 2020, and they're still hovering close to the dismal lows they hit in June. It's safe to say that the brief burst of optimism during the COVID-19 pandemic didn't pan out for this company. And the lack of profiteering certainly hasn't helped their case.

However, if you're willing to absorb the risk and volatility that comes with this stock, there's a four-pronged argument why you might want to give it a second look.

What is FuboTV?

So, if you've stumbled upon this text and have no idea what FuboTV is, let me enlighten you. It's basically a streaming alternative to traditional cable TV services, like Spectrum or Xfinity. It offers the same (mostly) network broadcasts and cable programming as those services, but delivers it all through a digital stream.

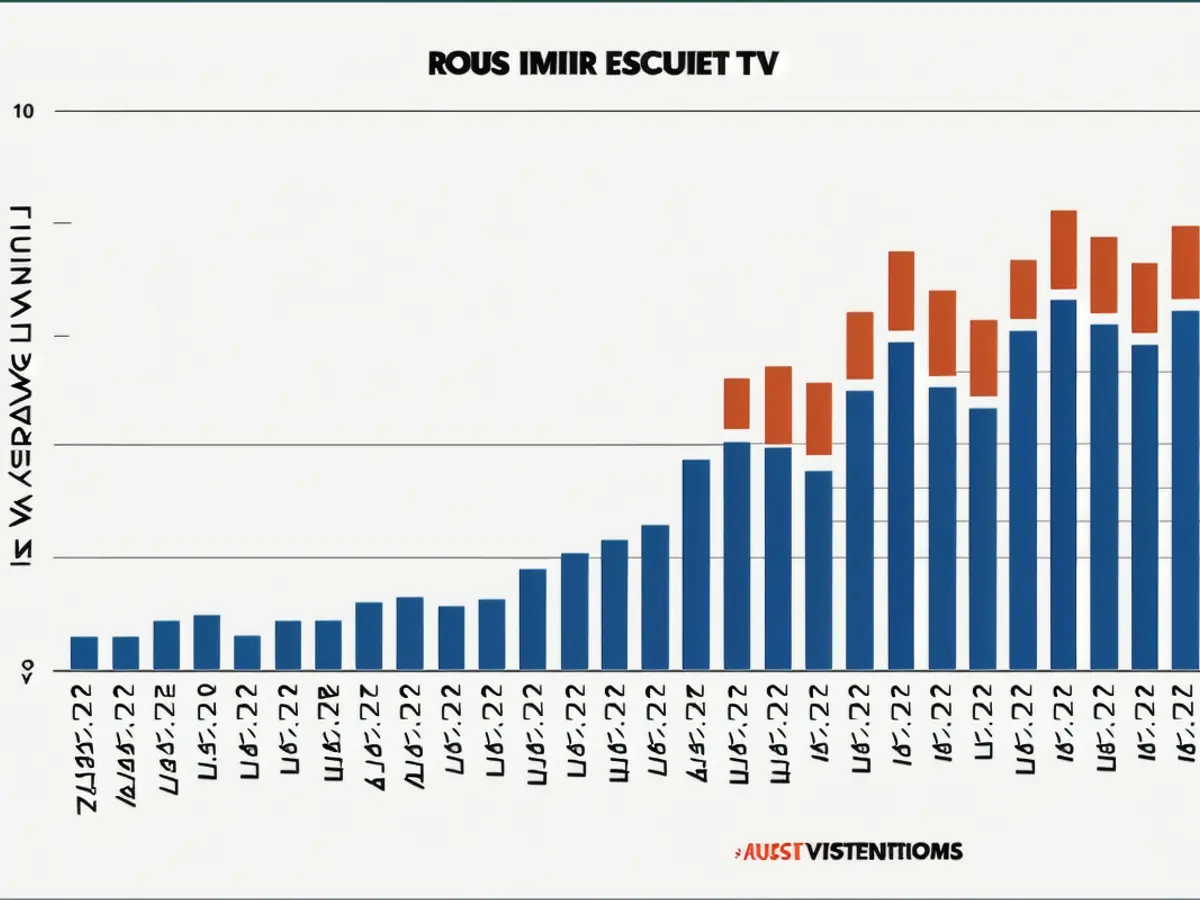

In the realm of cable alternatives, FuboTV stands out from the pack. It has a focus on sports, making it easy for customers to access additional sports channels and even some international sports events that aren't typically available in the U.S. FuboTV was launched as a niche sports streaming service back in 2015, and has since morphed into a full-blown cable alternative. The company now boasts 1.6 million subscribers to its cable-like service, along with another 400,000 subscribers to its more streamlined overseas sports package.

Last quarter's revenue reached a whopping $386 million, moving FuboTV ever closer to profitability.

Unfortunately, not everyone shares this optimism about FuboTV. And it's hard to blame them, as the television industry is undergoing a significant transformation. Despite its streaming nature, FuboTV faces the same basic challenges faced by traditional cable TV services, including increasing prices and competition from other streaming platforms like Netflix and Disney+.

But there may be more working for FuboTV than against it. And the same can be said for its stock.

Four reasons to buy FuboTV stock

So what makes this unprofitable laggard such an appealing investment option despite its descent from its peak price? Four main factors, the first of which has already been mentioned – its sports-centric focus.

A recent survey by CableTV.com sheds some light on this, revealing that the top reason people still subscribe to cable (even when they don't have to) is access to live sports events.

Consumers' willingness to pay sky-high cable prices for access to sports programming hasn't exactly stopped the cord-cutting trend, but it may be slowing it down. If and when this trend reaches its peak, expect more and more cable customers to switch to FuboTV's sports-focused service.

We're also seeing the streaming segment of the cable TV market mimic the same basic trends as its coaxial cable counterparts. Specifically, this means imposing price increases that may push consumers away. YouTubeTV, for instance, recently boosted its monthly price by $10 to a base rate of $82.99 per month – and that's just for the basic package. This service now has over 8 million subscribers, and they have a difficult decision to make. Alphabet followed up with a similar price hike for its Hulu+Live service earlier in the year.

This isn't to suggest that FuboTV is immune to future price hikes. It certainly has room to grow, but it does a good job of avoiding unnecessary expense by not carrying some of the lesser-watched cable channels.

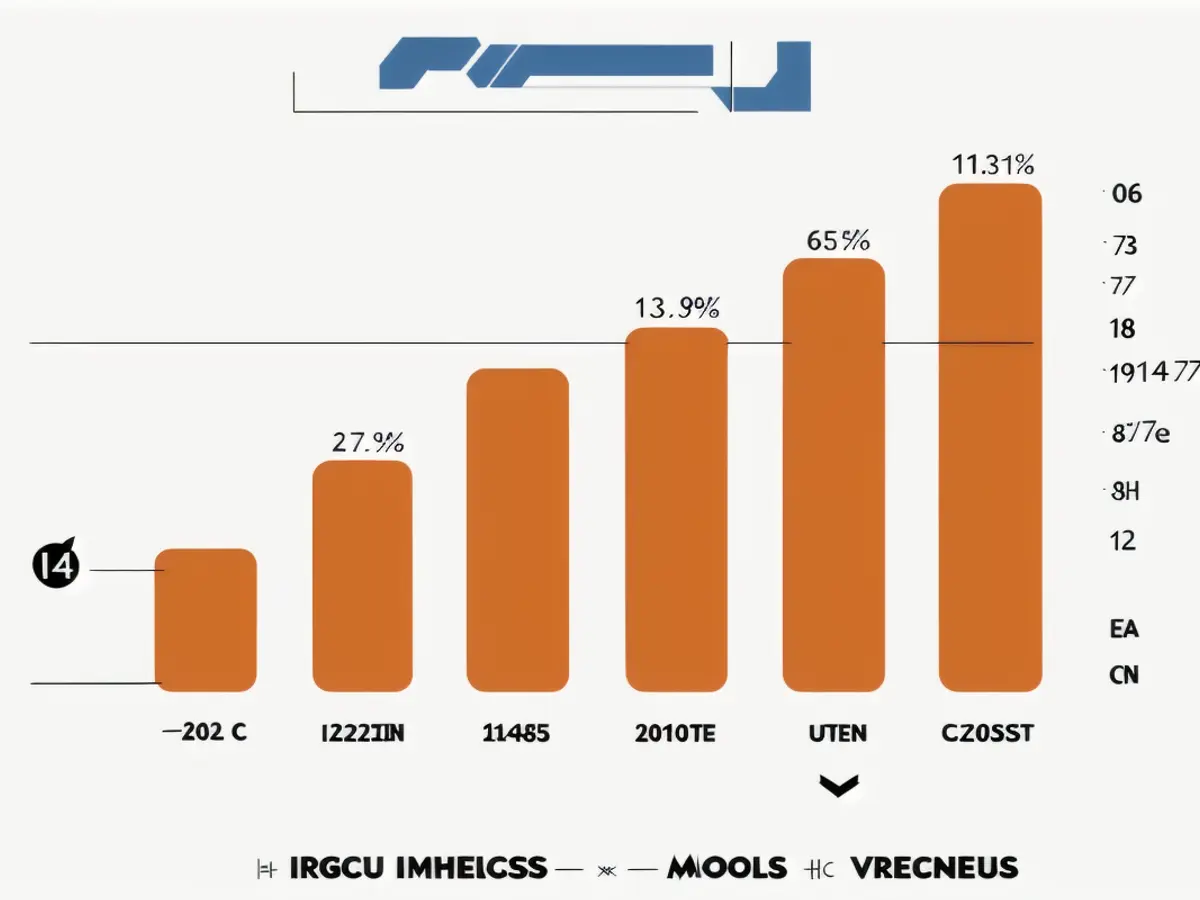

Regardless of what FuboTV is or isn't, one thing is clear – it works. The company continues to add subscribers to its flagship service, and expects to see even more growth in the coming quarter. And even more than that, this revenue growth is inching the company closer to profitability. At its current pace of progress, FuboTV could be in the black by 2027.

The market might reward at least some of this progress.

And this prospect brings up the fourth key reason to consider investing in FuboTV stock. This company is significantly undervalued.

Determining an appropriate price for shares of an unprofitable company that doesn't plan on turning a profit anytime soon is challenging, but not impossible. Analysts estimate that shares of this company are currently worth $2.38 apiece – that's 70% more than their current price.

If nothing else, these are qualities that an investor interested in the streaming cable market might find appealing.

Keep it in perspective

FuboTV isn't a good fit for everyone's investment portfolio, and it's certainly not a cornerstone holding for any portfolio. The risks associated with this company are significant, not the least of which being the proposal of federal legislation to regulate FuboTV like a traditional cable company, which could increase their operating costs.

With the passage of time, it's increasingly evident that fuboTV is pretty much as near as the television industry can get to providing the "slender," a la carte, sports-focused cable package that many people are yearning for. The company's meteoric rise to challenge heavyweights like Walt Disney and tech titan Alphabet is a testament to this fact.

To summarize, investing a small portion of a growth investor with a penchant for risk in fuboTV wouldn't be a terrible decision.

Despite its current struggles, some analysts argue that FuboTV's focus on sports and its ability to cater to consumers' willingness to pay for live sports events could position it well for future growth. In fact, the company's shared challenges with traditional cable services, such as increasing prices and competition, may actually be slowing down the cord-cutting trend, potentially leading more customers to switch to FuboTV's sport-focused service. Moreover, FuboTV's strategic avoidance of lesser-watched cable channels has helped it maintain costs, enabling it to continue adding subscribers and moving closer to profitability. Considering the market's potential recognition of this progress and the estimated undervaluation of its shares, investing in FuboTV stock could be an appealing option for those willing to take on some risk in the streaming cable market.