Germany's Automotive Crisis: The Storm Ahead Suggests 70,000 More Job Cuts

Major job reductions sweeping across German industries: 100,000 positions eliminated in a single year - German businesses eliminate 100,000 work positions within a year

Reading time: 2 minutes

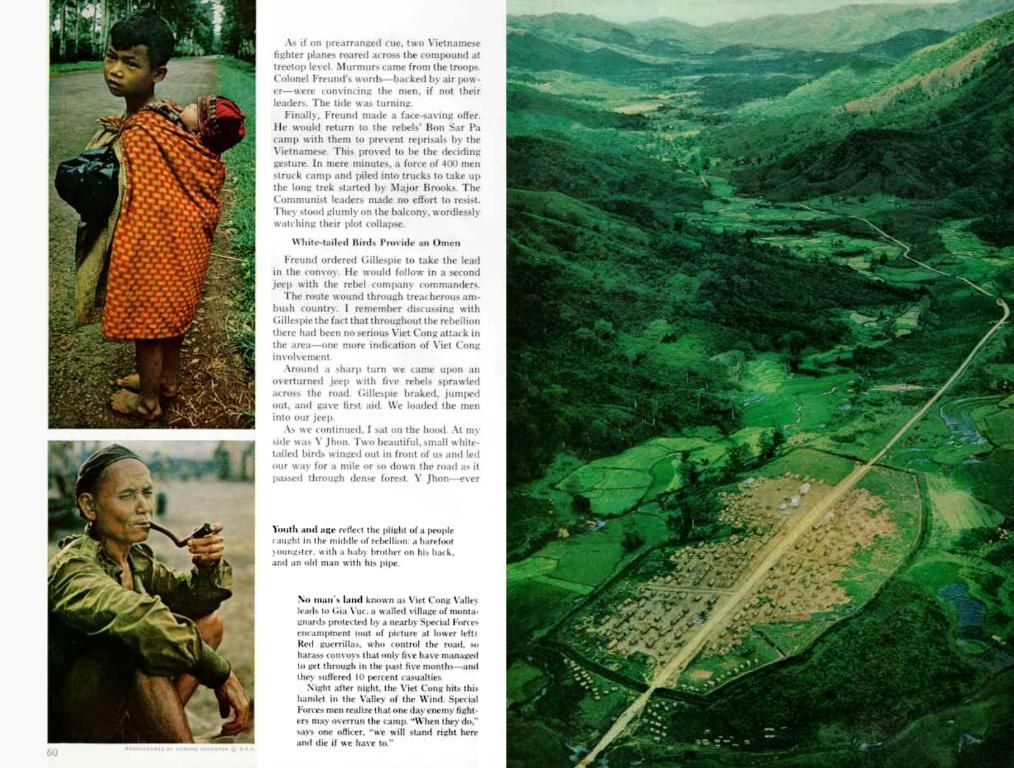

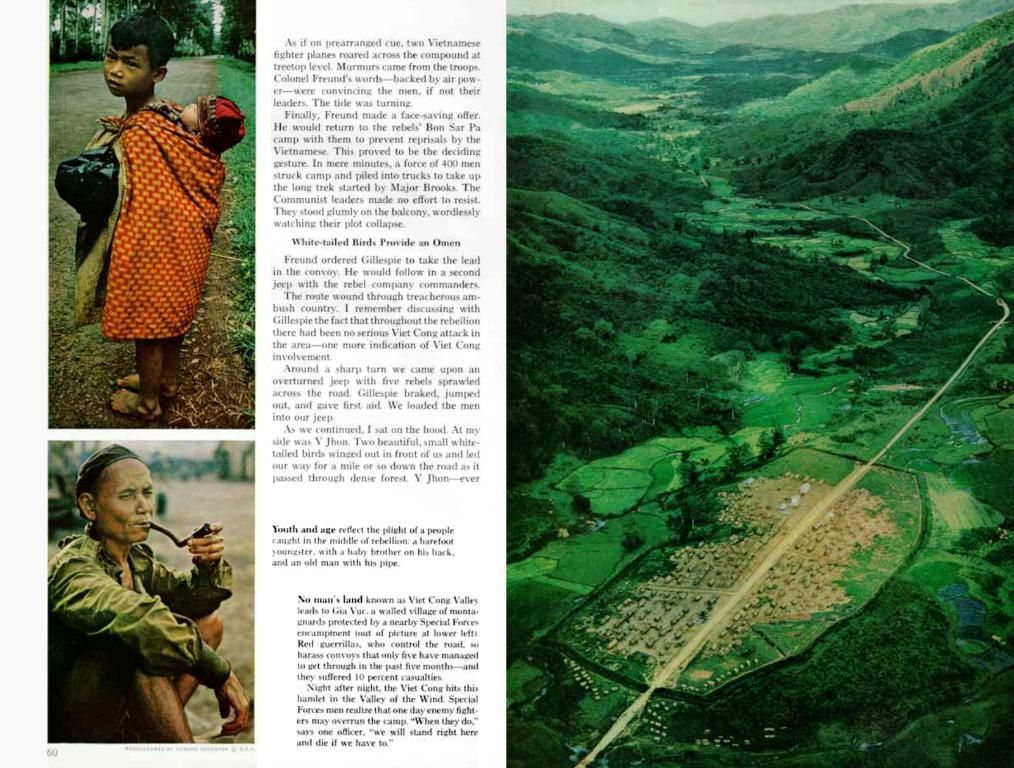

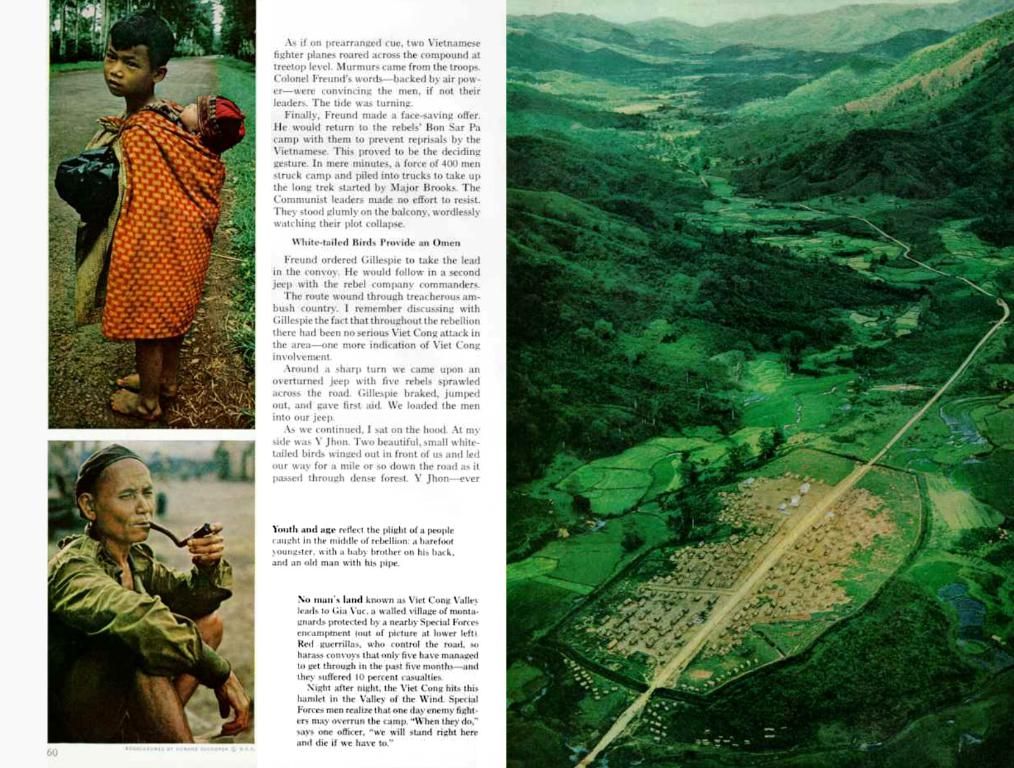

The turmoil gripping Germany's automotive industry has no signs of slackening, as the sector sheds over 100,000 jobs in a single year. According to market analysis by the auditing and consulting firm EY, obtained by the German Press Agency, the automotive sector witnessed a net loss of around 45,400 jobs.

As of the first quarter, the German industry employed roughly 5.46 million workers—a decline of 1.8 percent or 101,000 workers compared to the previous year. This figure represents a total drop of 217,000 workers when compared to the pre-pandemic year 2019. Back in 2018, industrial employment reached an all-time high of around 5.7 million jobs.

Industrial companies face intensifying pressure, according to Jan Brorhilker, Managing Partner at EY. "We've got aggressive competitors from China pushing down prices, crucial markets wavering, stagnating demand in Europe, and a big question mark hanging over the entire US market. On top of that, companies are grappling with high costs—for energy, personnel, and more," says Brorhilker.

Plans for More industrial Job Cuts of 70,000

After a slight dip in industry turnover since 2024, an end to the job cuts is not yet in sight, as Brorhilker anticipates at least 70,000 more industrial jobs will be lost by year's end. Companies in the machinery and automotive sectors have already initiated savings programs, and Brorhilker suggests ominous tidings lie ahead before things start looking up again.

The automotive sector, plagued by sliding sales and stiff competition from China, as well as the shift towards e-mobility, experienced a loss of around six percent of jobs in just one year. By the end of March, employment figures stood at approximately 734,000 employees, representing a significant decrease in the metal and textile industries as well. The chemical and pharmaceutical industries, however, shed a mere 0.3 percent of their workforce.

A Long-Term Perspective on Industrial Jobs in Germany

Critics often cite the current crisis in the German industrial sector as evidence of deindustrialization. Yet, in a long-term perspective, employment in the industry has actually grown. As of the end of 2024, it was 3.5 percent or 185,000 people higher than in 2014, according to the Federal Statistical Office.

Brorhilker of EY comments, "Germany's industrial location has been declared dead many times before—and each time it has proven remarkably resilient thanks to its strong foundation. However, we need to work on improving conditions: Lower costs, less bureaucracy, and strengthening domestic demand are crucial to making our economy less dependent on exports." The federal government's billion-euro investment package could potentially provide a much-needed boost.

The VDA's Plea for Reform and Competitiveness

The Association of the Automotive Industry (VDA) also places the blame on politics. Hildegard Müller, VDA President, believes the competitiveness of Germany's location has lost ground in recent years. "Competitiveness and location attractiveness must be the guiding principles of the new federal government. After all, these factors determine where and to what extent investments are made—and thus also where future jobs will be created," asserts Müller.

- To address the ongoing decline in employment due to Germany's automotive crisis, the government could consider implementing strategies such as industry-specific vocational training programs to foster worker adaptability and improve the industry's competitiveness.

- Understanding the financial implications of the automotive crisis, the urgent need for business growth and job preservation in Germany's industries extends beyond just the automotive sector, necessitating a broader community policy focus on reducing costs, streamlining bureaucracy, and stimulating domestic demand to ensure a resilient and competitive industrial landscape.