Guidance for Spouses: Overseeing Your Partner's Debts Following Their Demise: Essential Information for Widows and Widowers

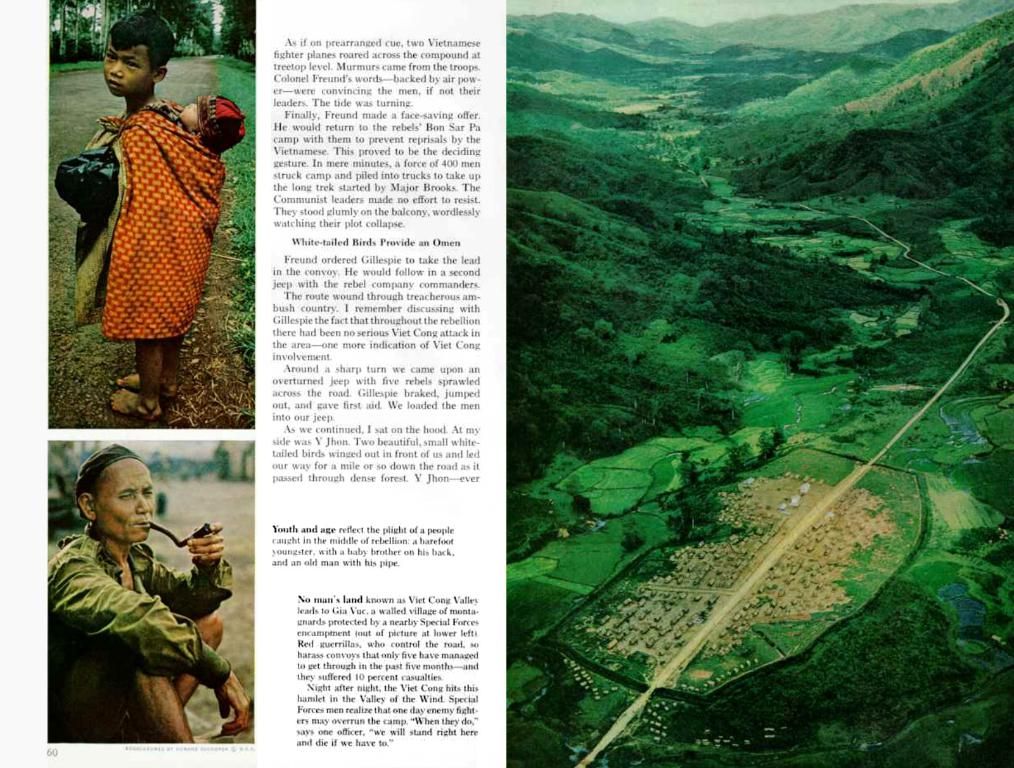

Stacy Francis, the brilliant mind behind Francis Financial and Savvy Ladies, is dedicated to empowering women to achieve financial independence. When Margaret's life took a dreadful turn with her husband Ben's passing, her world turned chaotic. Overwhelmed by grief and Financial pressures, she found herself struggling to make ends meet.

Dealing with debt after a spouse's demise is an excruciating ordeal. Few understand the intricate federal and state laws surrounding outstanding debts. Margaret, like many widows, feared she'd have to use her savings to pay off these debts. Fortunately, she wasn't liable for Ben's debts unless paid on a joint credit card or cosigned loan. Debts should be repaid from the estate, comprising the value of all assets left behind.

However, if the surviving spouse is the only heir, they inherit what's left after debts are settled - which may result in a smaller inheritance due to debts being paid off first. In some scenarios, the estate may not have enough funds to cover all debts, which could leave the widow with no inheritance. In such cases, the person managing the estate can appeal to the court to reserve a specific amount to prevent financial destitution.

Margaret, lost and in despair, reached out to her estate planning attorney. Together, they strategized a plan to tackle debts, secure assets, and build a stable financial future. Understanding various debt types and how they're handled upon death was pivotal. Costly credit card debt and exorbitant medical bills were just a few of these responsibilities.

Margaret's Financial Protection Plan

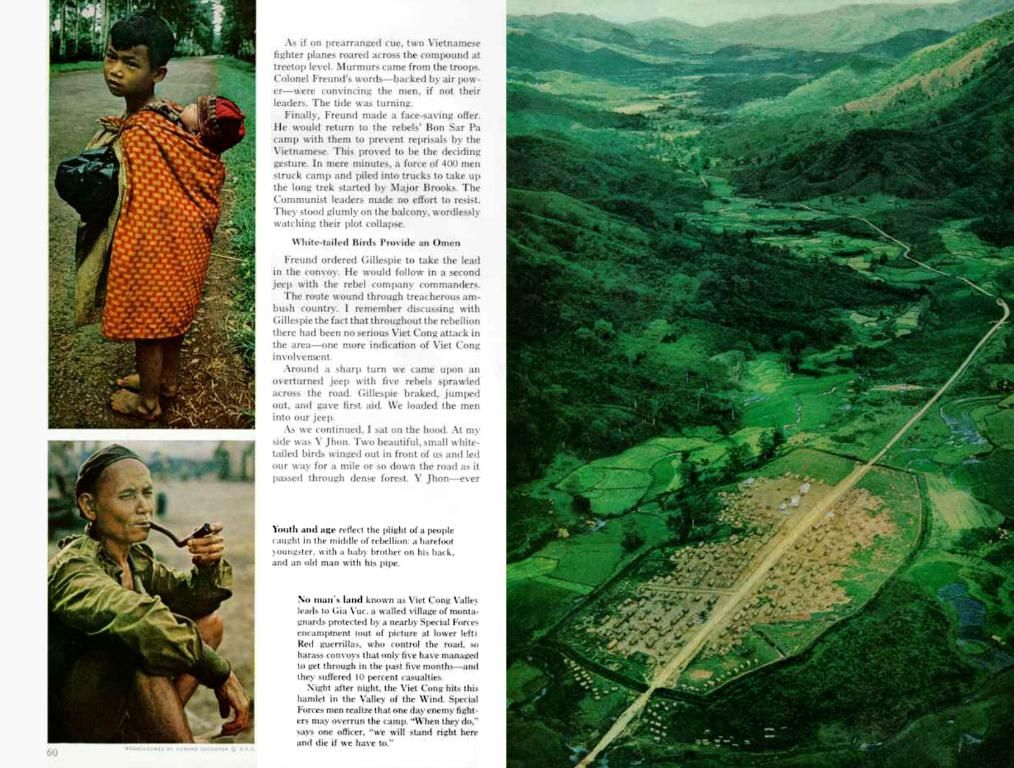

Margaret's credit cards, in Ben's name, posed a significant challenge. Debt collectors, equipped with relentless tenacity, bombarded her waves of intimidating calls. However, Margaret was not personally liable, a fact her attorney swiftly confirmed. Debt collectors often target vulnerable individuals like Margaret following a loss, so prompt communication with the credit card companies was crucial.

Margaret's attorney provided a death certificate to the credit card company, which then pursued payment from Ben's estate. Margaret's lawyer also haggled a reduced settlement for several credit cards, further alleviating financial stress.

Medical bills, often a significant burden for widows, were another hurdle. Margaret struggled with her own hefty medical bills of $35,600. Guided by her financial advisor, she delved into the rules governing medical debt and negotiation options. After a thorough review of Ben's insurance policies and negotiation with the hospital's billing department, Margaret's medical debt reduced to less than half its original amount.

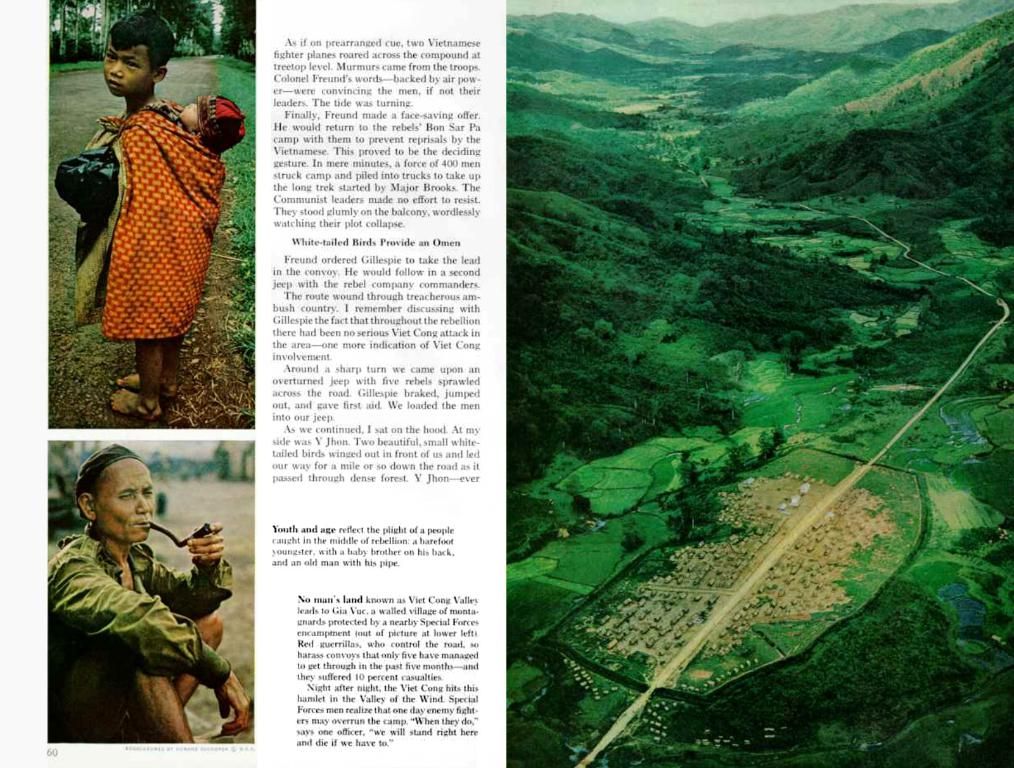

Mortgages and home loans can also pose a challenge for surviving spouses. If the loan was in both names, the surviving spouse was typically responsible for payments. However, in Margaret's case, her home in Long Island was jointly owned with Ben. She ensured timely mortgage payments while using the life insurance proceeds to finance this responsibility.

When it came to auto loans, widows needed to cover the balance if they wanted to continue using the vehicle. If the deceased had outstanding private student loans, their heirs or co-signers were liable for repayment. Luckily, federal student loans were forgiven upon a borrower's death.

While this article provides guidance, it is essential to consult a licensed professional for advice tailored to your situation. If you are a successful financial planning or wealth management firm executive, you may qualify to join the Our Website Finance Council, an invitation-only Council dedicated to your peers.

Stacy Francis, the founder of Francis Financial and Savvy Ladies, has been instrumental in empowering individuals like Margaret who are dealing with debts following a spouse's demise. Despite being overwhelmed by grief and financial pressures, Margaret was fortunate to learn that she wasn't personally liable for Ben's debts. In their quest to tackle debts and secure a stable financial future, Margaret sought the advice of Ladiestm, an estate planning attorney.