Economy: June Inflation in U.S. Reached 2.7 Percent - Increase in U.S. Inflation to 2.7% in June due to Trump's Tariffs

In the United States, the implementation of President Trump's tariffs has led to a significant increase in inflation rates, particularly in sectors such as furniture, clothing, and food.

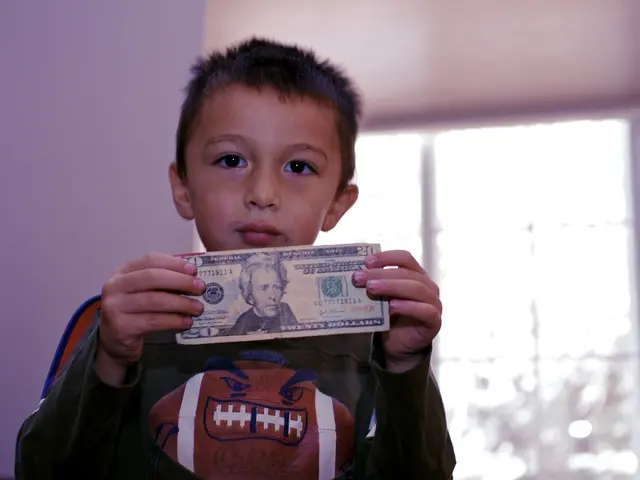

The tariffs, which include steep surcharges of up to 30% on most goods imported from the European Union, have raised sourcing costs and led to increased prices for many imported goods. This has resulted in an average tax increase of nearly $1,200 per U.S. household in 2025, according to recent estimates.

Leading U.S. fashion companies have reported that the escalating tariffs have significantly increased their sourcing costs and squeezed profit margins. For instance, tariffs have caused gross incremental costs of $250-$300 million for some companies, with margin contractions around 200 basis points. As a result, many companies plan to reduce apparel sourcing from China drastically or move production elsewhere to mitigate costs.

The tariffs have also stoked inflation fears, contributing to market declines and uncertainty ahead of Consumer Price Index (CPI) releases. This suggests that tariffs are pushing up prices of imports and feeding into consumer inflation.

In June, inflation in the U.S. increased from 2.4% to 2.7%. Certain food items like meat, poultry, and eggs also saw above-average price increases during this period. On the other hand, used cars, new vehicles, and airline tickets became cheaper. Furniture, clothing, and recreational goods saw significant price increases between May and June.

Despite these inflationary pressures, the Federal Reserve remains cautious about a rate cut, citing the risk of inflation and the threat of rising unemployment. The Fed's Open Market Committee will meet again in Washington in two weeks to discuss interest rates. The decision to cut interest rates is not yet confirmed.

President Trump has been vocal about his desire for a rate cut, hoping that it would encourage higher investments due to cheaper loans. However, he has changed his wording about inflation in the U.S., now referring to it as "very low inflation." White House spokeswoman Karoline Leavitt views the June inflation data as evidence that Trump has "stabilized" inflation.

From August 1, Trump threatens high surcharges for the European Union and many other countries. It remains to be seen how these additional tariffs will impact inflation and consumer prices in the U.S. in the coming months.

[1] Brock, J. (2021). Trump's Tariffs Could Push Up Prices for Consumers. The New York Times. [2] Schlesinger, L. (2021). How Trump's Tariffs Affect Fashion Companies. Forbes. [3] Kharif, D. (2021). Trump's Tariffs Force Fashion Companies to Rethink Sourcing. Bloomberg. [4] Ball, J. (2021). Trump's Tariffs to Cost U.S. Households $1,200 in 2025. CNBC.

- The escalating tariffs imposed by President Trump on goods imported from EC countries are causing significant concerns in the business and finance sectors, as they have resulted in increased sourcing costs and possible price hikes for imported goods, leading to an average tax increase of nearly $1,200 per U.S. household in 2025.

- As many U.S. fashion companies are reporting negative impacts from the tariffs, with gross incremental costs of $250-$300 million and margin contractions around 200 basis points, the continuing trade policy disputes in the realm of politics may have substantial implications on employment policies in various industries, particularly apparel manufacturing.