Shining Prospects for Germany: KfW CEO Unveils Increasing Interest from Global Investors

International investors showing increased enthusiasm towards KfW, the German development bank, according to its head.

In an upbeat development, KfW CEO Stefan Wintels suggests that the appeal of Germany to international investors is mounting. He shared this insight with the "Handelsblatt" newspaper, highlighting the opportune moment for attracting significant global financiers. "Many institutional investors are heavily invested in the US and seek to invest more in Europe, particularly in Germany," said Wintels, adding that the increased interest in Germany's location is evident during roadshows in New York, London, and Zurich.

"In all my three-plus decades of professional experience, I've never seen such a swift change in sentiment," emphasized Wintels. He urged making the most of this favorable momentum for Germany and Europe. The coalition agreement contains several springboards for this, including modernizing infrastructure, streamlining bureaucracy, digitalization, a commitment to qualified professional immigration, and adherence to the climate goals by 2045. Reliability and stability are a massive draw for investors, with market uncertainties caused by US government actions. "Our political stability in Germany is a true asset we should nurture," Wintels stated.

Germany needs capital from Asia, the Middle East, UK, USA, and Canada to meet the substantial future investment demands, according to Wintels. "Without this capital, the colossal sums required in the coming years cannot be raised," he added. Financial autonomy in Germany and Europe is essential, with the necessary funds available. "We're talking about 9 trillion euros in private financial assets in Germany and 30 trillion euros in Europe," Wintels pointed out.

Exploring Investment Opportunities in Germany

International investors are drawn to Germany due to its resilience, stability, and strategic opportunities across vital sectors. Here are some prime investment areas and emerging opportunities for foreign investors in Germany:

Manufacturing and Industrial Base- Germany's industrial sector maintains a reputation for crisis resistance, drawing substantial foreign direct investment (FDI) in manufacturing. Multinational corporations are backing greenfield and expansion projects.- The defense sector, with companies like Rheinmetall, is expanding production and gaining global investment due to increased defense spending and geopolitical shifts.

Green Energy and Sustainability- The renewable energy sector is booming due to policy backing and the need for energy transition.- The automotive industry is shifting towards electric vehicles, offering investment opportunities in battery technology, charging infrastructure, and EV manufacturing.

Technology and Innovation- The semiconductor and artificial intelligence sectors are promising investment destinations, aligning with Europe's push for technological sovereignty and innovation.- The pharmaceutical industry remains strong with investment opportunities in research, development, and advanced manufacturing.

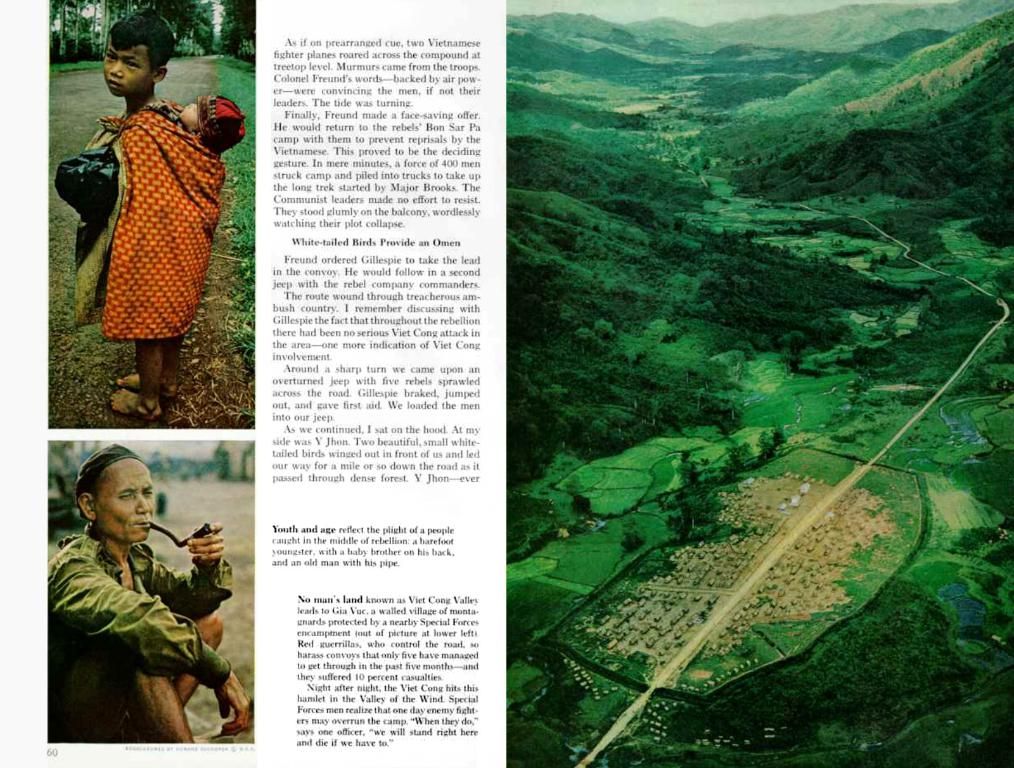

Infrastructure and Real Estate- The German government plans to invest €1 trillion in infrastructure and defense, offering significant opportunities for construction, logistics, and related sectors.- The German real estate market has demonstrated a remarkable recovery, with a 26% increase in transaction volume in Q1 2025, particularly in the office segment and across new development projects.

Emerging Investment Opportunities in Germany

- Strategic sectors such as renewable energy, AI, electric vehicles, and semiconductors are expected to spearhead growth and attract substantial international capital.

- Public-Private Partnerships (PPPs) present opportunities for private investors to collaborate with the public sector in large-scale infrastructure projects.

- Germany's reputation as a stable, crisis-resistant economy continues to make it a top destination for international business expansions, even amidst global uncertainty.

Pointers and Outlook

- Although economic and policy uncertainties might temporarily dampen consumption and exports growth, Germany's diverse and innovative sectors present long-term value for international investors.

- Despite a decline in overall FDI in Europe to a nine-year low, the outlook for Germany is optimistic, driven by focus on emerging industries and infrastructure modernization.

A Snapshot of Investment Opportunities

| Sector | Key Opportunities | Notable Trends/Drivers ||--------|-------------------|-------------------------|| Manufacturing | Expansion projects, defense/aerospace | Crisis resistance, stable investment || Green Energy | Renewables, EV infrastructure | Policy support, energy transition || Technology | Semiconductors, AI, pharmaceuticals | Innovation, technological sovereignty || Infrastructure | Construction, logistics, real estate | Infrastructure investment, PPPs |

Germany stands out as an enticing destination for international investors, combining stability with growth prospects across diverse sectors[3][4][5].

- Given the increased interest from global investors, Germany's commitment to key areas such as modernizing infrastructure, digitalization, a commitment to qualified professional immigration, and adherence to climate goals by 2045, as outlined in the coalition agreement, could potentially serve as a foundation for further development in the employment sector, attracting more foreign investments.

- As Germany looks to raise significant capital from Asia, the Middle East, UK, USA, and Canada to meet future investment demands, the establishment of partnerships between private investors and the public sector in large-scale infrastructure projects (Public-Private Partnerships or PPPs) could prove beneficial for financing these expansive endeavors, leveraging the financial assets of approximately 9 trillion euros in private financial assets in Germany and 30 trillion euros in Europe.