Investment strategists unveil top ETF portfolio projection for the upcoming decade

40/60 ETF Portfolio: A Less Risky Approach for the Next Decade

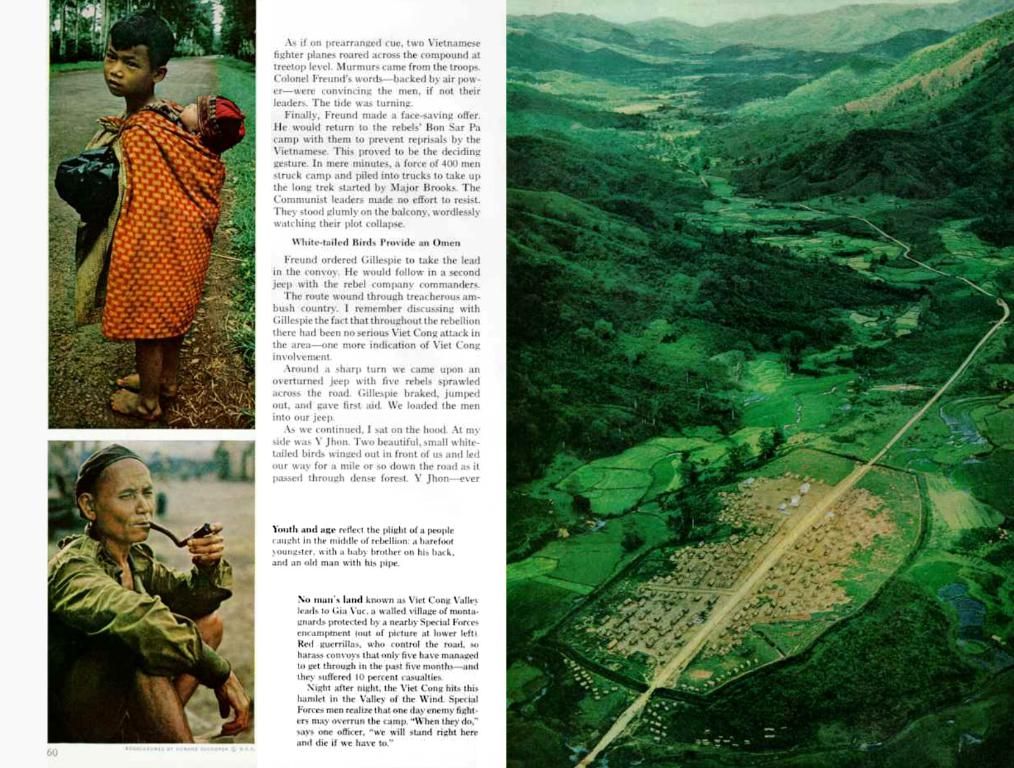

Many investors might be tempted to invest their money in a 100% equity allocation, thinking it'll deliver the highest returns over a long investment horizon. But for the coming ten years, the world's second-largest asset manager, Vanguard, suggests a smarter strategy.

The Sweet Spot: A 40/60 ETF Portfolio

According to Vanguard analysts, "High interest rates and high stock valuations mean a low equity risk premium. Therefore, our time-varying portfolio with asset allocation has a significant overweight in fixed-income securities compared to a 60/40 benchmark."

Instead of the traditional 60/40 allocation, they recommend a more balanced 40/60 mix. Todd Schlanger, an expert from Vanguard, explains, "It's about risk management – investors can achieve similar returns by taking less risk if one asset class is less volatile than another."

The Conservative Edge of Bonds

While a portfolio heavily invested in bonds may not have paid off in the past, it's worth noting that conservative investors might find benefits in a higher-yielding bond allocation, especially in the current economic climate.

Compared to a 100% stocks portfolio, a 40/60 portfolio might provide lower returns but could help reduce the volatility, making it appealing to risk-averse investors or those in the later stages of life.

What's the Catch?

With lower returns and an increased exposure to inflation risks, it's crucial to consider the trade-offs of a 40/60 ETF portfolio. Lower returns and tax implications could affect your net returns, so balancing risk, returns, and financial objectives is key to success.

Looking Ahead: 60/40 vs 40/60

A traditional 60/40 portfolio is more dynamic, offering higher returns albeit with higher volatility. It's best suited for investors who can tolerate moderate market fluctuations. On the other hand, a 40/60 portfolio may be less risky and more conservative but with potentially lower returns.

Ultimately, the choice between a 40/60, 60/40, or 100% equity allocation depends on an investor's risk tolerance, investment horizon, and financial goals. Whether you're a risk-taker or a risk-averse investor, align your portfolio with your personal finances to secure your financial future.

Also Read:

- Navigating a Stock Downturn: What to do when the SDAX drops 15%

- Sticking to Your Guns: Expert advice on investing in these volatile stocks

Personal finance experts at Vanguard suggest a more balanced 40/60 ETF portfolio as a less risky approach for the next decade, compared to a traditional 60/40 allocation. This approach aims to provide lower volatility, which might be appealing to risk-averse investors or those in the later stages of life, though it may have lower returns than a more equity-heavy portfolio.