Lucrative Day for Financial Backers: Successful SuperReturn Event

"Investing private funds, public consequences" - the annual conference of financial investors, SuperReturn International, draws mixed responses based on one's viewpoint. Held in Berlin since 1997, this gathering of around 50 trillion US dollars worth of investment managers has attracted criticism from groups like Finanzwende, who view it as "speed dating for financial investors." This year, Bono and Serena Williams are scheduled to speak.

Financial investors, including asset managers and private equity firms like Blackstone, purchase, restructure, and sell companies for substantial profits within five to seven years, promising an annual return of around 20%. Critics argue that these returns can't be justified purely by business acumen.

The impact on the local population has been highlighted by Franz Michel, head of housing and rent policy at the German Tenants' Association. Companies, like the Adler Group and Vonovia, have been accused of deliberately allowing their properties to deteriorate, inflating rent prices, and exploiting legal loopholes to avoid property transfer taxes.

Healthcare is another sector heavily influenced by commercialization, claims Sylvia Bühler of the Verdi union. Financial investors cut costs primarily through low staffing ratios and wages, which affects those in need of care and leads to increased prices for facilities, with private equity owning around 30% of nursing home places in Germany in 2022.

Reiko Woellert of the Agricultural Law Working Group (AbL) raises concerns about the increasing takeover of agricultural operations by investors, particularly in the east. Large investors like Munich Re are using legal loopholes to gain secure, low-risk investments, causing land prices to rise and making it difficult for farmers to compete.

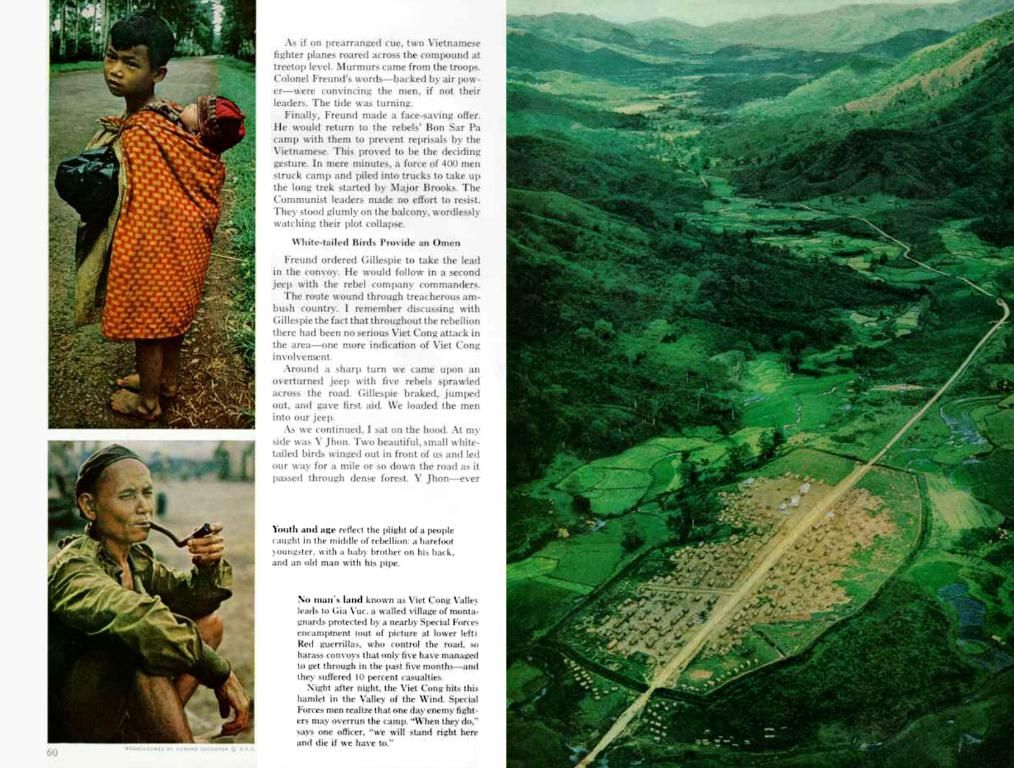

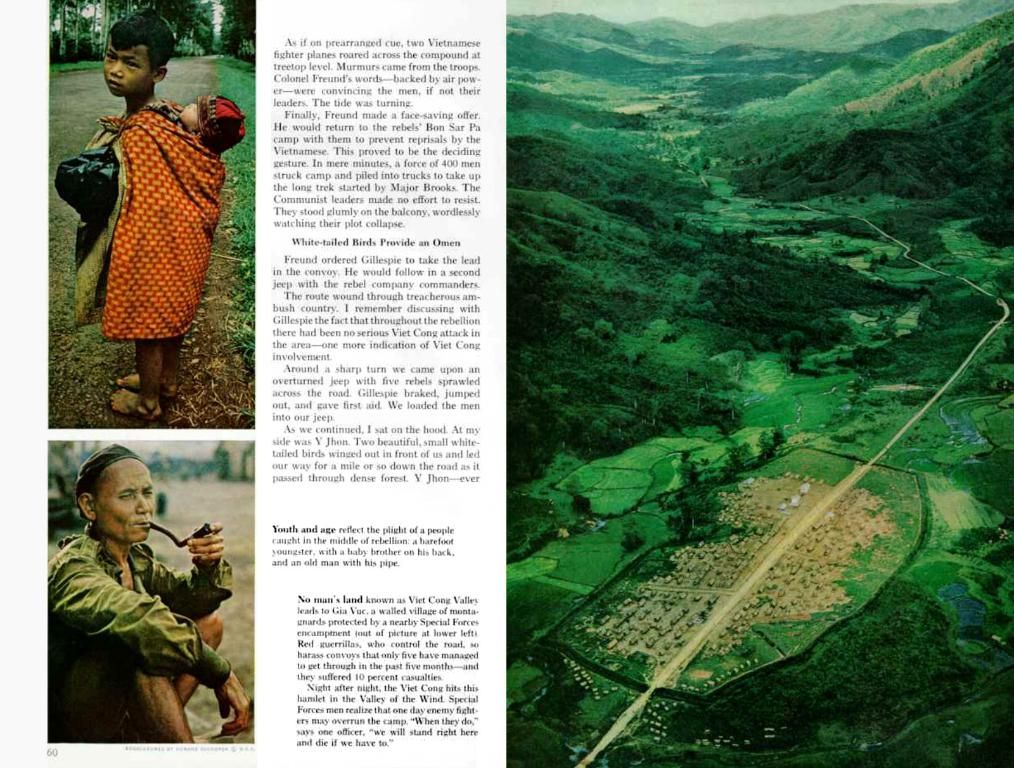

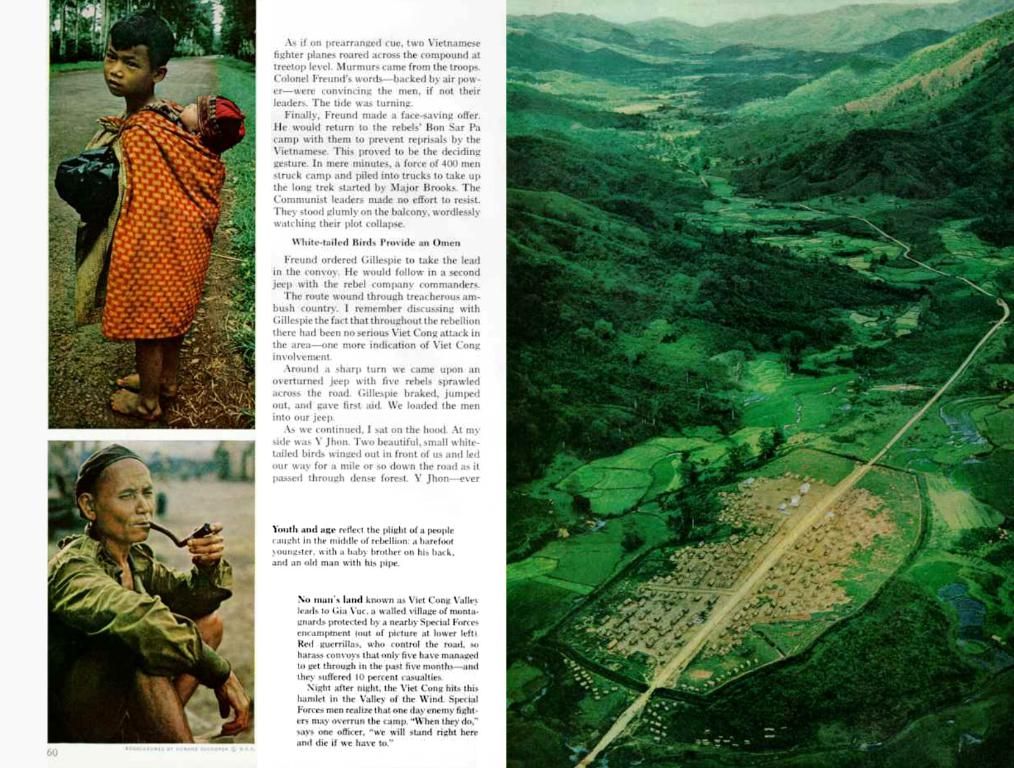

Critics argue that private equity investments can compromise public accountability, lead to reduced service quality, and increased costs, among other issues across various sectors. While private equity can bring necessary capital and efficiency improvements, these risks and potential negative social impacts warrant scrutiny.

Investing private funds in businesses, such as asset management or private equity, can lead to significant profits for financial investors, as they often purchase, restructure, and sell companies for a return of approximately 20% annually. However, critics contend that the high returns can't be solely justified by business acumen, as the impact on sectors like housing, healthcare, and agriculture may result in increased prices, reduced service quality, and negative social impacts, making public accountability compromised.