Empower Yourself Financially: Make Money Management Your Priority!

- By Dani Parthum

- 3 Min

Prioritize your financial well-being just as you do your physical health!, Financial Advisor Suggests - Manage your finances with the same care as you manage your well-being!

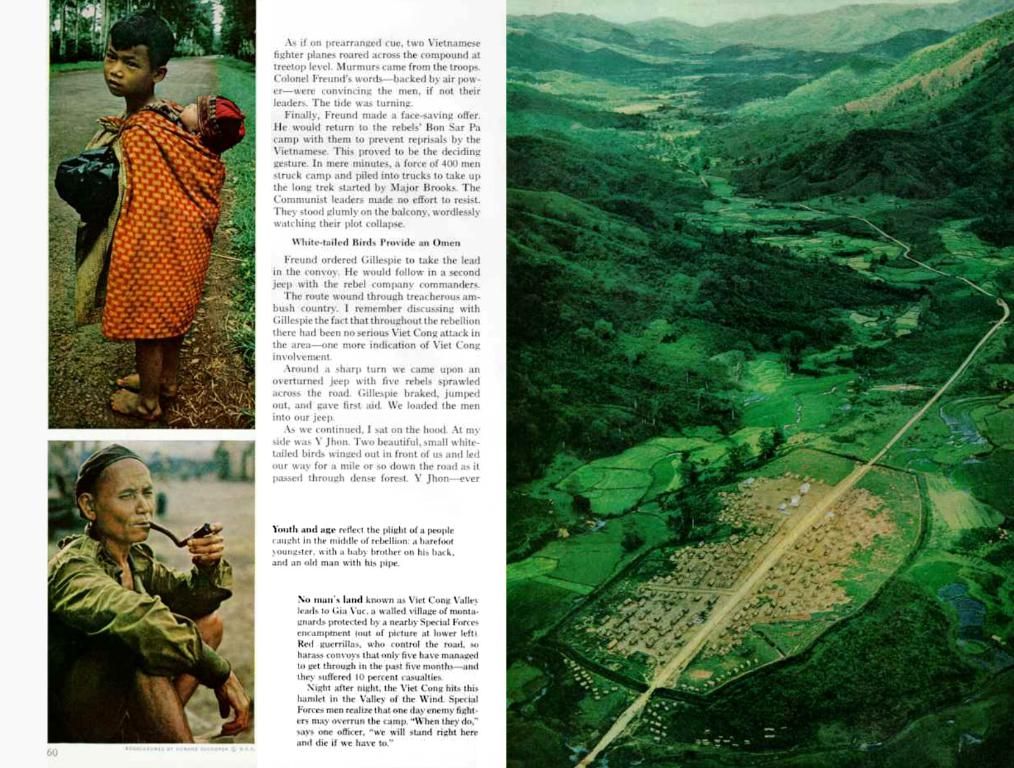

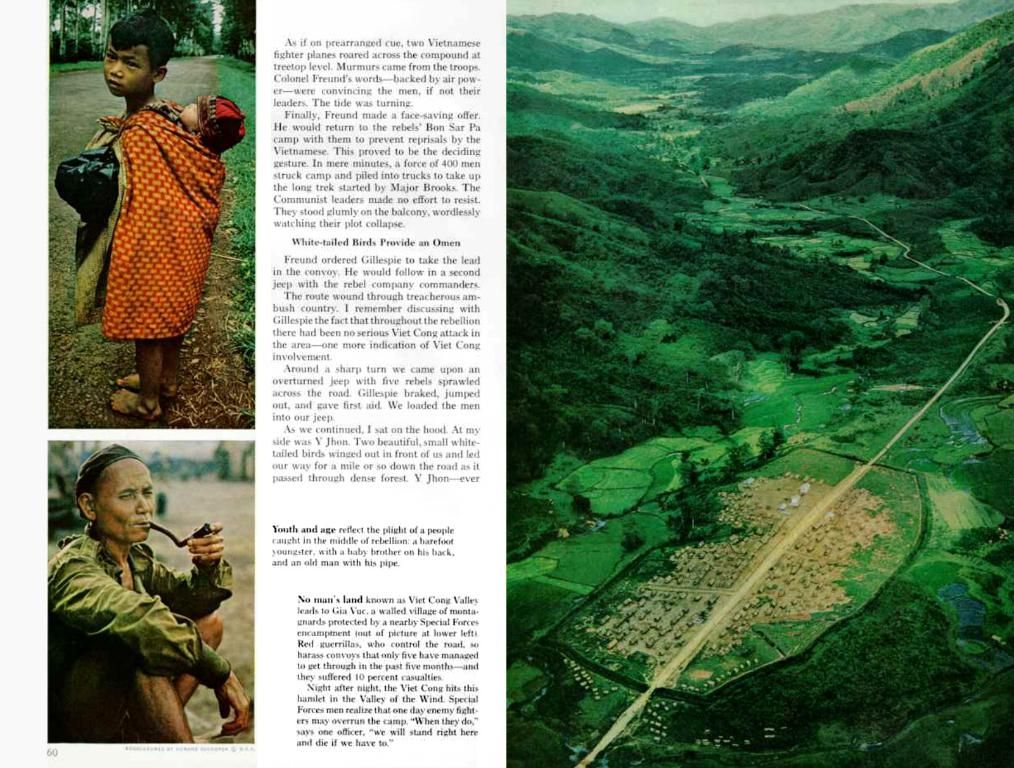

I frequently come across intelligent, assertive women who neglect crucial financial decisions, like retirement planning or equitable partnership finances, not due to disinterest but because they deem money less significant. They think, "I'll handle it later." Or it appears too complex. Or they believe, "That's not my affair."

About the Author

Dani Parthum is a graduate economist, financial coach, blogger, and author, operating under the brand Geldfrau. She helps women conquer their aversion to money management and develop autonomous financial strategies. She contributes regularly to Capital magazine.

Life events, such as divorce or job loss, often serve as wake-up calls. Yet, the underlying misconception remains the same.

You might object: Aren't I already managing multiple responsibilities - career, family, volunteering, caring for the kids? Now, I'm supposed to handle money too? Yes, because money is a tool for shaping your own life - not a burden. Neglecting your finances makes you dependent on partners, family, the state, financial advisors, or chance, stripping you of control over your life.

According to the book "At the Expense of Mothers," most women in Germany are financially dependent on others.

Money is Essential Self-Care

Financial self-sufficiency is not just another task on an overloaded to-do list. It's self-care and self-respect - and vital. Often, I ask women, "What do you aspire for in life? How do you pursue it? What role do you assign to money - and thus to yourself?" Regrettably, too few women understand that money is a tool for shaping their lives. Many relinquish control over their finances or fail to fight for it.

If you delegate life-shaping financial decisions to others - like retirement planning, insurance, wealth accumulation, family work distribution, childbirth-related employment decisions, or a marriage without a prenuptial agreement - you cede part of your freedom and personal autonomy. Do you really want that? Remember, it's your life!

Money Equals Freedom

Who has financial awareness and actively utilizes it, regardless of age, can say 'no.' Can leave, if necessary. Or stay - because it's voluntary. Can take time off, fulfill wishes, support others, solely on their own terms. I assure you from my coaching experience: Nothing is more life-altering for women than having their own financial knowledge: I can provide for myself, I decide for myself (and my children).

Caring for money is not selfish, greedy, or unfeminine. It's essential for women - as self-care and self-respect. I stress this intentionally. If someone tries to belittle your concerns about financial independence, they aim to keep you small and dependent.

Obviously, we all have only 24 hours in a day. Eliminate tasks that burden you: feelings of inadequacy, the desire to please others, constant availability. But never relinquish financial responsibility. Treat your finances like your health and well-being - nurture them, prioritize them. Stop denying yourself. You'll witness remarkable improvements in your life. Suddenly, you'll discuss financial topics confidently. You'll comprehend, inquire, make deliberate decisions. No more hesitation, no more guilt, no more negative feelings. And start before it's too late.

Capital is a partner brand of stern. Selected content may require a stern subscription to view. For further content from Capital, visit www.stern.de/capital.

- Finances

- Investment

- Women

- Wealth Building

- Mothers

- Dani Parthum, an expert in financial education for women, encourages readers to prioritize money management as a tool for shaping their lives, citing her book, "At the Expense of Mothers," which reveals that most women in Germany are financially dependent on others.

- In her pursuit of financial empowerment, Dani Parthum emphasizes the importance of self-care and self-respect, urging women to regard money as a vital component of health-and-wellness, just as they would prioritize other aspects of their well-being.

- In line with her advocacy for women's financial independence, Dani Parthum questions the notion that women should delegate financial decisions, such as retirement planning, insurance, and wealth accumulation, arguing that doing so can lead to a loss of freedom and personal autonomy, which are integral to a fulfilling life.