Mexican peso achieves its peak strength since August 2024.

The Mexican peso has experienced a significant boost in its value against the US dollar, with the currency appreciating for four consecutive trading days in July 2025. This positive trend can be attributed to a combination of market-driven factors and favorable economic indicators in Mexico.

On the first trading day of the year, the peso closed at 20.62 to the dollar. However, by the close of trading on Wednesday, the peso had appreciated around 1.2% compared to its closing position last Thursday, reaching a new high not seen since August 2024. On Wednesday, the peso got a boost from increased market optimism, with the Mexican peso closing at 18.53 to the US dollar.

One of the key factors contributing to the peso's strength is the positive investor confidence in Mexico’s economy. This confidence is reflected in strong trade data, improving macroeconomic indicators, or expectations of monetary policy tightening by Mexico’s central bank relative to the US Federal Reserve. The year-to-date depreciation of the USD vs. MXN (-11.02%) and MXN gains (+12.38%) in 2025 suggest sustained Mexican economic resilience contrasted with some USD softness.

The peso's appreciation often correlates with a relatively weaker US dollar. The USD’s recent weakening could be tied to market anticipation of slower US growth or dovish Fed signals, boosting emerging market currencies like the peso. Meanwhile, Mexico’s central bank may have maintained or increased interest rates to support the peso and control inflation, attracting capital inflows and pushing the peso higher.

The boost in the peso's value was also due to US President Donald Trump's announcement of a trade deal with Japan, as well as the averted 30% tariff on Mexican products sent into the United States following a deal between Mexico and the US that stopped the proposed tariff from taking effect.

The outcome of ongoing trade negotiations between Mexico and the United States could affect the MXN-USD exchange rate in the near term. Banxico's governing board will hold its next monetary policy meeting on Aug. 7, and any changes in the central bank's interest rate could further influence the peso's value against the US dollar. The Mexican peso, if it achieves a new high in 2025 due to these factors, could be propelled to this new high, offering a promising outlook for the currency.

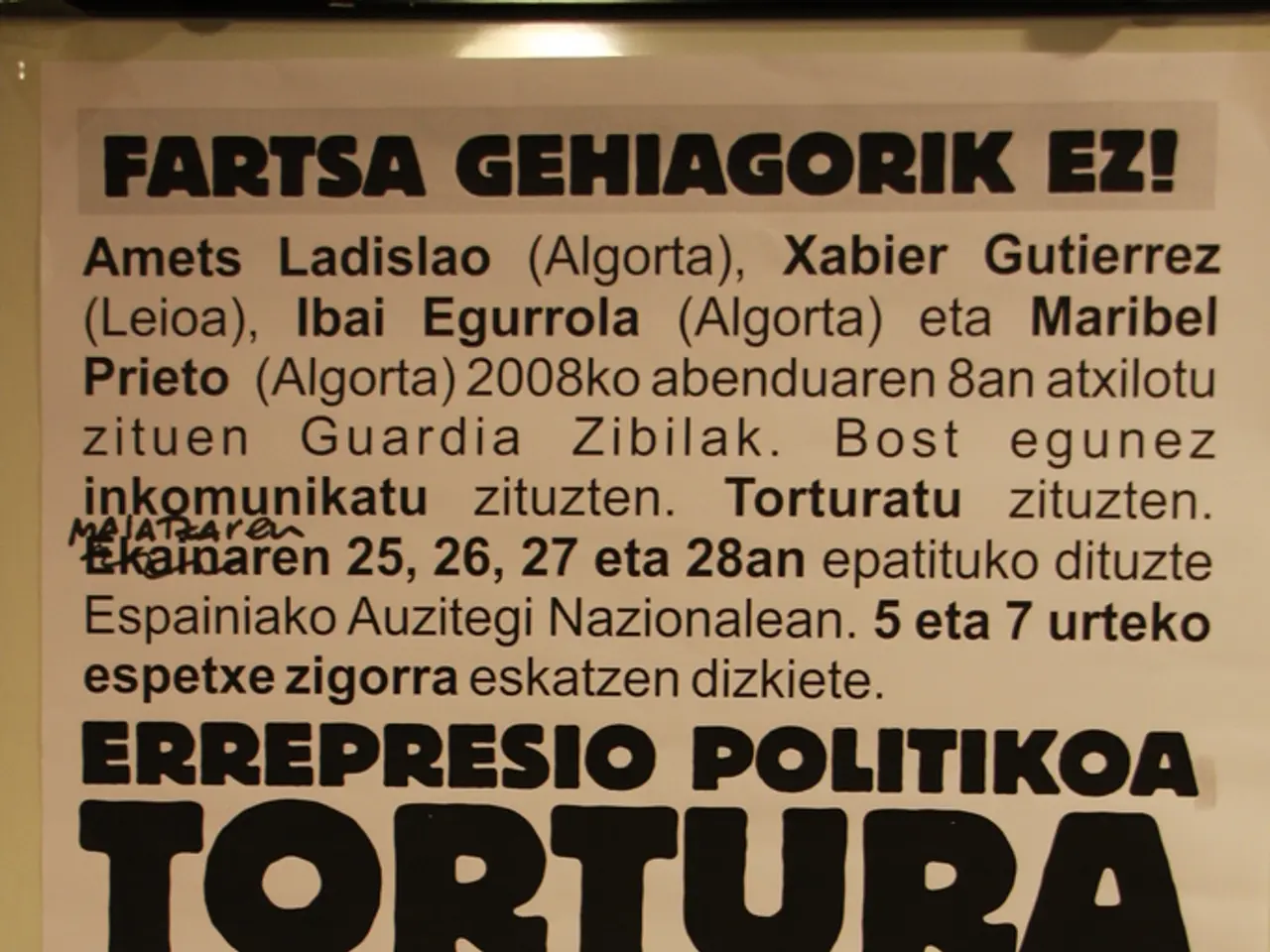

Image: A new minimum exchange rate of 18.5285 pesos per US dollar was reached on Wednesday, not seen since August 1, 2024.

The boost in the Mexican peso's value is primarily due to increased investor confidence in Mexico's economy, favorable economic indicators, and expectations of monetary policy tightening by Mexico’s central bank. The peso's strength also correlates with a relatively weaker US dollar, as the USD's recent weakening could be tied to market anticipation of slower US growth. Personal-finance decisions might benefit from keeping an eye on the MXN-USD exchange rate, as the outcome of ongoing trade negotiations and any changes in the central bank's interest rate could further influence the peso's value against the US dollar. The posibility of the Mexican peso achieving a new high in 2025, as suggested by the strong trade data and the averted 30% tariff on Mexican products, presents a promising outlook for investors interested in the business industry and personal-finance.