Navigating Financial Freedom at Every Stage: Discovering the Route to Autonomy and Peace of Mind

Financial independence is a goal that transcends age and income levels. Contrary to popular belief, financial independence isn't solely attainable for young people or those with high-paying jobs. It's about making intentional decisions that align with your financial goals, managing your finances effectively, and growing your wealth over time.

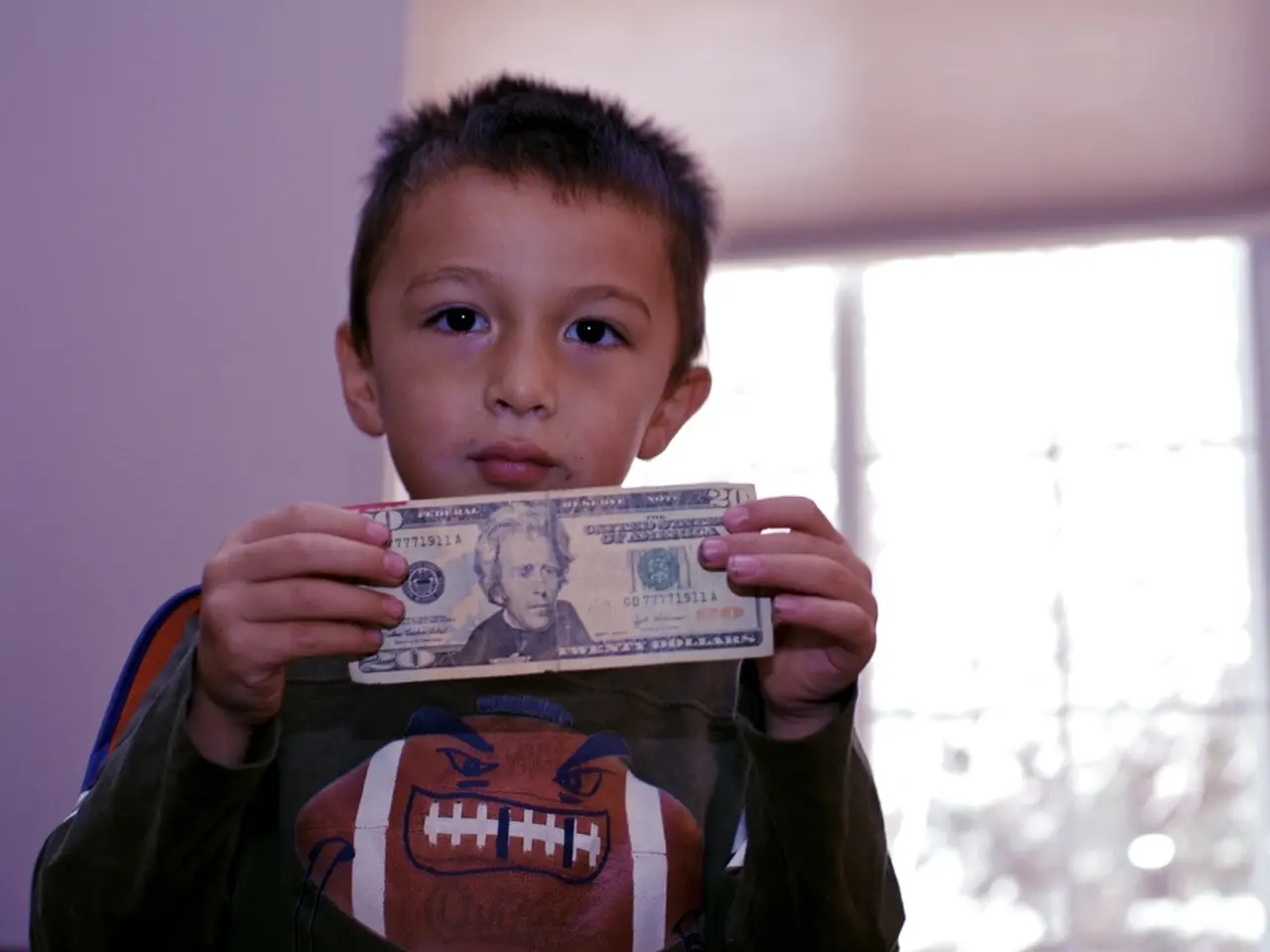

The Foundation: Young Adults (18–30 years)

Young adults are at the beginning of their financial journey. The focus should be on establishing a strong foundation by cultivating good savings habits, managing debt responsibly, and starting investments early. This period is about covering basic needs, building emergency funds, and preparing for long-term wealth accumulation.

Emphasize creating a consistent surplus from income, ideally following approaches like the 50/30/20 budgeting rule, where 20% of income is saved or invested. By doing so, young adults can build a solid foundation for their financial future.

Balancing Act: Middle-Aged Adults (31–65 years)

Middle-aged adults often find themselves juggling complex financial demands such as mortgage payments, family expenses, and career growth. The strategy shifts towards optimizing investments, accelerating retirement savings, and protecting wealth via insurance and tax planning.

Increasing passive income to cover comfort and lifestyle needs is key, moving from basic financial independence to comfort independence, where passive income covers more than just essentials. Preparing for retirement through intentional pension optimization and transition planning becomes crucial as retirement approaches.

Maintaining Independence: Older Adults (66+ years)

Strategies for older adults focus on managing income drawdowns smartly to maintain financial independence during retirement while minimizing tax burdens. Planning for longevity includes estate planning, legacy structuring, and securing long-term care funding.

In later decades (75+), preserving independence and comfort, as well as making provisions for healthcare and family, are primary concerns. The emphasis is on sustainable wealth management rather than growth.

Key Takeaways

- Financial independence can be pursued at any age.

- A diversified portfolio is crucial for financial independence, based on risk tolerance and long-term goals.

- Prioritizing high-interest debt and focusing on paying it off quickly is essential in minimizing debt.

- Investing is a powerful tool for achieving financial independence, regardless of age. Index funds and exchange-traded funds (ETFs) offer a low-cost, diversified way to begin investing.

- The goal of investing is to build wealth gradually over time, not to get rich quickly. Consistency in contributions to investments benefits from the power of compounding.

- Debt is a significant obstacle to achieving financial independence, especially consumer debt like credit cards or high-interest loans.

- Budgeting is the foundation of financial independence, helping you track income, control expenses, and direct money toward savings and investments.

- Goal setting, with specific, measurable, and realistic goals, is crucial in working toward financial independence. Creating a clear vision of what financial independence means for you is the first step in embracing financial independence.

- Developing a growth mindset around money is key to overcoming challenges and sticking with your financial plan.

- Building multiple streams of income can accelerate your journey to financial independence. Multiple income streams could include side hustles, investments, passive income, and more.

- It's important to stay patient and avoid trying to time the market. Compounding is a process that makes investing a powerful strategy, where returns on investments generate their own earnings.

- Young adults should focus on establishing a strong foundation for financial independence by cultivating saving habits, managing debt effectively, and starting investments early for long-term wealth accumulation, employing budgeting strategies like the 50/30/20 rule.

- Middle-aged adults, with complex financial demands, should aim to optimize investments, accelerate retirement savings, and protect their wealth through insurance and tax planning, increasing passive income to cover comfort and lifestyle needs, and plan for a smooth retirement transition.

- Older adults should focus on managing income drawdowns during retirement, planning for longevity through estate planning, legacy structuring, and securing long-term care funding, and preserving independence by emphasizing sustainable wealth management in later decades.

- Financial independence can be attained at any age, and a diversified portfolio is essential, based on risk tolerance and long-term goals. Investing is a powerful tool, offering a low-cost, diversified way to start with index funds and exchange-traded funds (ETFs), with a goal of building wealth gradually over time through consistent contributions and the power of compounding.