Breaking News: Nippon Steel Snags US Steel - boon for American steelmaking, but watch the US veto!

Nippon Steel affirms intent to completely own US Steel in acquisition deal

Good news for the steel industry, as Nippon Steel Corporation officially acquires all common shares in United States Steel Corporation (US Steel)! According to officials from the Japanese firm, President Donald Trump, in a turn of events, has endorsed this "historic partnership" following Trump's revocation of President Biden's decision that previously blocked the takeover.

In a joint statement from the two companies, they expressed their excitement about building a strategic alliance, first announced in 2023. This deal, amounting to a whopping 14 billion dollars, will see the firms settle for a "golden share" under a national security agreement, giving the US government veto rights over important decisions such as board appointments and mergers.

Trump is emphasizing that the Pittsburgh-based company will remain under US control, and has overturned Biden's decision that demanded the companies "abandon" the deal within a month. The national security agreement between the US government and the steelmakers is set to result in approximately 11 billion dollars in new investments by 2028.

"We eagerly anticipate putting our commitments into action to revitalize American steelmaking and manufacturing!" proclaimed the firms in their statement. The combined crude steel output of the two entities ranked fourth in the world last year, providing hope for the strengthening of the US steel industry.

Jay, it's complicated - the politics behind the takeover

Stepping back, one might wonder - why the sudden change of heart from the US government? Well, it's a tangled web that involves everything from national security concerns to trade negotiations and job creation. Here's the summary:

- The Deal has Legs: This partnership is banking on $11 billion in new investments, creating over 100,000 jobs in the steel industry by 2028.

- Enhancing American Steelmaking: The companies aim to revive the US Steel industry, bolstering its domestic steel manufacturing capabilities.

- Domestic Production Commitments: As part of the national security agreement, the firms have agreed to maintain and enhance domestic steel production, ensuring continued robustness in US manufacturing.

- US Veto Power: To allay initial concerns about foreign ownership and national security, the US government will be given "golden shares" granting veto power over key strategic decisions. This ensures that the US maintains oversight of the merged entity, aligning developments with US interests.

- Antitrust Approvals: The deal has successfully completed the Department of Justice’s antitrust review process, a necessary step in approving mergers and acquisitions.

Intrigued? Ready to dive deeper into the world of steel, politics, and national security? Stay tuned to find out more!

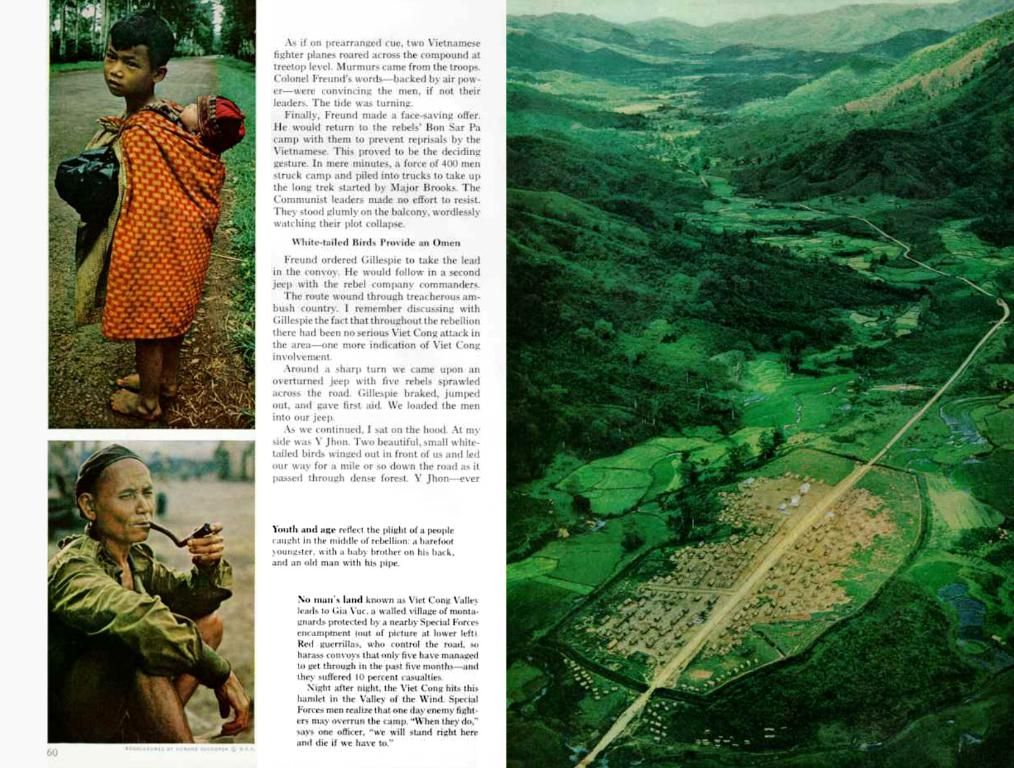

[📸By Reuters]

- Tags:

- Japan

- US

- US Steel

- Donald Trump

Sources:1. Reuters2. The Jiji Press, Ltd.

- The unexpected approval of Nippon Steel's acquisition of US Steel could significantly boost the American steel industry, due to the $11 billion investment promised and the creation of over 100,000 jobs by 2028.

- This strategic alliance aims to enhance domestic steel manufacturing capabilities in the United States, with a commitment to maintain and improve domestic production.

- To address concerns about foreign ownership and national security, the merged entities will operate under a national security agreement, granting the US government veto power over key decisions.