Potential Rebound for WBA Shares Following Significant 65% Decline?

Walgreens' stock (NASDAQ:WBA) has gained traction after whispers of a potential acquisition by private equity firm Sycamore Partners resurfaced. Sycamore, known for its investments in consumer, distribution, and retail sectors, reportedly held talks with Walgreens last December. With CNBC's David Faber stating that the deal is gaining momentum, WBA shares have perked up, though they've had a rough year: down 54% since 2024's beginning while the S&P 500 climbed 28%.

For those seeking growth with lower volatility than an individual stock, the High-Quality portfolio might be worth considering. Launched in Q1 2024, this collection of 30 stocks has outperformed the S&P 500, bringing in over 91% gains since launch.

However, Walgreens' performance doesn't make for pretty reading. Things took a turn for the worse beginning in 2023. Let's break it down:

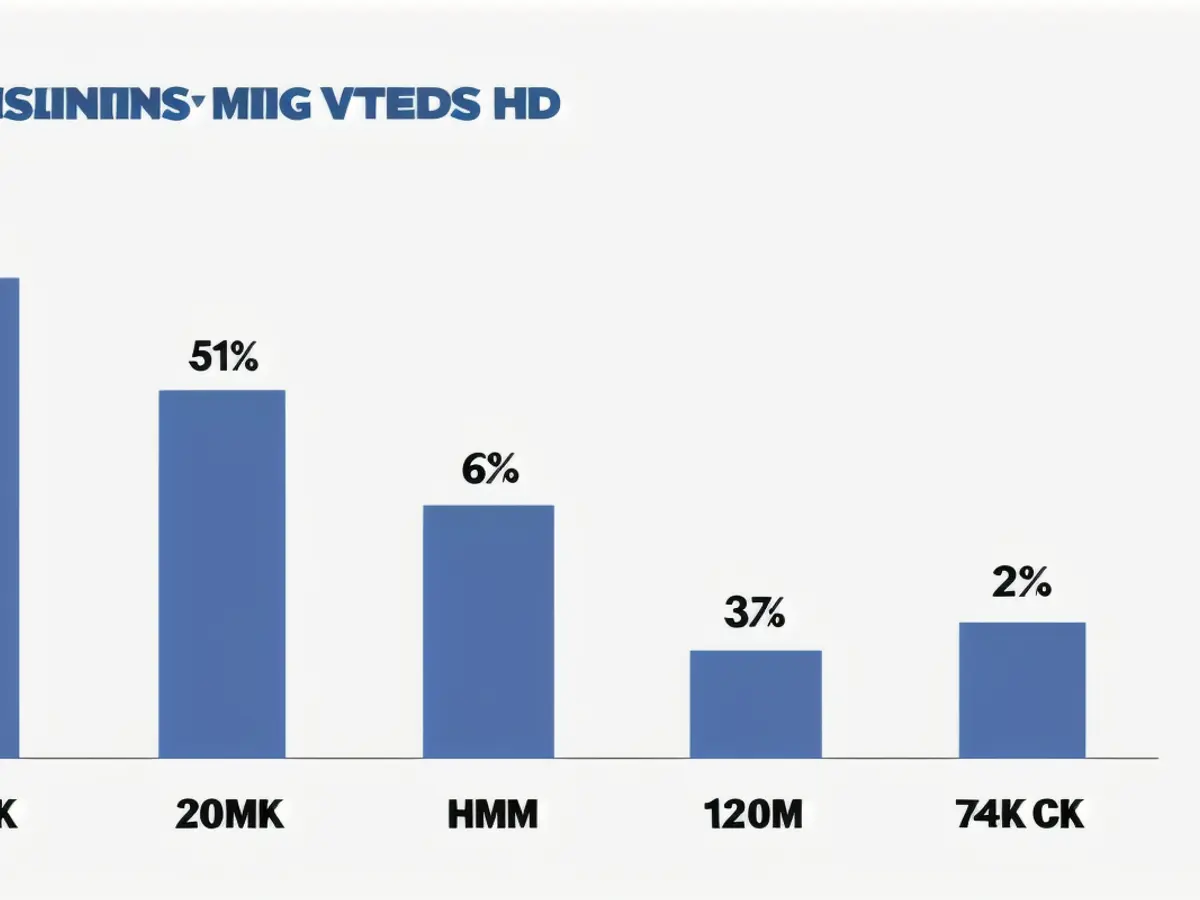

- Earnings per share: A 46% tumble from $5.04 in 2022 to $2.73 now.

- Trailing P/E ratio: A 37% dive from 6.4x to 4.1x over the same period.

Walgreens' revenues climbed to $150 billion in the past year due to higher prescription volumes and drug price escalations. But while its German wholesale division bumped up its international performance, the retail segment struggled, recording a 6% sales dip between 2022 and 2024. This downward spiral led to store closures and profitability issues, with the operating margin slumping from 0.7% in 2022 to -1.2% currently, and the adjusted margin dropping from 3.4% in 2022 to 1.6%.

Investors have taken notice of these profitability problems, pushing Walgreens' valuation multiple down into the 4.1x territory – compared to its last four-year average P/E ratio of 5.9x. This stock price slide, marked by swings in annual returns and a major plummet in 2024, is a stark reminder that Walgreens hasn't been in a winning streak for some time.

But all's not lost. The High-Quality portfolio offers a potential escape for those looking for low volatility amidst market uncertainties. With a strong track record, this diverse collection of stocks has consistently outperformed the S&P 500 since launch. It's worth keeping an eye on Walgreens, too. If the Sycamore Partners acquisition talks gain traction, WBA stock could see a surge.

- Walgreens' potential acquisition by Sycamore Partners, known for its investments in the consumer, distribution, and retail sectors, has led to speculation in the market, resulting in a rise in Walgreens' stock (WBA).

- Despite the gains in WBA stock, Walgreens' revenues reached $150 billion last year due to higher prescription volumes and drug price escalations, but the retail segment struggled, recording a 6% sales dip.

- Walgreens' German wholesale division boosted its international performance, but this was not enough to offset the retail segment's struggles, leading to store closures and profitability issues.

- Sycamore Partners' talks with Walgreens have led to a drop in Walgreens' valuation multiple, with its P/E ratio falling from its last four-year average of 5.9x to 4.1x, indicating investor concern about Walgreens' profitability problems.

- Amidst these challenges, Walgreens could still see a surge in stock price if the Sycamore Partners acquisition talks gain traction, and for those looking for low volatility, the High-Quality portfolio, which outperformed the S&P 500 since launch, could be a potential option.