Qatar Purchases $500 Million Stock in Canadian Mining Company Ivanhoe

In international news, a significant development unfolded as Saudi Arabia and Pakistan signed a formal mutual defense pact, strengthening their decades-long partnership. The agreement, though ambiguous, has not raised immediate alarm in Israel, India, or the US, with Saudi officials stating that it was years in the making.

Meanwhile, countries worldwide are beginning to distance themselves from partnerships with Washington, or openly defy the White House, suggesting that US President Donald Trump's aggressive foreign policy approach may not be yielding the desired results.

Moving on, the UAE is expanding its global footprint in AI technology. e& enterprise, a company with the Emirates Investment Authority as its largest shareholder, is seeking international expansion as growth slows in its existing markets. Serbia is the latest country to be a part of this push, with e& enterprise planning significant investments.

Russia and Belarus have caused unease across Europe with military drills that included rehearsals involving the launching of tactical nuclear weapons. This move has raised concerns and underscores the ongoing geopolitical tensions in the region.

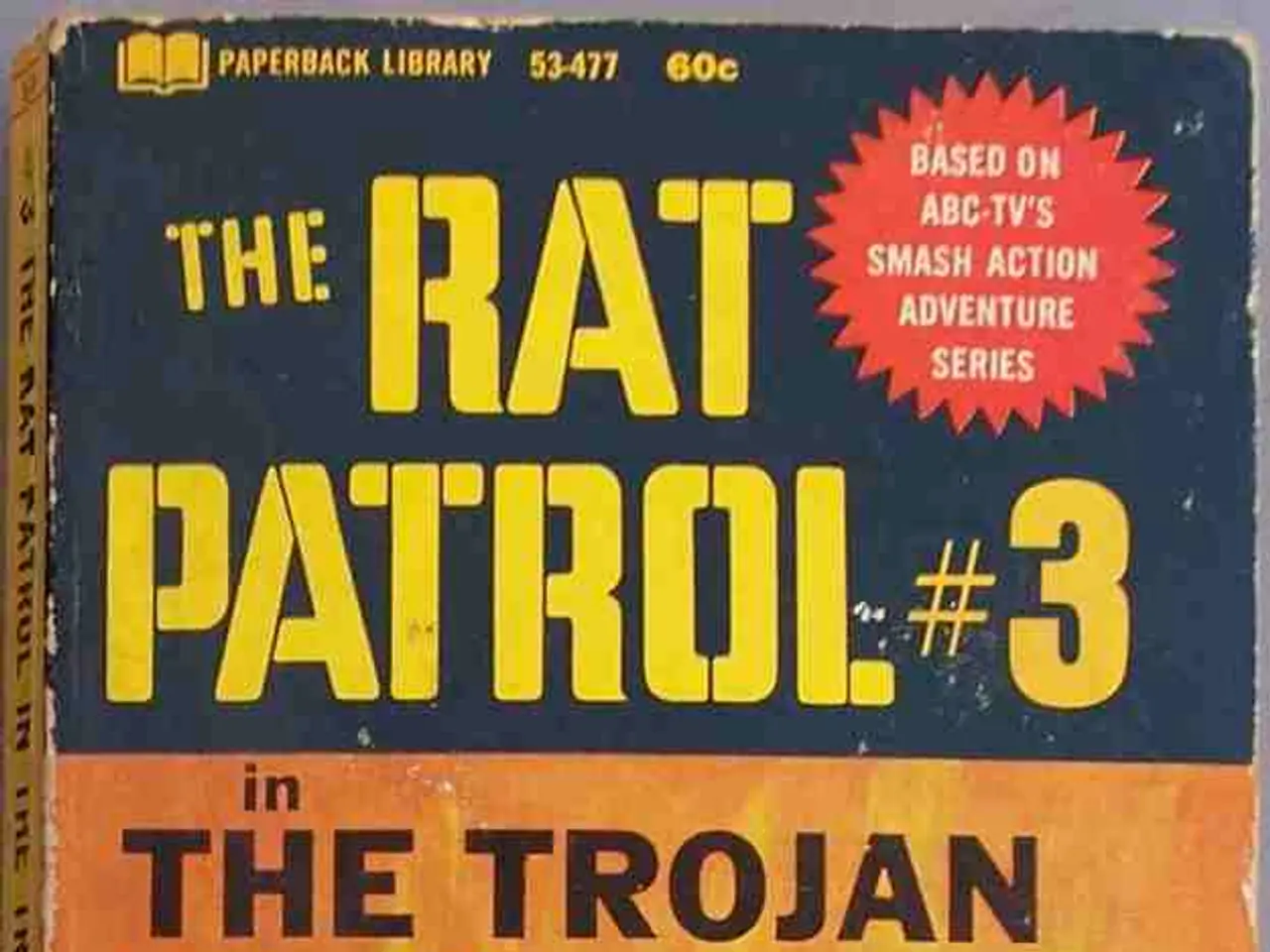

In economic news, Qatar's sovereign wealth fund has announced a $500 million investment for a 4% stake in Canada's Ivanhoe Mines. The investment will be used to fund the exploration and development of mines for metals such as copper, palladium, nickel, and zinc, all critical for the energy transition and data centers.

The US, Mexico, and Canada have begun consultations ahead of a high-stakes review of their $2-trillion trade agreement. As global trade dynamics continue to evolve, these consultations are crucial in maintaining stability and fostering economic growth.

Other Gulf investors have been pouring capital into African resources. For instance, Emirates Global Aluminium is planning a major investment in a bauxite project in Ghana, and Abu Dhabi's International Resources Holding agreed to buy a majority stake in a DRC tin producer.

The EU has unveiled plans to impose sanctions and tariffs on Israel as it expands its war in Gaza, marking a tougher stance against the country. This decision comes as a response to Israel's continued military actions in the region.

In technology news, the Financial Times reported that Chinese regulators have issued an order to firms, instructing them not to use another China-specific Nvidia chip. This ban could be a strategic move to push Washington into greenlighting exports of more powerful chips, or to accelerate decoupling from American technology.

A $19-billion refinery in Nigeria has sent its first shipment of gasoline to the US, marking a new chapter for the country as a major fuel exporter. This development is expected to boost Nigeria's economy and strengthen its position in the global energy market.

In sports news, seven-time Super Bowl winner Tom Brady is coming out of retirement to play flag football in Saudi Arabia. Brady will join current and former NFL stars at the Fanatics Flag Football Classic in Riyadh in March.

In the tech industry, Abu Dhabi AI investment firm MGX has acquired a stake in American chips. The G42 and Mubadala-backed fund co-invested with private equity firm Silver Lake to acquire 51% of California chipmaker Altera, in a deal worth $3.3 billion.

OpenAI on Tuesday announced a version of ChatGPT for teens, as tech companies face growing pressure to protect minors who use chatbots. This move comes as a response to concerns about the potential risks and harms that chatbots can pose to younger users.

In a historic case, a tribunal in London is adjudicating the fallout from the Qatar embargo. A case against Luxembourg-based Banque Havilland, which stands accused of pitching a plan to UAE officials to destabilize the Qatari riyal in 2017, is currently being heard.

Finally, the Middle East's largest retailer, Majid Al Futtaim, is phasing out Carrefour, replacing it with a new in-house grocery brand. This move reflects a broader trend of consumer loyalties shifting away from Western names towards local brands.

In addition, the US Federal Reserve has cut interest rates, marking the first trim since last December. This decision was made in response to economic conditions and is expected to have implications for global financial markets.

Read also:

- Potential Consequences of Dismantling FEMA Vary Across States

- Railway line in Bavaria threatened by unstable slope - extensive construction site at risk

- Wind Farm Controversy on the Boundary of Laois and Kilkenny

- Puerto Rico's Climate Lawfare Campaign experiences another setback with the dismissal of its deals.