Unveiling Tax-Free Pension Limits for New Retirees in 2025

Inquiring about the maximum pension amount that might be tax-exempt. - Question: Inquiry on the possible pension amount without tax deductions

Let's dive into taxation and pensions, shall we? In the world of finance, the term 'tax-free' pensions doesn't necessarily mean contribution limits, but rather, it's about the tax treatment of pension income. For instance, in the U.S., the tax-handling of pensions might differ based on the specific plan type and other factors.

Now, let's take a gander at the retirement contribution limits for 2025:

- 401(k), 403(b), and Profit-Sharing Plans: An employee can contribute up to $23,500 annually. For those aged 50 and above, a catch-up contribution of $7,500 is allowed, bringing the total to an impressive $31,000. What's more, for retirees aged 60 to 63, a 'super catch-up' contribution of $11,250 boosts their total contribution limit to a staggering $34,750.[1][5]

- IRA and Roth IRA: Contribution limits remain stagnant at $7,000 for 2025. However, those aged 50 and above can enjoy an extra $1,000, bringing the limit to $8,000.[5]

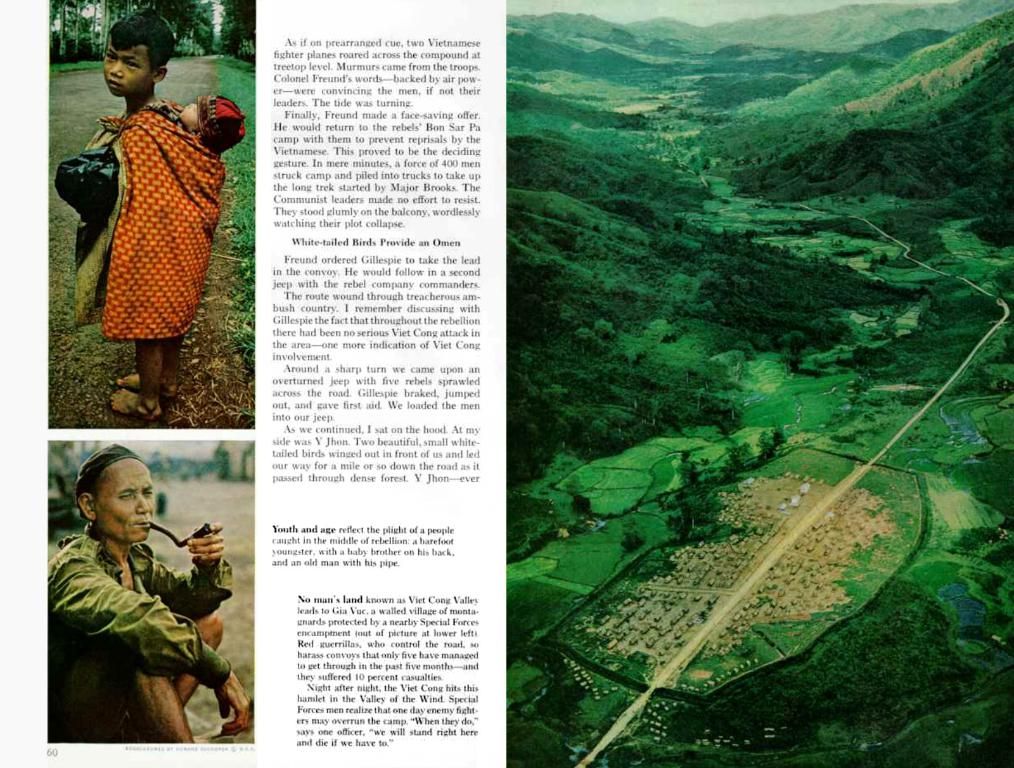

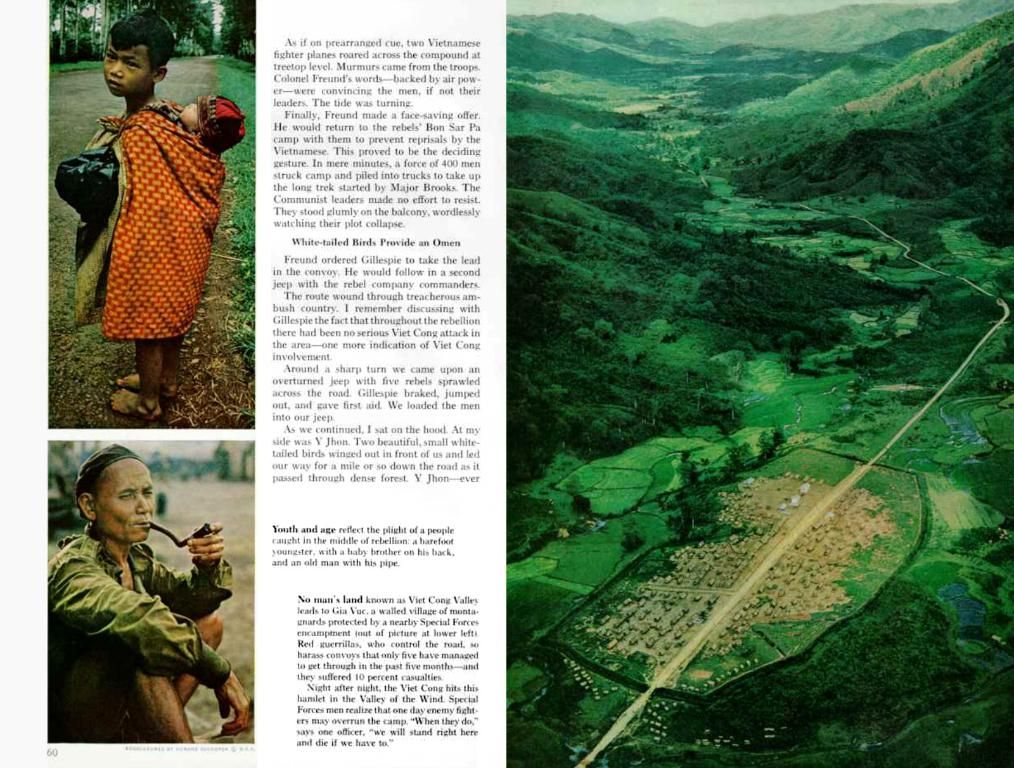

Interacting with aging retirees compared to fresh faces in their golden years, you'll find:

Taxation of Pension Income

The taxation of pension income is largely based on individual circumstances, yet lacks specific tax-free thresholds for new and older retirees. Nevertheless, older retirees often benefit from tax deductions or exemptions that might cut their overall tax bill.

Tax Relief Proposals for Seniors

There are whispers of proposals aimed at providing tax relief for seniors aged 65 and older, potentially affecting pension income taxation indirectly. For example, a proposed increased standard deduction for seniors could potentially lower the taxable income of retirees, thus decreasing their pension tax liability.[3]

Existing Tax Considerations

- Social Security Income: Part of Social Security benefits are taxable, but there's no alteration to the taxable thresholds for Social Security income in 2025.[4]

- Other Retirement Income: Amenities like distributions from 401(k) plans or IRAs are generally taxable. However, tax rates and handling can differ depending on the type of plan and the retiree's overall income situation.

In a nutshell, while specific "tax-free" pension limits for new and older retirees don't exist, proposed changes in tax laws and potential deductions might influence how pension income is taxed.

Cheers to your fruitful retirement journey!

- Tax

- Pension taxation

- New retirees

- BMF

- As new retirees plan their tax-free pension strategies in 2025, it's crucial to be aware that tax-free pensions don't refer to contribution limits but rather the tax treatment of income.

- In the discussion of employment policies for retirees, it's worth noting that tax relief proposals for seniors aged 65 and older could indirectly impact pension income taxation, potentially benefiting new retirees.