Record-breaking dividend yield in 15 years: Is there a chance to revive this struggling stock?

Wanna hop on the Nike comeback train? Here's a sneak peek at the shoe giant's potential rebirth.

Market rallies have sent tech stocks soaring, while traditional retail values have lagged behind, mainly due to sluggish consumer spending. Yet, a value stock with an irresistible dividend yield might catch the eye of investors hunting for lucrative income streams.

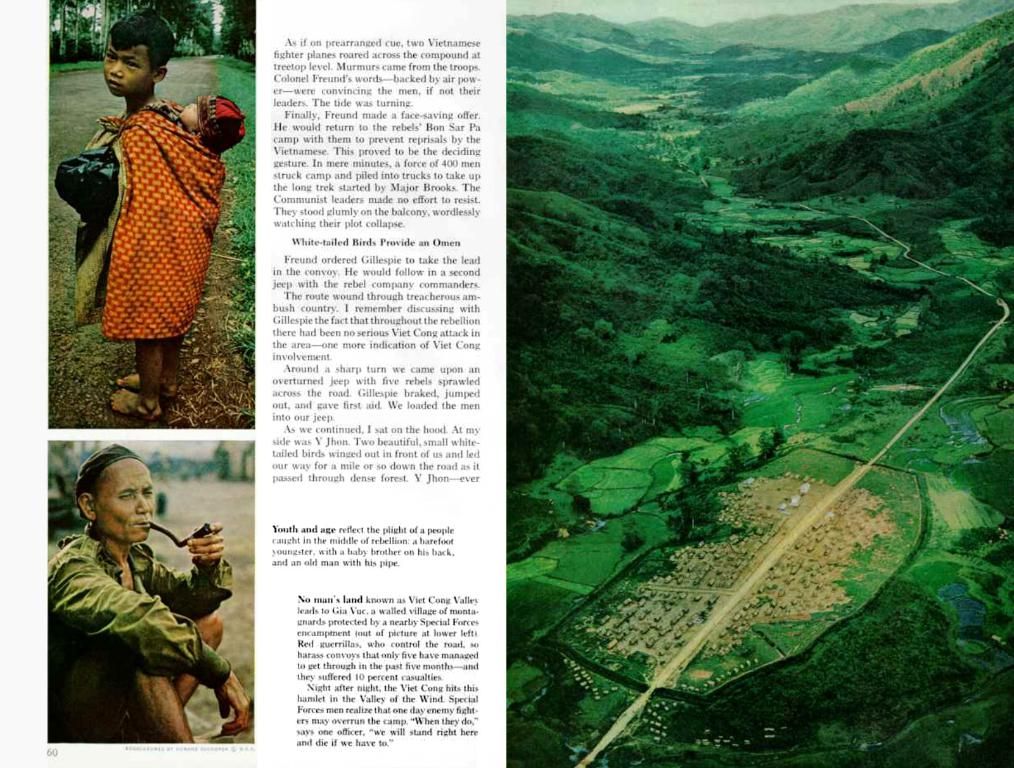

Enter the swoosh – Nike, a global juggernaut of athletic footwear and apparel. Lately, it's been struggling with declining revenue and weak consumer spending, leading to a tumble in the stock price – a whopping 57% off its all-time high. But fear not, dear investor, for this downturn could present a golden opportunity!

Nike (WKN: 866993)

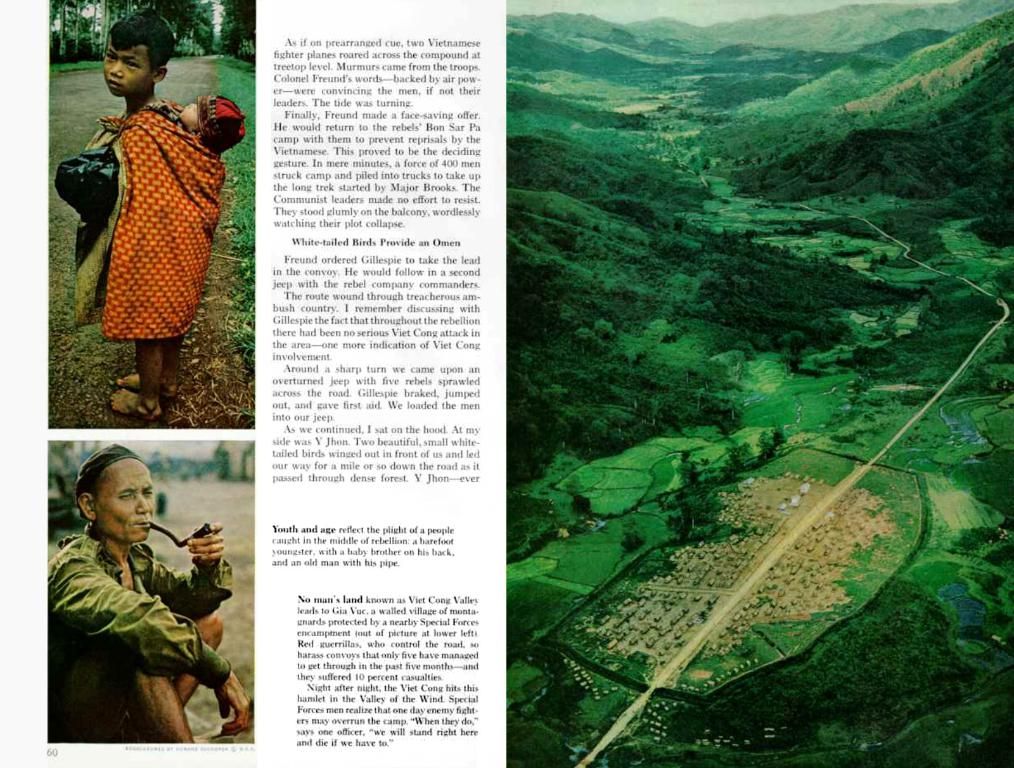

In the latest financial quarter, Nike's revenue plummeted by a staggering 9.3%, but hope is sill on the horizon. Behold, the juicy dividend yield currently perched at around 2%, marking the highest it's been in a whopping 15 years! In November 2024, Nike wisely boosted its quarterly dividends by 8% to a tasty 0.40 US dollars. Best of all, analysts anticipate these sweet payments to persist for the foreseeable future.

Despite its troubled times, Nike's business model isn't exactly a mess. The sneakers continue to fly off the shelves, and Nike running shoes stormed the charts in the last quarter, outpacing other segments. The company's new CEO, Elliott Hill, aims to strengthen this sector even further. According to "Yahoo Finance", analysts forecast a slight dip in earnings for the current fiscal year 2025, but the profits are expected to bounce back to 2.50 US dollars in fiscal year 2026. So, hang tight! The comeback on the stock exchanges is on the horizon!

Does this crisis spell doom for Nike? Think again!

Read more: "Don't panic during a crisis: Why you should never sell this pharma stock" or "KI-Aktie Palantir vor den Zahlen: 35% Crash risk or Mega Stock Surge?"

[1] Sindelar, B. (2024). Nike's Amazon comeback: What it means, why it matters, and what's next for the sneaker giant. Forbes.

[2] Chen, T. (2025). Nike's darkest hour: Analyzing the forces driving the downturn and its chances for recovery. Yahoo Finance.

[3] Silverman, L. (2025). Nike's new CEO Elliott Hill: Analyzing his background, vision, and potential impact on the company's turnaround. CNBC.

[4] Kim, J. (2025). Nike's future on the stock market: a comprehensive analysis of the challenges, strategic moves, valuations, and investor sentiment. Morgan Stanley Research.

[5] Brown, S. (2025). The truth about Nike's gross margin: Debunking the myths and understanding the reality. Harvard Business Review.

Personal-finance enthusiasts might find the stumbling stock of Nike, a renowned name in footwear and apparel, an intriguing opportunity for investing. As analysts predict potential recovery in Nike's earnings, the current dividend yield of around 2% presents an appealing income stream within personal-finance portfolios.