Rural banks hold advantageous positions in aiding the agricultural pursuits of small-scale farmers – asserts ARB Apex Bank's Managing Director

Smallholder farmers can anticipate increased financial assistance from rural banks in Ghana, as the sector collaborates with development partners to enhance their productivity. Mr. Alex Kwasi Awuah, Managing Director of ARB Apex Bank PLC, emphasized that rural banks, with their large branch networks, are ideally positioned to support agriculture, particularly smallholder farmers.

To enable this support, rural banks have been urged to allocate credit to the agriculture sector, as it plays a significant role in Ghana's economy, contributing approximately 20% to the country's Gross Domestic Product (GDP). However, Mr. Awuah highlighted a scarcity of funding in the sector, with commitments from universal banks at about 4%, and rural banks at 6.4%. He believes rural banks could do more to support agriculture.

The link between rural banking and Ghana's agricultural sector goes back to the initiation of rural banks by the Central Bank (BoG) to promote financial intermediation within communities. Today, agriculture still accounts for about 20% of the country's GDP, indicating the sector's continued significance, and necessitating vigilant focus on its growth.

During the 40th-anniversary celebrations launch of Kumawuman Rural Bank PLC, Mr. Awuah also disclosed that ARB Apex Bank is collaborating with the International Fund for Agricultural Development (IFAD) on initiatives to provide support to smallholder farmers, primarily based on the Green Climate Facility. In addition, discussions are underway with development partners to gain access to inexpensive funding that can be distributed to many smallholder farmers. This funding would provide farmers with the necessary credit to carry out their operations efficiently, allowing them to purchase seeds, farming equipment, and other necessities.

The Government of Ghana and the World Bank have offered support for farmers, forming part of the government's financial inclusion strategy. ARB Apex Bank, along with rural banks, has benefited from an intervention worth about US$8 million in this regard.

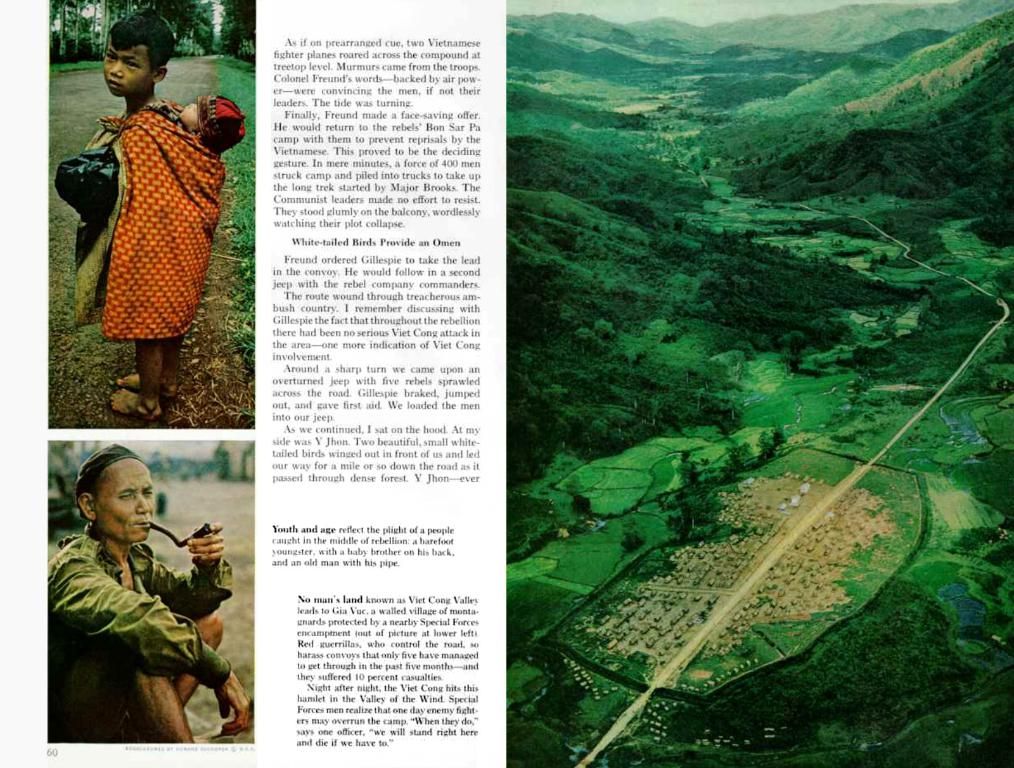

In their address during the celebrations, Dr. Alex Adomako-Mensah, Chairman of the Board of Directors, acknowledged the contributions of key stakeholders, including Kumawuman Rural Bank's founding fathers. The bank was established with a focus on promoting reliable, cost-effective banking services to the general public, aiming to become the preferred choice for customers and investors alike.

Throughout its 40-year history, Kumawuman Rural Bank has prioritized share and deposit mobilization, cost reduction, strengthened internal control measures, and the development of its human capital to cater to the demands of a competitive rural banking environment. The bank has also maintained mechanisms for delivering exceptional socio-economic returns to its stakeholders, ensuring sustainable growth and development.

Kumawuman Rural Bank has consistently catered to micro, small, and medium enterprises, with plans to continue market penetration and product development to better serve clients. The Managing Director of ARB Apex Bank PLC, Alex Kwasi Awuah, commended the bank, its founding fathers, and the current board and management for their hard work, which has placed the bank among the top-performing rural banks in terms of growth, efficiency, and regulatory compliance.

In her address, Mrs. Comfort Owusu, Executive Director of the Association of Rural Banks (ARB) Ghana, congratulated Kumawuman Rural Bank on its anniversary and wished it continued growth in the future. She urged the bank to remain dedicated to maintaining cultural ethical values, staying abreast of emerging banking trends, and adopting good corporate governance practices within its existing strategic plan.

[Enrichment Data]The evolving relationship between rural banks and agriculture has led to the development of tailor-made financial services, including savings, insurance, and mobile money platforms for farmers and cooperatives. The Feed Ghana Programme, a flagship initiative by the Ghanaian government, aims to enhance financial inclusion for farmers by providing access to credit, loans, and investment packages for organized farmer groups and cooperatives. The program also supports farmer service centers, capacity building, market linkages, agricultural financial products, and the development of insurance innovations.

- Smallholder farmers in Ghana can expect greater financial support from rural banks, as these institutions collaborate with development partners to improve their productivity in the agriculture sector, which contributes around 20% to the country's GDP.

- Rural banks, with their extensive branch networks, are well-positioned to support smallholder farmers and the agriculture industry, but face a shortage of funding, with commitments from universal banks at about 4% and rural banks at 6.4%.

- Rural banks, such as ARB Apex Bank PLC, are working together with organizations like the International Fund for Agricultural Development (IFAD) on initiatives to offer financial assistance to smallholder farmers.

- The government of Ghana and the World Bank are providing support for farmers as part of the government's financial inclusion strategy, with rural banks, including Kumawuman Rural Bank, benefiting from interventions worth millions of dollars.

- Kumawuman Rural Bank, a leading rural bank in Ghana, prioritizes the development of financial services specifically designed for farmers, such as savings, insurance, and mobile money platforms, to enhance their operations and foster growth in the agriculture sector.

- The Feed Ghana Programme, a government initiative, aims to enhance financial inclusion for farmers by offering credit, loans, and investment packages for organized farmer groups and cooperatives, as well as enabling market linkages, capacity building, and agricultural financial products development.