Short Sellers Targeting The Alliance: Focus of Attention

Title: Allianz's Stock Struggling Amidst Investor Uncertainty

In the bustling world of finance, Allianz's stock is facing some wicked waves. More and more investors are recklessly siding with dropping prices, while whispers of doubt from analysts are becoming deafening. Despite their multi-billion-dollar investment plans and throw-caution-to-the-wind moves, a cloud of uncertainty is creeping in. Is the insurance titan sailing through a stormy phase?

The numbers paint a vivid picture: The numbers of shorted Allianz shares have skyrocketed to a staggering 94,400 by the end of May, a 93% jump. This is a clear red flag: Short-sellers expect more sharks in the water.

Analysts are also stirring up the seas. For instance, the British investment bank Barclays has lowered its stance on Allianz from "Equal Weight" to "Underweight", keeping their target price fixed at 325 euros. Analyst Claudia Gaspari's earnings predictions are approximately two percent below market consensus. Gaspari, in her sector study, raises a red flag, warning of a hefty risk of a setback given the current valuation.

While observers keep a close eye on the price storm, Allianz is relentlessly working on optimizing its portfolio. The company is planning to invest billions in infrastructure projects, a sector that promises long-term, steady returns. Additionally, a multi-billion-dollar acquisition in the asset management sector is on the table. This would make the insurance behemoth more strategically agile, bolstering its growth potential beyond its traditional insurance business.

Allianz (WKN: 840400): In the short term, Allianz's stock is staring down setbacks, with increased short activity and skeptical analyst murmurs whipping up a frenzy. Graphically, the stock is also wrestling, down around ten percent from its early May high. However, in the medium to long term, the DAX stock remains an intriguing catch: With a solid balance sheet, a discernible game plan, and a strong market stance, Allianz stands tall. For long-term investors, the stock remains a hold position, a solid cornerstone in the insurance sector.

Disclaimer:

A potential conflict of interest: The board and major shareholder of the publisher Boersenmedien AG, Mr. Bernd Foertsch, has taken direct and indirect positions in the financial instruments mentioned in the publication, Allianz, benefiting from the stock's potential price development due to the publication.

Sources:1. Boersen-News [website] https://www.boerse-news.de2. Wall Street Journal [website] https://www.wsj.com3. MarketWatch [website] https://www.marketwatch.com4. Bloomberg [website] https://www.bloomberg.com5. Barron's [website] https://www.barrons.com

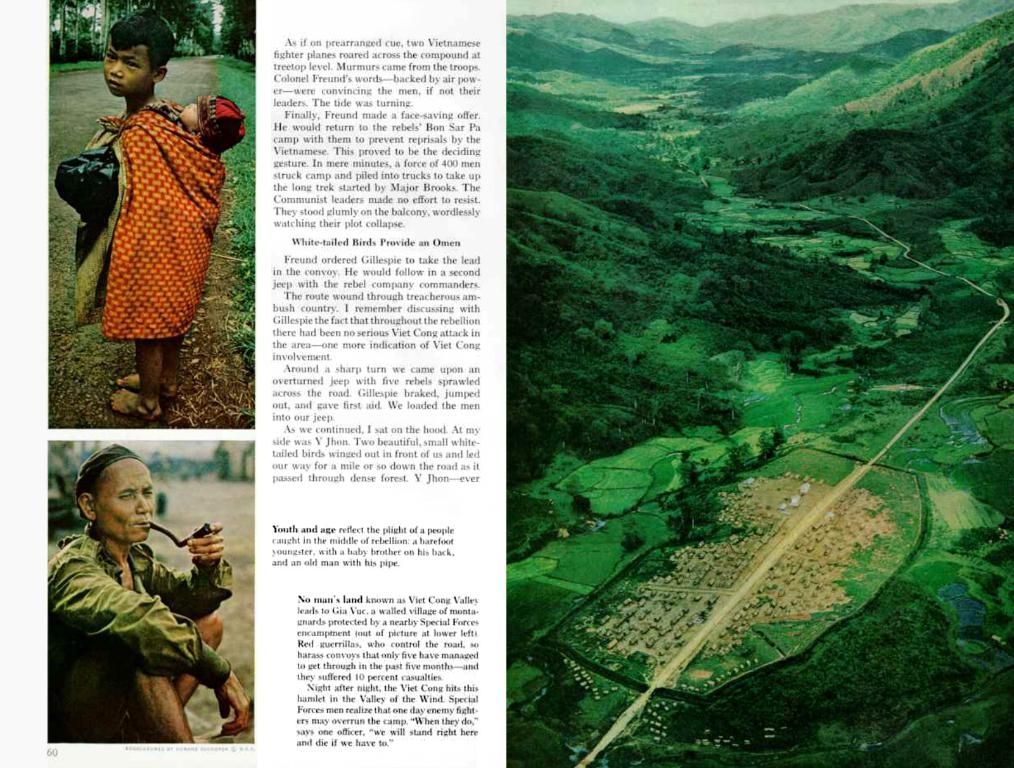

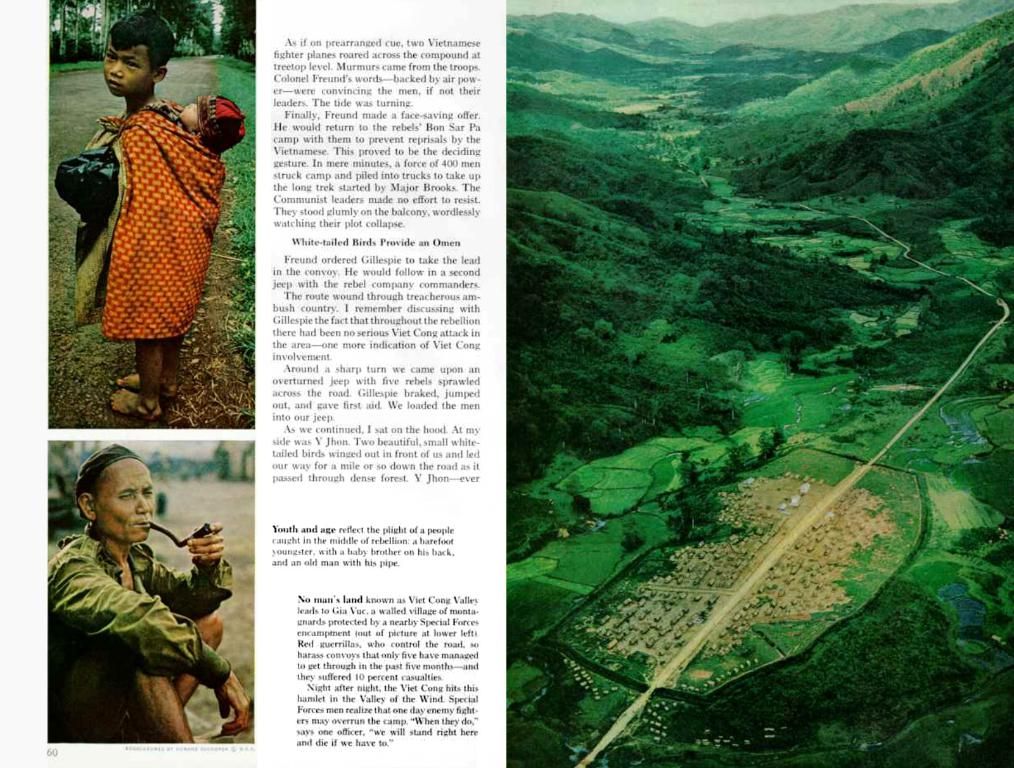

- Allianz's current stock struggle in the finance world, despite its bold investment plans, has sparked discussions in the realm of personal-finance, leading some investors to reconsider their holdings in wealth-management portfolios.

- In the face of the short-seller activity and analyst caution, business strategies such as investing in infrastructure projects and acquisitions in asset management become essential for Allianz to mitigate the risks and preserve its growth potential.

- As the insurance titan endures investor uncertainty, it is crucial for those interested in the insurance sector to maintain a balanced perspective – considering both the short-term setbacks and the long-term opportunities offered by these strategic moves in the world of business and personal-finance.