Spending a Pretty Penny on Thuringia's Real Estate Tax Reform

- significantfinancial investment required for property tax reform, totalling several million euros

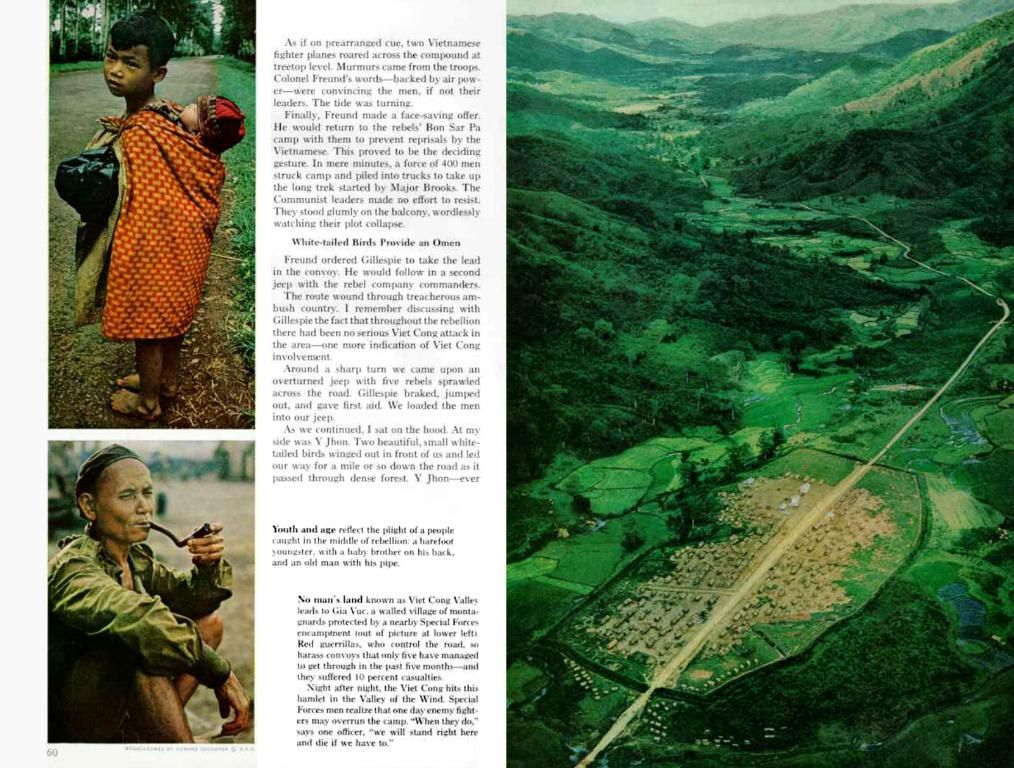

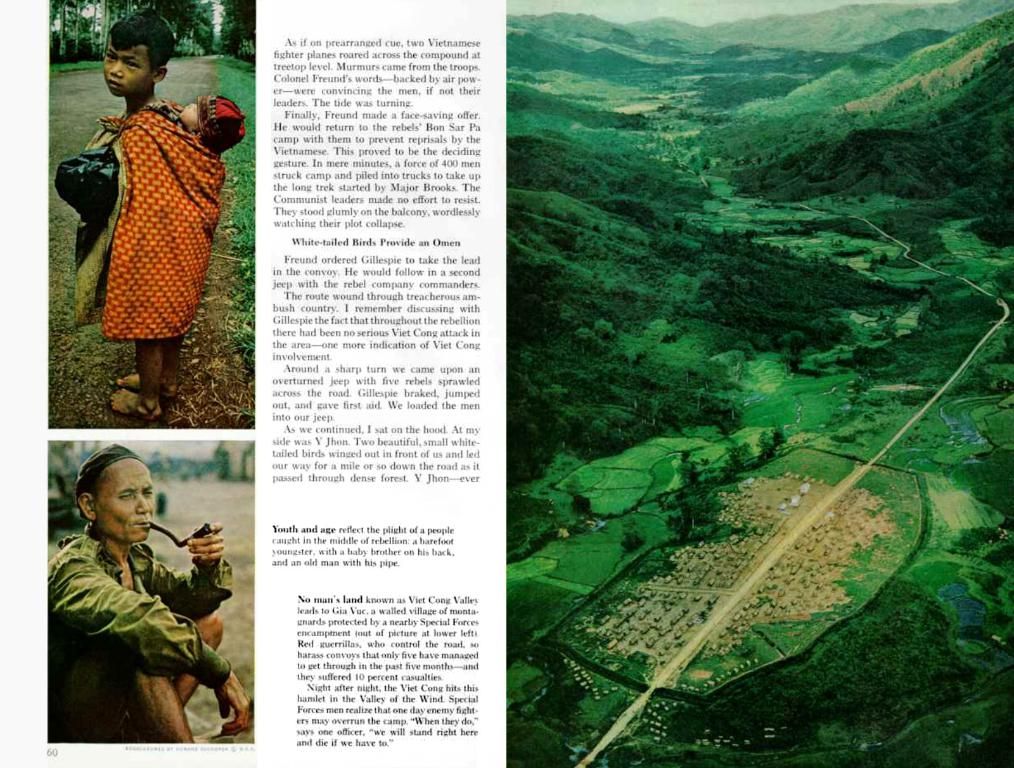

They're handing over some serious cash for that real estate tax reform in Thuringia, announced Finance State Secretary Julian Vonarb in Erfurt. The hefty bill for this project? A cool three million Euros, according to Vonarb. Sounds like quite the chunk of change, don't you think?

Now, here's where the numbers get a little tricky. Two million Euros of this hefty sum will go toward the hiring of temporary staff in the tax administration. Don't let that reassuringly simple Excel table fool ya; it takes more than just a good spreadsheet and sending out notices to get this party started.

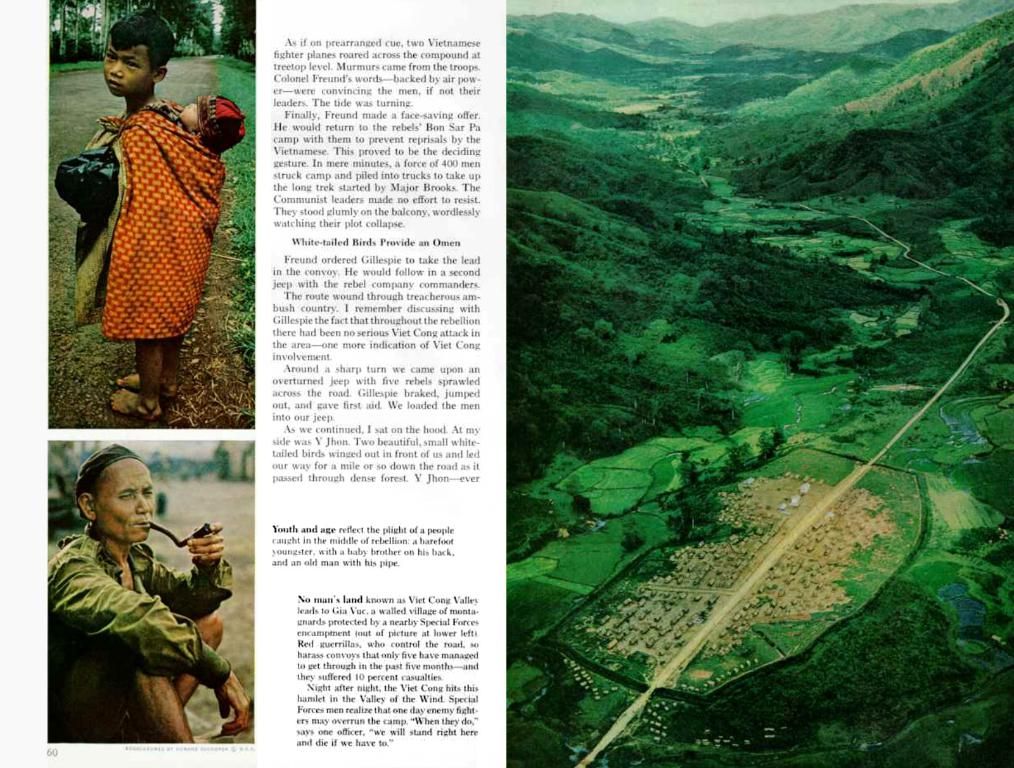

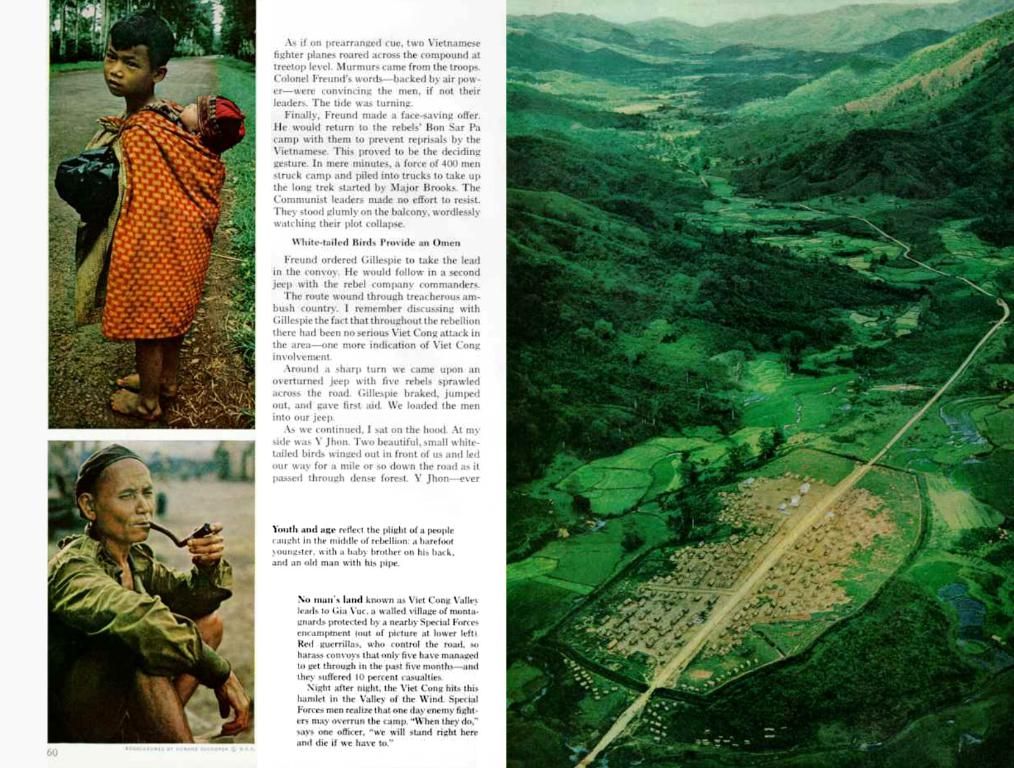

Additional costs will be incurred for distributing approximately 865,000 newly crafted notices and for programming wizardry, emphasized Vonarb.

The new tax regulations, effective January 1, 2027, will spell good news for Thuringian homeowners and tenants, as they'll see a decrease in their real estate tax bills. Yet, the coalition of CDU, BSW, and SPD needs a majority in the state parliament to push their tax reform proposal through. With 44 seats out of 88 in the parliament, the coalition will need to trim some deals with the Left party, as both the AfD and CDU's usual partners are out of the question.

The Left faction, meanwhile, has its own proposal, poised to bring relief as early as January 1, 2026. The Left party accuses the state government of dawdling on tax relief for residential buildings, claiming that folks will continue to fork over unnecessary charges until next year, at the least.

The real estate tax stash in Germany has been undergoing a makeover due to a ruling from the Federal Constitutional Court. As of January 1, 2025, taxes were reassessed under the new calculations in Thuringia, resulting in increased taxes for residential buildings and lower taxes for commercially used structures by companies. The coalition aims to correct this imbalance by adjusting Thuringia's calculation model for real estate tax, so that homeowners enjoy a tax decrease, while companies shoulder the burden for their commercially used properties.

Municipalities throughout Germany rake in around 240 million Euros annually from real estate taxes. The Constitutional Court's ruling gives state governments considerable room for maneuver in how they collect real estate taxes. Other states have taken the opportunity to develop their own models for calculating the taxes, and Thuringia is now eyeing the "Saxon model."

The model that Thuringia will mirror closely is a brainchild of Saxony and largely based on practical insights from the region. The Finance Ministry emphasizes that this approach will grant municipalities the latitude to tailor tax rates for residential and non-residential structures, ensuring a more accurate distribution of property tax burdens.

* Thuringia* Real Estate Tax* Tax Reform* State Parliament* Left Party* Federal Constitutional Court* Saxon Model

Insights:

New tax regulations for residential buildings in Thuringia that will take effect on January 1, 2027, will bring down the tax burden on homeowners and tenants, while putting more of the responsibility on companies that use commercially owned properties. The estimated cost of implementing this reform in Thuringia is approximately three million Euros.

In Germany, real estate taxes are primarily collected as annual real property taxes by municipalities. The tax rate within a municipality depends on the municipal multiplier (Hebesatz), which can range from 0.26% to 1% of the assessed property value. State governments have some flexibility in how they collect real estate taxes due to a ruling from the Federal Constitutional Court, and may develop their own models to account for unique local needs.

Thuringia's transfer tax rate is 6.5%, a relatively high rate compared to other German states. This tax is usually paid by the buyer, unless otherwise negotiated. Costs associated with real estate tax reform typically include hiring temporary personnel and programming expenses for software or systems needed to manage, track, and collect real estate taxes under the new reform. Specific figures related to Thuringia's real estate tax reform would be most accurately found in official government reports or press releases.

- The Thuringia government is spending €3 million on the real estate tax reform, with a large portion going towards hiring temporary staff and notice distribution, indicating a complex and costly overhaul of the tax administration.

- German states, including Thuringia, have the flexibility to develop their own models for real estate tax collection due to a ruling from the Federal Constitutional Court, suggesting that other states have already implemented unique tax models to address local needs.