Soaring Corporate Default Rates in Germany Reach Pre-Recession Levels

Soaring Bankruptcy Rates in Germany Approach Critical Point

Sound the alarm bells! Germany's corporate landscape is battling a wave of unpaid bills and mounting debt, with the default rate reaching its highest point in over a decade.

Reports from Creditreform Rating show a staggering surge in the default rate in 2024 - jumping from 1.49% in the previous year to 1.78%. This figure hasn't been seen since 2013 and is projected to climb higher, predicted to exceed 2% in 2025 - a level last seen during the global financial crisis in 2008 and 2009.

The "Default Study" by Creditreform Rating defines a default as an instance when a company or self-employed individual becomes insolvent or is highly likely to miss their payment obligations based on Creditreform's data.

The troubling economic climate of Germany is the primary cause for this worrying trend. "The issues at hand consist of investment stagnation, industrial barriers, and external financial pressures stemming from US tariffs," explains Benjamin Mohr, a member of Creditreform Rating's management board.

Alarmingly, experts forecast that the default rates are unlikely to decrease in the coming months. "Temporary recovery factors such as reduced inflation or ceased interest hikes are yet to counter the escalating default risks," Mohr cautions. "As a result, the default rate is expected to continue ascending momentarily."

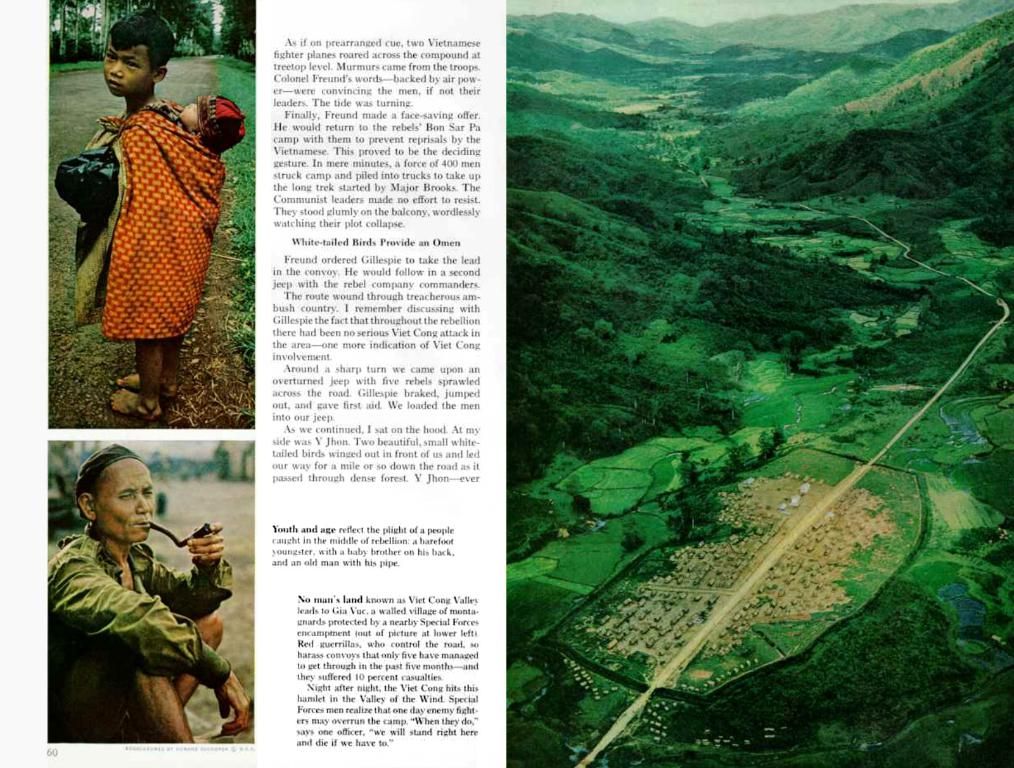

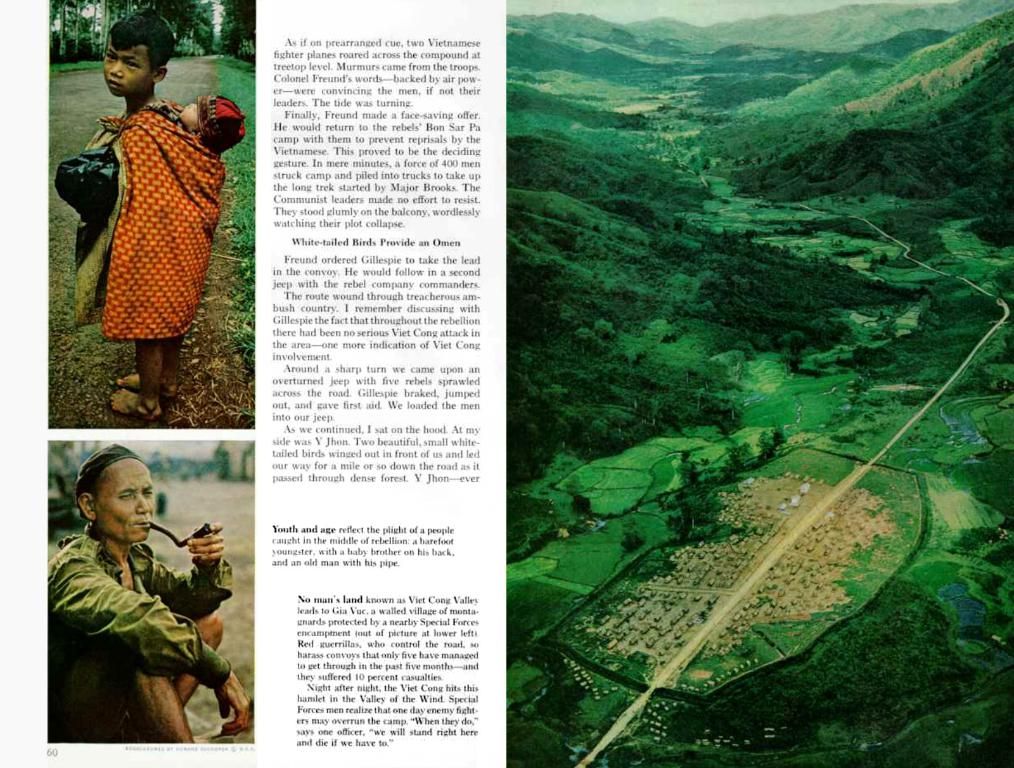

A Dire Predicament for Small and New Businesses

Despite a minimal projected economic growth for Germany this year, a decline in defaults isn't imminent. Lessening costs such as subsiding inflation or a halt in interest rate hikes are not yet sufficient to quell the growing default risks.

The burden of defaults is disproportionately shouldered by smaller businesses with annual turnover between €500,000 and €2 million and young companies aged between two and five years, which have default rates of 1.99% and 3.66%, respectively. Contrastingly, established companies older than ten years boast a default rate of just over 1%.

Tragically, the sectors most affected by defaults are the transport and logistics sector, with a default rate of 3.37%, followed closely by the crisis-ridden construction industry with a default rate of 2.30%. On the bright side, the basic chemicals industry displays the lowest default rate, nearing 1%.

Macroeconomic factors, yield and spread dynamics, sectoral strains, and ongoing credit-environment pressures contribute to the mounting default risks in Germany. These factors warrant close attention and proactive measures from policymakers and businesses alike to ensure economic stability moving forward.

The escalating default rates in Germany, as demonstrated by the surge in company defaults noted in the 2024 Default Study by Creditreform Rating, pose a significant threat to small and new businesses, with higher default rates observed among businesses with annual turnover between €500,000 and €2 million and those aged between two and five years, compared to established companies. Thus, it is crucial for community and employment policies to address these risks, while businesses must carefully manage their finances to mitigate these mounting default risks.