Stock Market Vulnerability: Could a Downturn Be Imminent?

Following a remarkable improvement in company profits over the past two years, particularly in the tech sector, stock returns have been fairly substantial. However, the question now lies in whether this progression in profits will continue in 2025 or if the anticipations have become excessively high. By studying historical stock returns and earnings patterns over the long term, we can gain more clarity.

"The market is a voting machine in the short term, but a weighing machine in the long term." – Benjamin Graham

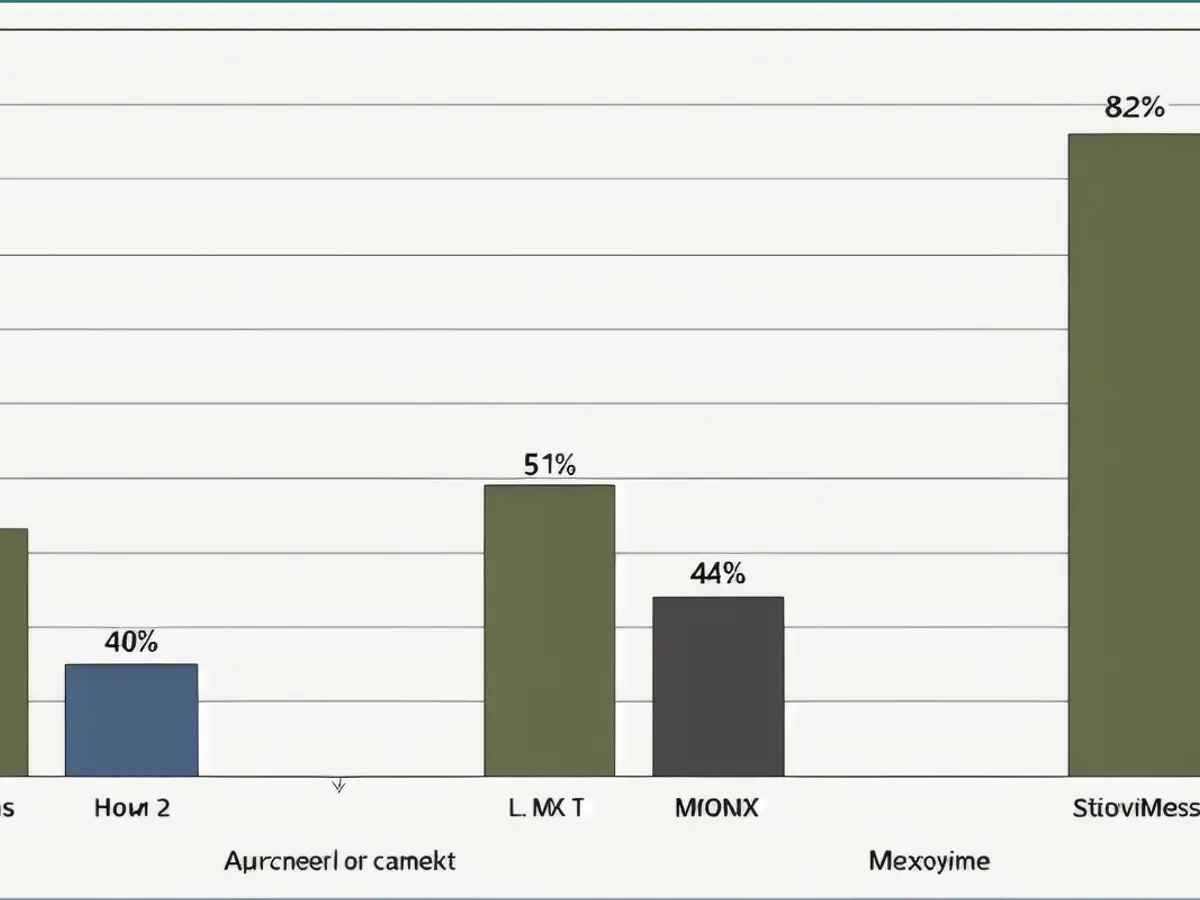

The S&P 500 saw a total return of 25% in 2024, yet a closer look at longer-term annualized returns can hint towards a potential risk of mean reversion after such significant outperformance. By tracing a 10-year annualized performance, stocks delivered a 13% return through 2024, which is lower than the long-term annualized performance of 9.9% since 1928.

As the primary focus of investing is boosting purchasing power, it's essential to analyze real, post-inflation, stock returns. In this regard, stocks yielded a 9.7% return through 2024, which is less than the long-term annualized performance of 6.7% since 1928. These figures point towards an augmented risk of mean reversion.

"A good business performs well, and its stock follows suit." – Warren Buffett

Earnings serve as a powerful predictor of long-term stock performance because, according to Warren Buffett, "the value of a business is the cash it will generate in the future, valued at its present worth." Although earnings and stock prices can deviate in the short term, the long-term trajectory is aligned. Notably, the S&P 500 has consistently witnessed earnings growth surpassing inflation, highlighting the long-term purchasing power and wealth accumulation that comes from owning operating companies through stocks.

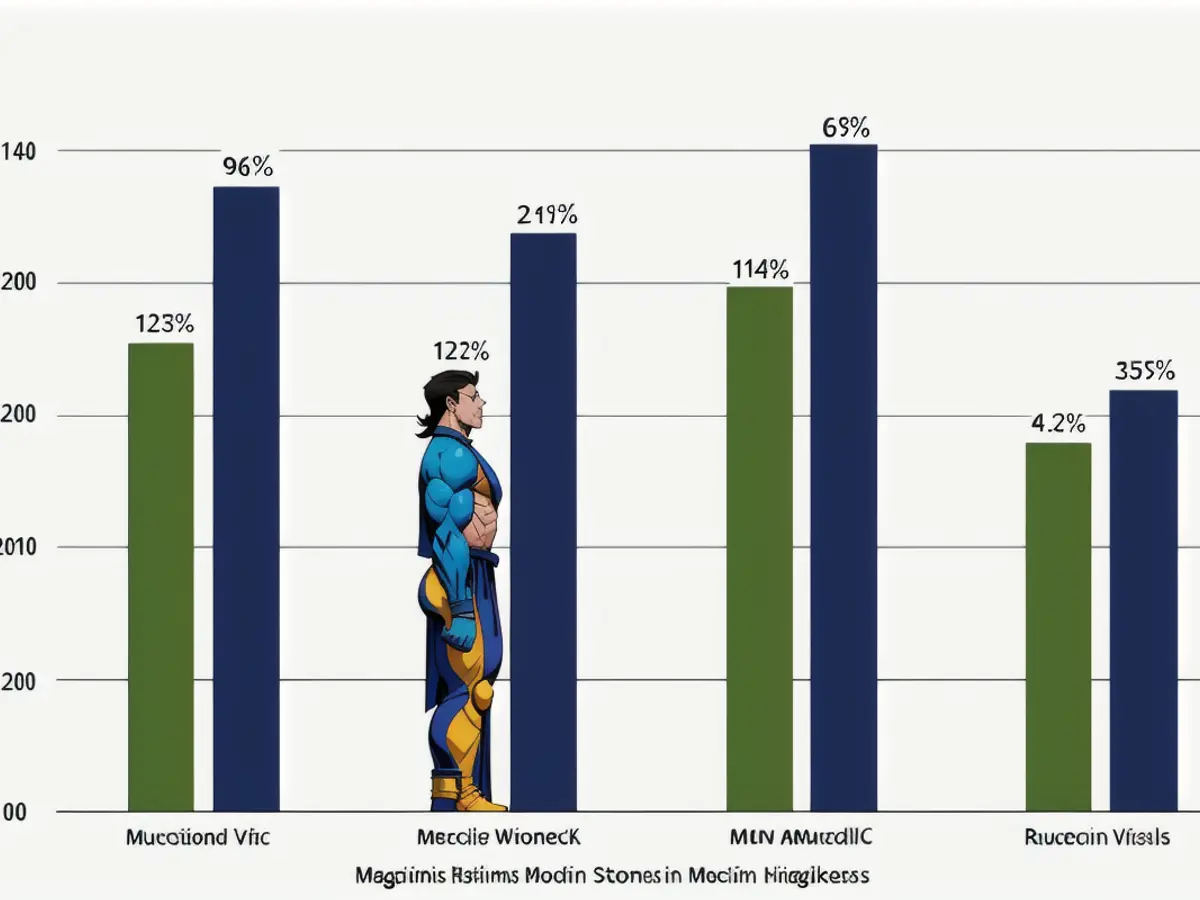

Since 1936, the S&P 500 has experienced a 6.7% annualized earnings growth rate, which has overpowered inflation by a 3% annualized increase. Interestingly, the last decade's higher-than-average stock returns were accompanied by above-average earnings growth on a nominal and real basis. The post-COVID earnings growth soared above typical levels even with elevated inflation rates. The S&P 500 earnings are anticipated to expand by more than 12% in 2025 after a 9% increase in 2024. The resilience of the improved profit margin of stocks is vital for whether they manage to avoid reversion to historical return levels.

"The market is a voting machine in the short term, but a weighing machine in the long term." – Benjamin Graham

Investing in stocks requires a long-term time horizon, regardless of valuation levels or market conditions. Stocks finish higher in 73% of any given calendar year, but the success rate climbs to 94% with a 10-year holding period. Interestingly, bonds outperform stocks in 79% of any given calendar year with a 10-year investment term, but perform flawlessly with the same time horizon.

The situation becomes more intriguing when considering after-inflation returns. Over one year, stocks have a positive hit rate more than bonds, and the lead broadens over a 10-year period. To reiterate, the initial losses for stocks tend to be more severe compared to bonds, hence the positive hit rate does not convey the whole story. Investors with short-term financial obligations should stick to bonds or cash. However, the data suggests that stocks are less risky to your wealth over a 10-year time frame compared to bonds!

"If you aren't prepared to face substantial market decline of 50% two or three times a century, you don't deserve the mediocre returns you'll secure." – Charlie Munger

Over the last decade, the S&P 500 has delivered an annualized total return of 13%, which falls short of the highest 10-year annualized return of 20.1%, attained in 1958. In real terms, the decade-average return settles at 9.7%, falling below the all-time high of 17.9%, also achieved in 1958.

The late Charlie Munger poignantly underscores that the worst annual return for stocks underestimates the distressing short-term declines that investors have endured historically. For instance, the S&P 500 plummeted by 49% when the technology bubble burst during 2000-2002. The global financial crisis provides a bleaker example, with stocks retreating by 57% from late 2007 to early 2009. Despite these devastating setbacks, stocks have consistently demonstrated the highest nominal and inflation-adjusted annualized return among various asset classes over the long term.

Another gauge of short-term risk is the yearly declines in stock prices, which have averaged 14.6% over the last 53 years. The last two years have shown lower-than-typical declines during the year, hence investors should be prepared for a return to average volatility. However, history reveals that lower-volatility markets can persist for a longer duration than two years.

Although critics may argue that stocks are currently overvalued due to strong tech sector earnings, stocks exhibit an augmented level of risk given the recent exceptional returns, lofty valuations, and optimistic economic prospects. However, historical data indicates that stocks can continue to rise even after the recent robust gains, and earnings can maintain their outstanding performance, making a market decline no easy bet.

Investors ought to reassess their risk appetite given the surge in stock values, likely boosting their exposure to risky assets over what it was just two years back. It's prudent for most investors to adjust their stock and bond proportions towards their preferred risk level, following the timeless guidance. As per Charlie Munger's earlier sentiment, investors who sell off during the anticipated sizable declines in stocks are destined for "subpar outcomes." Maintaining sufficient holdings in more stable or income-generating assets through rebalancing can offer the stability to weather the unforeseen market turbulence that can strike stocks at odd moments.

- Given Warren Buffett's belief that "the value of a business is the cash it will generate in the future, valued at its present worth," investing in stocks with strong earnings growth potential could be an attractive option, making it a potential time to buy stocks.

- Similarly, Benjamin Graham and Charlie Munger's perspective that "the market is a voting machine in the short term, but a weighing machine in the long term" suggests that while stock prices may fluctuate in the short term, focusing on the long-term potential of a company with robust earnings growth can be a wise investment strategy.

- In light of past performance, some investors may consider bonds as an inflation hedge, making it a time to buy bonds, especially considering the potential risk of mean reversion in stocks after significant outperformance.

- However, Warren Buffett and Charlie Munger remind us that "if you aren't prepared to face substantial market decline of 50% two or three times a century, you don't deserve the mediocre returns you'll secure." Investors should take into account the risk of stock plunges before making any investment decisions and maintain a balanced portfolio suitable for their risk tolerance.