Stratifying Share Prices Drops by 84% for Purchasing Opportunity Currently

Love a good bargain? How about a 84% discount on Roku shares (ROKU -3.30%)? Since its pandemic-induced 2021 peak, this streaming-technology giant's stocks have barely budged, leaving many investors on the sidelines, keen on more evidence of an impending rebound.

However, as the wise say - fear the herd when they're greedy, and be greedy when they're fearful. It seems the crowd is overlooking a great investment opportunity.

The Standout Streaming Middleman

Understandably, investor concerns about Roku stem from its unprofitable status and the highly competitive streaming market. Nonetheless, for risk-tolerant buyers, Roku still offers plenty of appeal at its discounted price.

But let's set the scene first. If you're not already familiar with it, Roku is a streaming technology company. It produces the small boxes that connect your television to apps like Netflix, Amazon Prime, and Disney+. In fact, screens with built-in Roku tech are becoming increasingly common.

Roku's core revenue and profits, however, derive from its service as a middleman for streaming services like Netflix and Disney+, and its self-run ad-supported streaming channel. Its devices serve as its stepping stones to bigger things.

Data from ComScore reveals that Roku commands an impressive 37% share of the United States over-the-top (non-cable) connected television advertising market. Parks Associates, too, reports that Roku nabs 43% of actively used media-playing devices in the U.S., outpacing competitors like Amazon's FireTV. Globally, Roku is making inroads, although it hasn't fully tapped foreign markets yet.

Best of all, Roku is still growing revenue and reducing losses.

The Disconnect Can't Last Forever

Roku's astronomical 2020 gain, fueled by the pandemic keeping millions captive, might explain its tepid performance since June 2022. However, the disconnect between the bullish 2020 trend and Roku's ongoing growth potential appears to be overdue for a course correction.

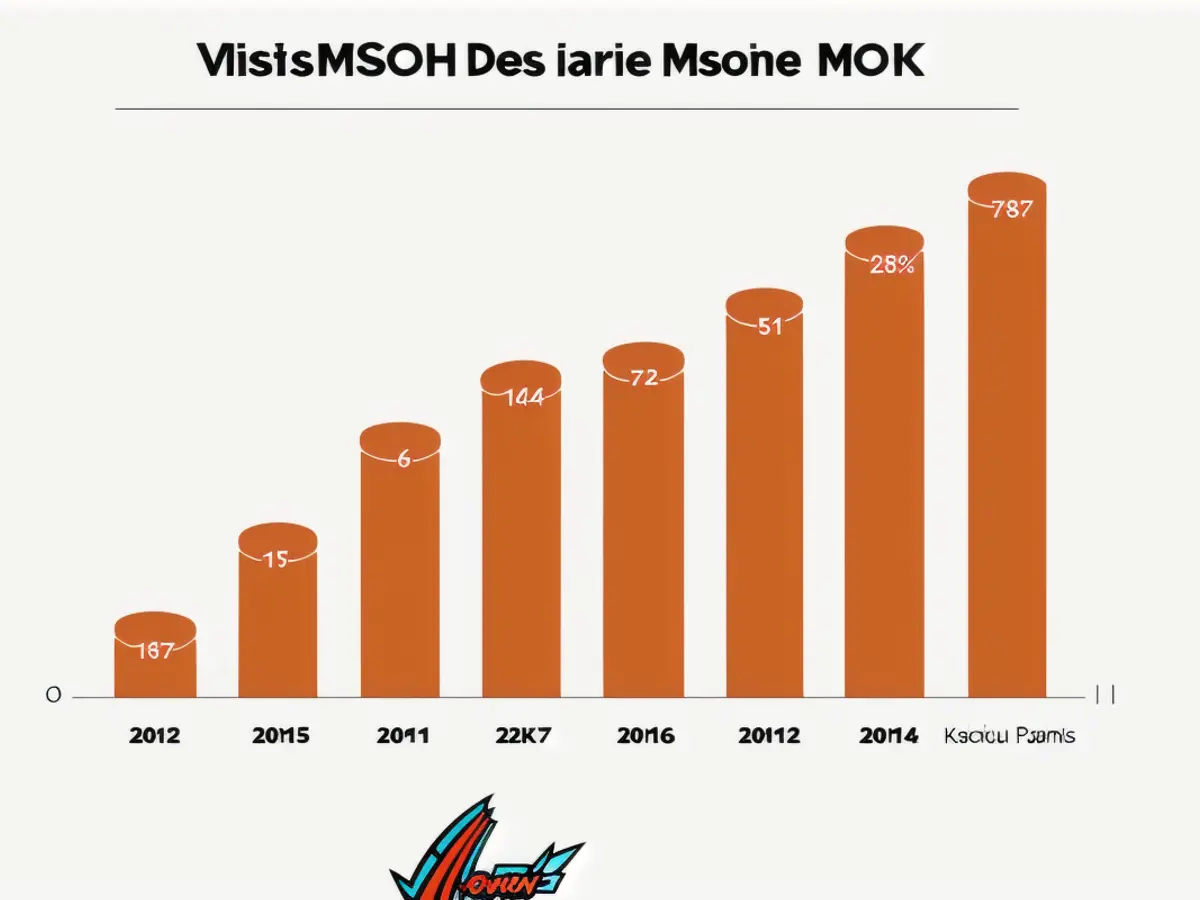

In 2020, Roku grew by 540% thanks to surging TV viewership. It added 4 million new streaming households in Q2 2020 alone, while active Roku accounts soared by 41% to 43 million. That momentum slowed in the latter half of 2021, but the underlying company has maintained its financial viability, aiming for positive full-year profits by 2026.

Despite the uptick in user growth and revenue for Roku, the stock hasn't equally caught up, leaving many investors on the sidelines. Analysts, too, are taking a wait-and-see approach, calling Roku a hold and fixing a modest consensus price target of $83.13.

But sometimes, the majority can be wrong. Given Roku's strong momentum, it might be time to seize the opportunity before the market activates and forces the stock to recognize its growth potential.

[1] MarketWatch [2] TechRadar [3] Seeking Alpha [4] The Motley Fool [5] Roku financial statements

- Despite Roku's unprofitable status and the competitive streaming market, the discounted price of its shares presents an attractive investment opportunity for risk-tolerant buyers.

- Many analysts have adopted a wait-and-see approach towards Roku, labeling it as a hold and setting a modest consensus price target of $83.13, yet the stock's underperformance may not accurately reflect its growth potential.

- In 2020, Roku displayed impressive growth, adding 4 million new streaming households in Q2 and surging active accounts by 41% to 43 million. The company aims to achieve positive full-year profits by 2026, illustrating its ongoing financial viability.

- Roku's strong position in the US over-the-top connected television advertising market, commanding a 37% share, and its dominance of actively used media-playing devices in the US, with a 43% share, are compelling factors for potential investors looking towards future finance and money-making opportunities in the tech sector.