Tariffs seen as accelerant for Bitcoin expansion by Arthur Hayes and Dan Tapiero

In a lively chat, two financial bigwigs—Arthur Hayes and Dan Tapiero—shed light on the impact of U.S. tariffs on Bitcoin adoption. With the world economy trembling, these trade barriers have stoked fears of global economic instability.

Arthur Hayes, the co-founder of BitMEX, argues that these new tariffs will widen financial divides worldwide. As governments resort to aggressive monetary policies, increased money printing becomes inevitable. This, Hayes proposes, will amplify Bitcoin’s clout as a reliable hedge.

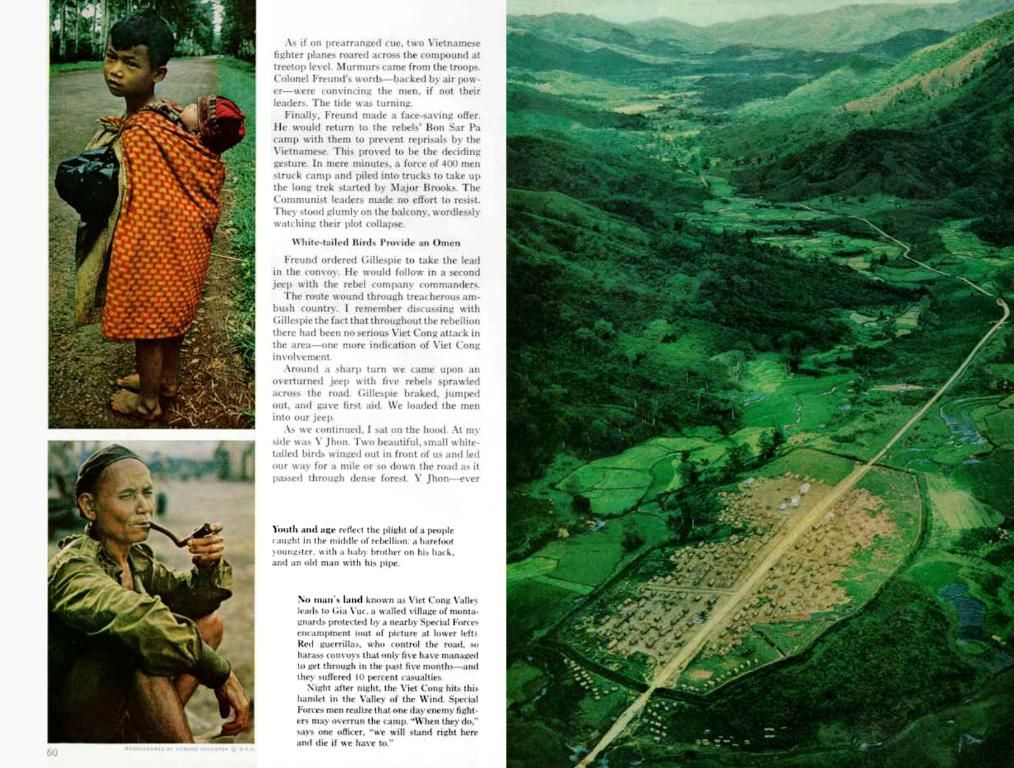

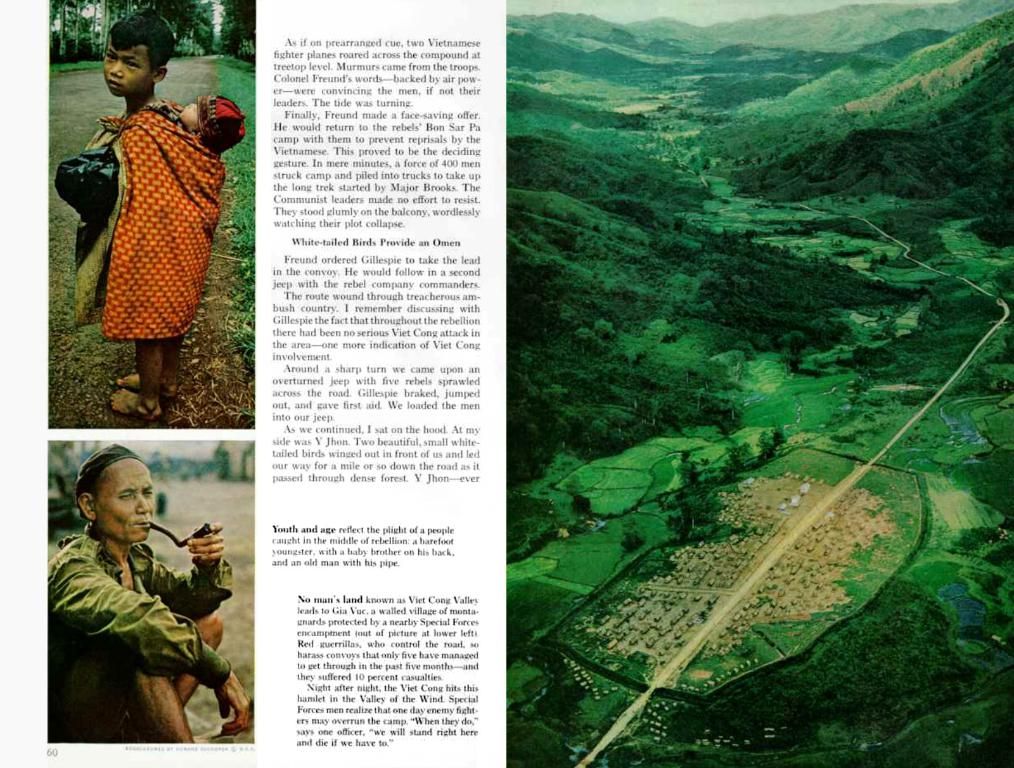

Meanwhile, Dan Tapiero, founder of 10T Holdings, views rising tariffs as a stark reminder of economic systems' weaknesses. In today's scenario, he opines, there's an urgent need for alternative payment systems surpassing traditional fiat currencies. Consequently, Bitcoin finds favor among experts seeking immunity against rampant inflation.

Bitcoin: A Shield in Trade Wars

Amid escalating trade tensions, Bitcoin presents itself as a promising hedge mechanism. Hayes explains that currency devaluations are acommon occurrence when governments resort to monetary expansion to combat economic disarray. Bitcoin's restricted total number offers investors a much-needed escape option, preserving economic value.

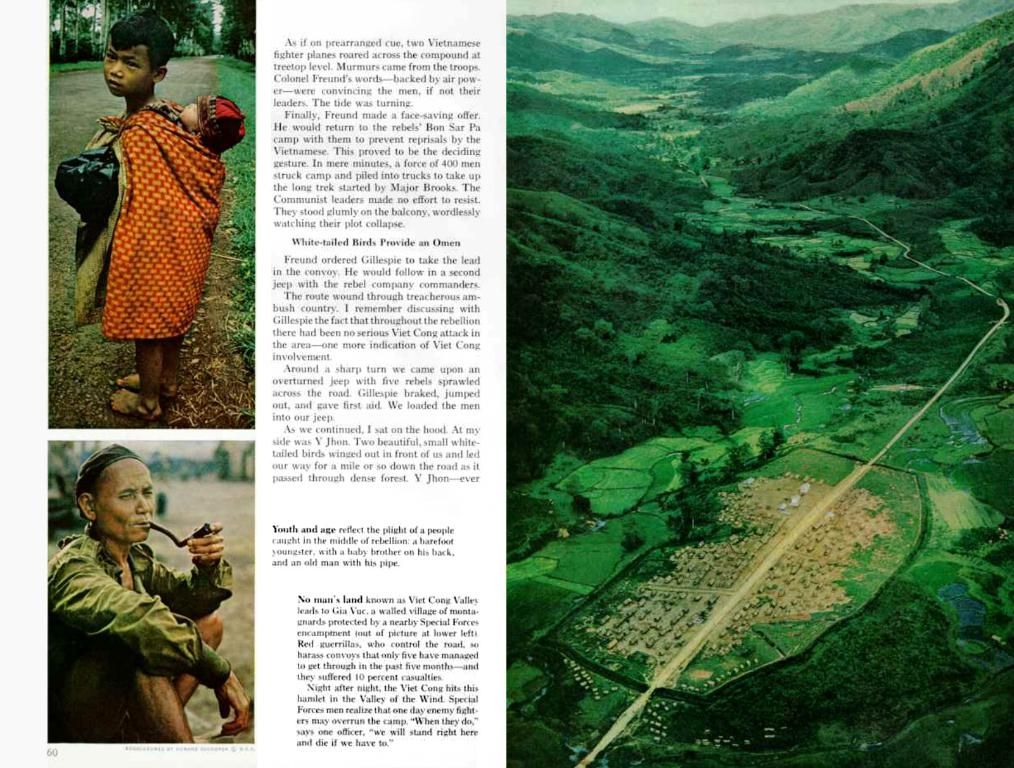

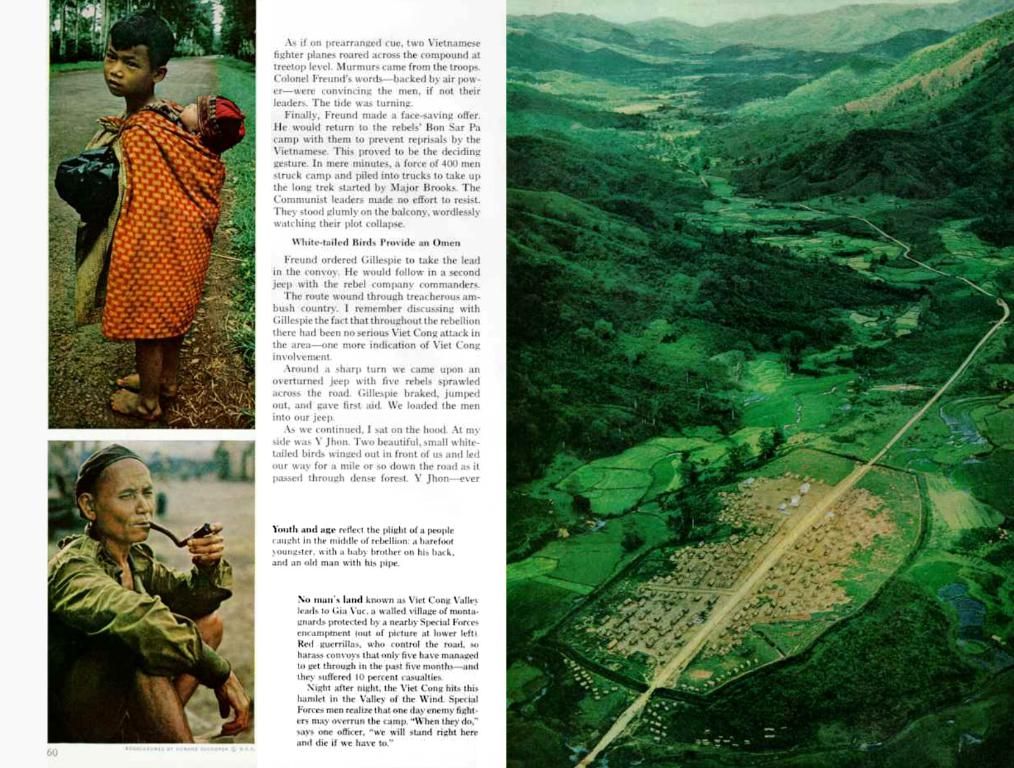

According to Tapiero, Bitcoin operates independently of political control that plagues traditional monetary systems. Amid trade tariffs and economic warfare, this decentralization entices investors to choose Bitcoin as a secure storage solution for value.

The Institutional Bitcoin Rush

With global economic risk levels escalating, institutional investments in Bitcoin are picking up pace. Hayes predicts that institutions, alongside individual investors, will opt for decentralized assets due to the escalation of money printing. The demand for Bitcoin is expected to soar because its transparent and predictable nature appeals more to users than centrally controlled fiat currencies.

Tapiero underlines Bitcoin's stability amid financial turmoil, making it a suitable tool for diversifying risks in portfolios. As trade disputes worsen, companies and asset managers are increasingly adopting Bitcoin investments, planning to enhance their allocation.

The Road Ahead for Bitcoin under Tariff Pressure

The trajectory of Bitcoin in the worldwide financial landscape is likely to be shaped by ongoing trade disagreements. Both experts agree that these disputes could reveal underlying weaknesses, leading to a shift in focus towards Bitcoin and other decentralized cryptocurrencies.

The broader macroeconomic backdrop, including monetary policy decisions and global trade tensions, will influence Bitcoin's direction. Current trends suggest that Bitcoin will maintain its status as a hedge instrument against economic instability.

In summary, despite the grueling effects of trade tensions and tariffs, Bitcoin's adoption remains buoyant due to its potential as a store of value, growing institutional adoption, and ongoing regulatory advancements. Yet, the broader cryptocurrency market—including altcoins—faces uncertainties owing to fluid regulatory and economic developments.

The two financial experts, Arthur Hayes and Dan Tapiero, suggest that Bitcoin's potential as a hedge against economic instability stemming from trade wars makes it an appealing option for investors seeking to preserve their economic value. As Bitcoin operates independently of political control, its decentralization appeals to investors looking for a secure storage solution amid economic warfare and rampant inflation. Moreover, the escalating global economic risk levels are driving institutional investments towards Bitcoin, as its transparent and predictable nature is preferred to centrally controlled fiat currencies.