The Central Bank acknowledges its belief in an impending surge in inflation.

If an image could represent a thousand thoughts, here's three thousand on the current economic status. First, utilizing the Personal Consumption Expenditures, a measure favored by the Federal Reserve for decision-making, inflation:

Moving on to gross national product, or GDP, representing the economic growth:

Lastly, the job market's health reflected in the unemployment rate:

Simply put, inflation is decreasing, economic growth is robust, and unemployment is at its lowest.

This appears like the so-called soft landing, where the economy remains stable without entering a recession. Everything seems good heading towards the end of the year.

However, things might not be as bright as depicted based on the most recent projections by the Federal Reserve.

On December 18, 2024, the Federal Open Market Committee, responsible for setting benchmark interest rates, announced a decrease in the federal funds rate by 0.25% (or 25 basis points).

Although markets anticipated this move, they were not prepared for the Fed's projections revealing their concerns about inflation starting to increase again.

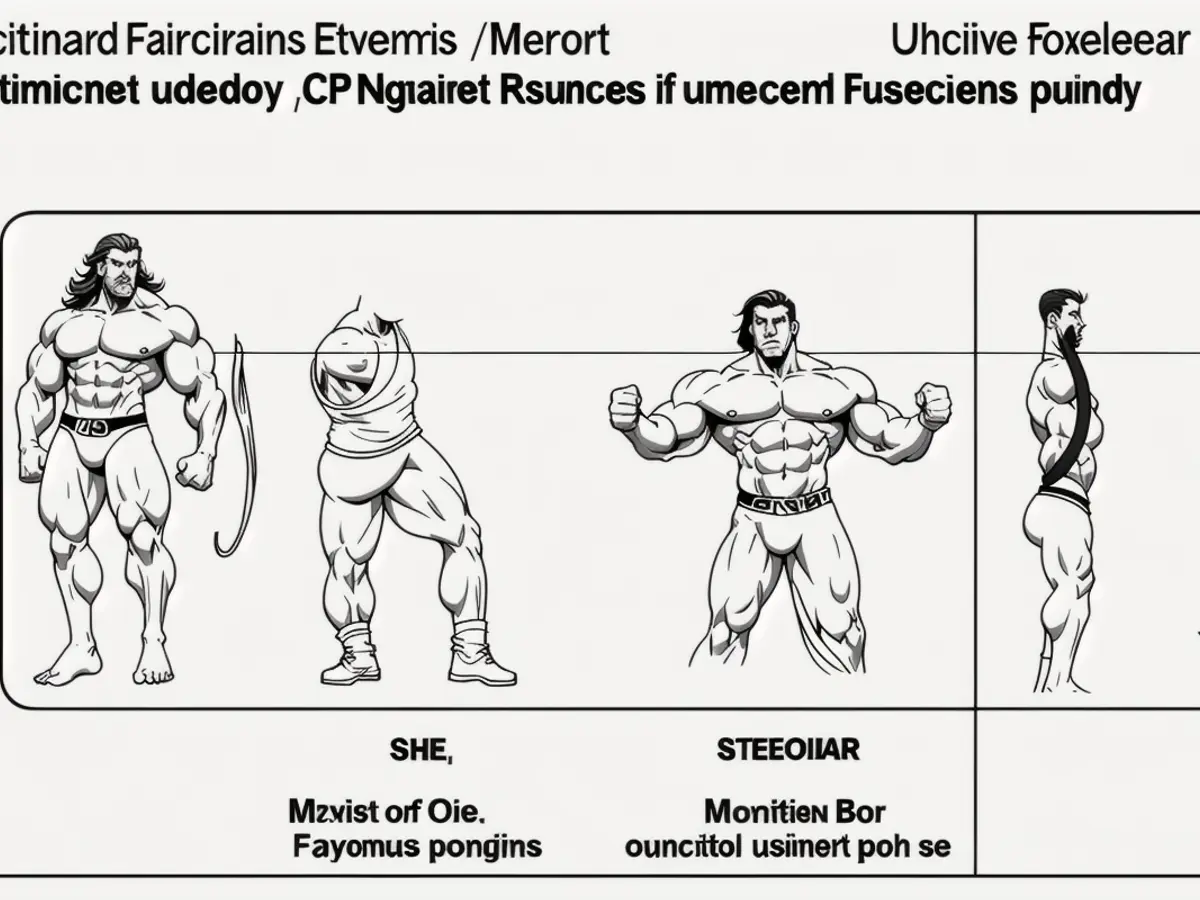

The table below summarizes these projections:

The numbers indicate that the Federal Reserve is worried that inflation will pick up again contrary to the trend of its decline, which started in September 2024 when price fluctuations began surging. A better way to grasp this is by comparing the organization’s projections from September and December to see the difference in their perspectives based on data analysis.

The Fed's projections represent the collective estimates of its officials. Here's some financial jargon to understand:

The median forecast means the middle value of the individual estimates submitted by Fed officials. The central tendency offers a broader perspective on the extent of these individual projections' variation. Finally, the range represents the lowest to highest projections made by individual officials. PCE inflation is a measure of inflation derived from the U.S. Bureau of Economic Analysis’s Personal Consumption Expenditures, while Core PCE inflation considers inflation minus changes in energy and food prices.

To illustrate, in September, the estimated median inflation (PCE) was 2.3% in 2024, 2.1% in 2025, and 2.0% in 2026 and 2027. The median estimate for Core PCE inflation was 2.6% in 2024, 2.2% in 2025, and 2.0% in 2026 and 2027.

However, the median inflation estimates for December were 2.4% in 2024, 2.5% in 2025, 2.1% in 2026, and 2.0% in 2027.

The central tendency for CPE inflation in September was 2.2% to 2.4% in 2024, 2.1% to 2.2% in 2025, and 2.0% in 2026 and 2027. By contrast, the December central tendency was 2.4% to 2.5% in 2024, 2.3% to 2.6% in 2025, 2.0% to 2.2% in 2026, and 2.0% in 2027.

The 2024 core inflation September central tendency was 2.6% to 2.7%; 2.1% to 2.3% for 2025, and 2.0% in 2026 and 2027. In December, however, 2024 core inflation ranged between 2.8% and 2.9%; 2025 was 2.5% to 2.7%; 2026 was 2.0% to 2.3%; and 2027 diminished to the Fed’s target of 2.0%.

The ranges offer a larger perspective of the central tendencies, and you can see the range in the chart.

These predictions will have significant repercussions next year. Look at the last section of the figures, which represents the federal funds rate. In September, the forecast was 4.4% in 2024, 3.4% in 2025, and 2.9% in 2026 and 2027. In December, the projections were 4.4% for 2024, 2.9% in 2025, 3.4% in 2026, and 3.1% in 2027. If these estimates turn out to be accurate, the federal funds rate will be higher by 0.5% compared to the forecast made in September, resulting in increased interest rates for consumers on cars, credit cards, and revolving credit. Businesses will also find credit more expensive. Furthermore, yields on the 10-year Treasury instruments will increase, making new or adjustable mortgages more expensive.

The Federal Reserve's recent economic projections indicate concerns about inflation starting to rise again, contradicting its previous trend of decrease. According to these projections, the median inflation estimate for 2024 increased from 2.3% in September to 2.4% in December.

Despite robust GDP growth and decreasing unemployment, the Federal Reserve's economic outlook for 2025 and beyond includes potential increases in inflation and interest rates, which could impact various sectors such as consumer loans, business credit, and housing markets.