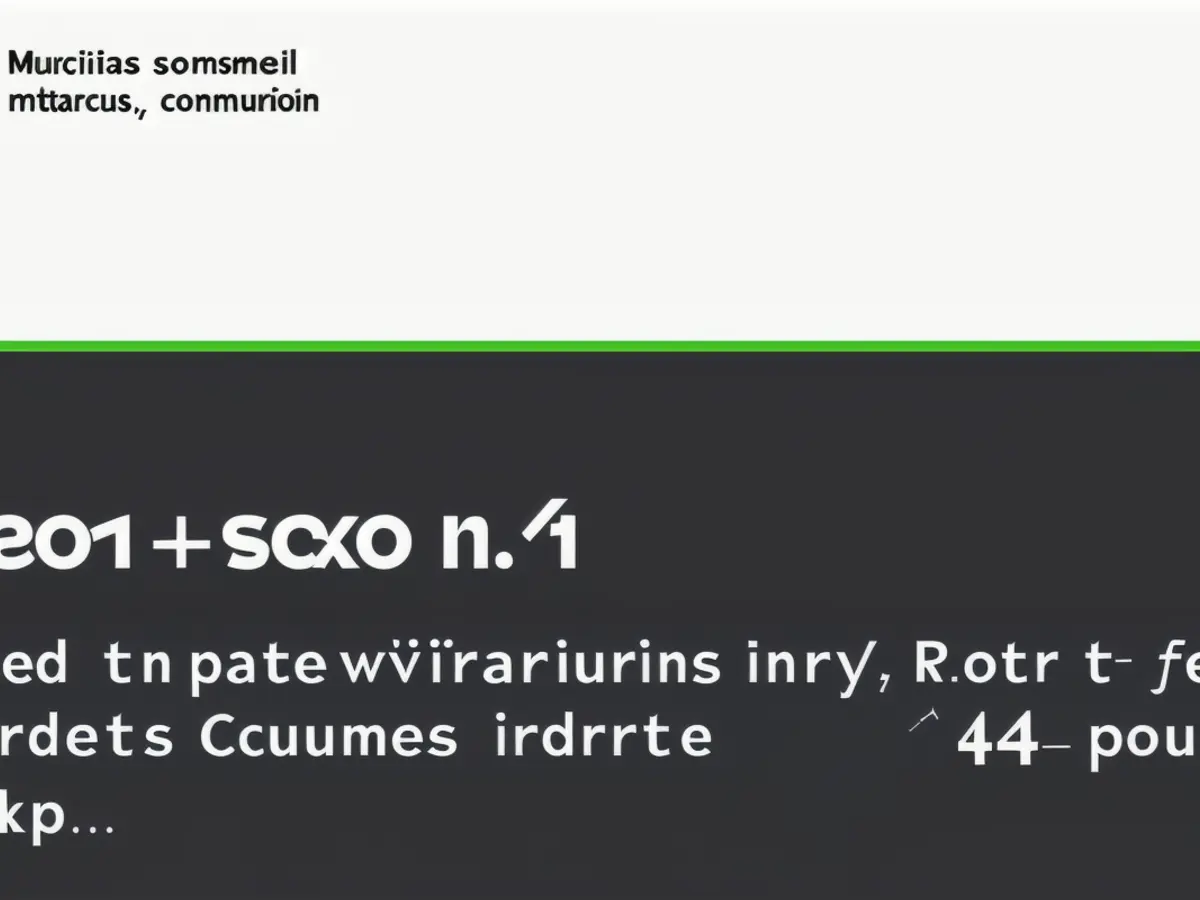

The Consumer Financial Protection Bureau Includes an Error Notification on its Main Website

Under the guidance of acting director Russell Vought, President Trump's Consumer Financial Protection Bureau (CFPB) has taken a drastic turn. This transformation, as reported over the weekend, involves a hammer-like approach, according to various sources. The most striking change is the appearance of an Internet 404 error message on the CFPB's homepage. While the rest of the page remains intact, the 404 error could mislead consumers, making them believe that essential resources or services are no longer available.

Despite reaching out to the agency for a response, I have yet to receive any confirmation before Sunday night. The CFPB's significance lies in its role as a watchdog for consumers, levying sanctions against financial companies and addressing consumer injuries. Established in 2010 in response to the financial crisis of 2007-2008 and the resulting Great Recession, the CFPB was authorized by Congress via the Dodd–Frank Wall Street Reform and Consumer Protection Act.

This move by the Trump administration is not unprecedented. Previous changes have included eliminating pronouns from government emails and removing resources associated with gender diversity. Additionally, NASA personnel have been directed to remove mentions of DEI, indigenous people, environmental justice, and women in leadership from their website. In 2017, searches on the White House website returned no results for certain terms, such as "LGBT," and the Office of National AIDS Policy's webpage was erased altogether.

The CFPB's 404 error message might seem minor in comparison to these more significant changes, such as the suspension of all activities, a funding cut, and the temporary closure of the CFPB headquarters, as reported by Reuters.

"This latest attempt to dismantle the consumer bureau is another blow to all Americans who rely on fundamental financial products and services," Dennis Kelleher, the head of Better Markets, which advocates for stricter government oversight of the financial sector, told Reuters.

According to Reuters, Vought issued a memo over the weekend ordering the cessation of all supervision and examination activities. On Saturday, he announced the temporary closure of the CFPB's Washington, D.C. headquarters from February 10 to 14, instructing employees and contractors to work remotely unless otherwise directed.

Vought also recently published a post on X, stating, "The CFPB has long been a woke and weaponized agency against disfavored industries and individuals. This must end." In another post, he announced the CFPB would not draw from its unappropriated funding, as he deemed it excessive in the current fiscal environment. However, it is inaccurate to claim that Congress did not fund the agency directly.

Under Vought's leadership, President Trump's CFPB, as mentioned in the memo, has ceased all supervision and examination activities. Visitors to the CFPB's website might notice an unexpected 404 error message, which could potentially mislead consumers about the availability of essential resources or services.