Title: Understanding a Company's Profitability with the Total Margin Financial Ratio

Evaluating a business' profitability can be accomplished in various ways, but one of the simplest methods is through the total margin ratio. This ratio shows a company's profitability in relation to the total revenue it generates. Here's how to calculate it and interpret the result.

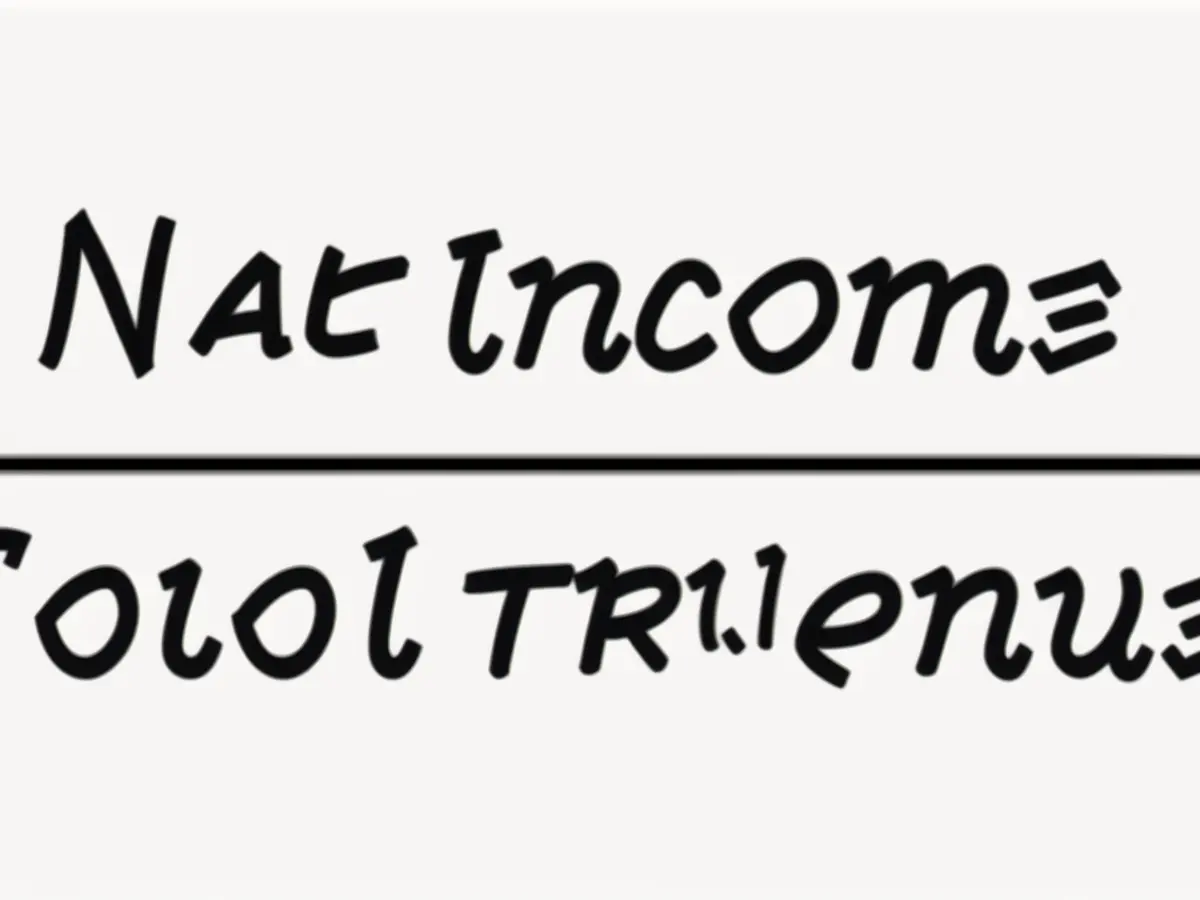

Calculating the Total Margin Ratio

First, determine the business' net income by subtracting its total expenses from its total revenue. Remember to account for all revenue, including operating and nonoperating revenue, and all expenses, even interest and taxes. The net income is your starting point.

Next, divide the net income by the total revenue and multiply the result by 100. This will give you the company's total margin ratio, a percentage that indicates its profitability. A positive percentage signifies a profitable business, while a negative percentage indicates a company operating at a loss.

Understanding the Enrichment Data

Three primary types of profit margins are essential to understand for calculating and interpreting the total margin ratio:

- Gross Profit Margin: Calculated by dividing gross profit (total revenue – cost of goods sold) by revenue and multiplying by 100. A high gross profit margin indicates the company manages production costs effectively or charges premium prices.

- Operating Profit Margin: Calculated by dividing operating profit (gross profit – operating expenses) by revenue and multiplying by 100. A high operating profit margin indicates the company effectively controls its core business expenses.

- Net Profit Margin: Calculated by dividing net profit (operating profit – taxes, interest, etc.) by revenue and multiplying by 100. A high net profit margin shows the company is profitable after accounting for all expenses.

To evaluate a business's profitability and identify areas for improvement, compare these margins. For instance, if the gross margin is high but the net margin is low, it might indicate high operating expenses or other nonoperating expenses reducing overall profitability.

Now you know how to calculate and interpret the total margin ratio as a simple yet effective way to assess a business's profitability.

After calculating the total margin ratio, investors might consider investing in companies with higher ratios as they are likely to generate more profits. By analyzing the net income, total revenue, and the resulting margin percentage, investors can make informed decisions regarding financing their portfolios.

Moreover, understanding the different profit margins, such as gross, operating, and net, can further enhance the financial analysis. For instance, companies with higher gross margins may be more successful in managing their production costs or pricing their products effectively, making them attractive investment opportunities in the finance sector.