Unveiling the Untaxed 7.8% Dividend's Potential Surge in 2025

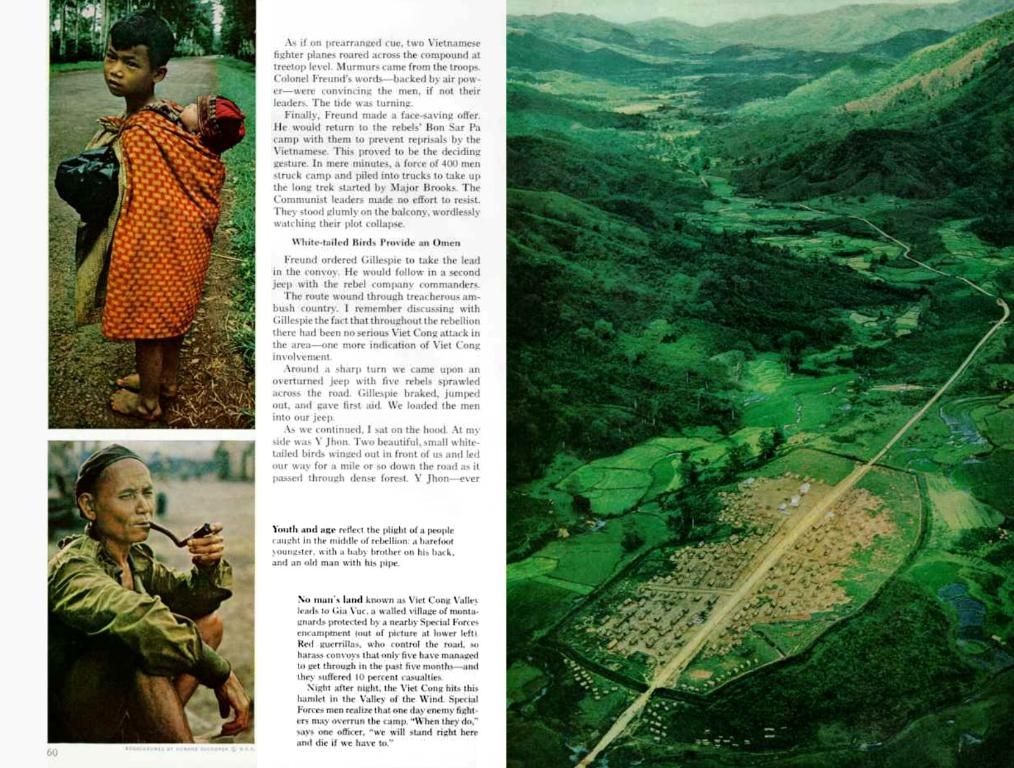

Breaking away from the family huddle on a Christmas Day festivity, you might have caught wind of an article that dissects the repercussions of Jay Powell's recent "hawkish cut" and its impact on high-yielding municipal bonds with a tax-free twist.

Let's dive into why this is a potent investment opportunity: Jay slashed interest rates by a quarter point in December but maintained a firm stance upon future rate cuts, cutting the 2025 forecast from four to just two. As expected, stocks had a momentary tantrum. However, the 10-year Treasury note yield, often dubbed the "long end" of the yield curve, surprisingly spiked.

In simpler terms, the Federal Reserve cut the rates but yielded higher interest. The bond market communicates clearly that the job on inflation isn't yet complete. Nonetheless, Powell appears to be listening, setting up an intriguing contrarian opportunity in municipal bonds.

Jay, the Adult in the Room, Triggering Muni-Bond Surge

We expect inflation and subsequent interest rates to climb under Trump's second-term. However, as contrarian investors, we're wary of the fact that when everyone anticipates something to occur, something else usually follows suit.

The unlikely chance of rates peaking and diving might just be the first investment surprise in 2025. While this scenario sounds far-fetched, a hawkish Powell is listening to the bond market buzz, potentially paving the way for municipal bonds to rise.

Muni-Bond CEFs: Your Steady Source of 7.8% Tax-Free Dividends

Munis are investment instruments issued by state and local governments for funding infrastructure projects. The charm of these bonds lies in the tax-free dividends, especially beneficial for top-bracket taxpayers. A 7.8% tax-free dividend from one of our coveted, low-priced CEFs equates to a taxable yield of 12.9% on a stock dividend.

Hopping on the Muni-Bond Bandwagon: Digging Deeper

The relationship between munis and the 10-year Treasury rate is palpable. When the treasury yields peak, muni-bond investors reap substantial rewards. A tax-free ETF with a meager 3% yield may not be an attractive option compared to the high-yielding municipal bond CEF we will explore next.

In the coming sections, we'll delve deeper into the high-yielding municipal bond CEF, its features, and why it is currently the best investment option for income-focused investors.

Notes:[1] Olson, R. (2019, December 19). What the Fed's new rate cuts mean for 10-year yields, stocks, and bonds. The Motley Fool. Retrieved from https://www.fool.com/education/terms/what-are-federal-reserve-feds-interest-rate-cuts.aspx[2] Olson, R. (2019, December 16). Federal Reserve to cut interest rates for first time since 2018. The Motley Fool. Retrieved from https://www.fool.com/investing/2019/12/16/federal-reserve-to-cut-interest-rates-for-first-tim.aspx[3] Brady, J. A. (2019, December 19). Stocks suffer worst day of the year as Fed makes highly anticipated rate cut, sets stage for policy shift. MarketWatch. Retrieved from https://www.marketwatch.com/story/stocks-suffer-from-worst-day-since-august-as-fed-on-track-to-deliver-first-rate-cut-in-10-years-2019-12-18[4] Miller, D.J., & Johnson, S.S. (2016). Municipal Bond Investing. CFA Institute Research Foundation.[5] Wealth Management (2020, February 26). Will tax policy changes impact municipal bonds? The Journal of Wealth Management. Retrieved from https://www.onlinejwm.com/sections/buying-and-selling-bonds/will-tax-policy-changes-impact-municipal-bonds/

Given the current interest rate environment and predictions of inflation under President Trump's second term, dividend investing in municipal bonds could prove to be a source of tax-free income. Despite Powell's hawkish stance on future rate cuts, the recent quarter point reduction has spiked the 10-year Treasury note yield, potentially indicating a contrarian opportunity in muni bonds. As the bond market suggests, the fight against inflation is ongoing, which could lead to an increase in interest rates and the appeal of high-yielding municipal bonds.