VTB's first-quarter net profit for 2025 experiences a significant 15% increase

💰 Here's the scoop on VTB Group's first-quarter earnings in 2025! 💰

VTB Group raked in a crazy 141.2 billion rubles in net profit during Q1 of 2025, which equals a whopping 20.9% return on capital. According to a VTB press release, this high profit level was achieved despite a squeeze on net interest margin and risk cost normalization. But wait, there's more! Positive vibes from securities operations gave them a significant boost.

VTB's First Deputy President, Dmitry Pyanov, spilled the beans on the bank's success. "You bet we're proud of this badass result! We planned it, and our trading strategy on geopolitical resolution played a big part in it. We made a killin' 233 billion rubles on this line, almost tripling the 2024 figure," he said.

Pyanov confirmed that this result met "planned expectations," and the annual profit target remains unchanged. However, he warned that this quarter might be the best for awhile, with the next two quarters likely taking a dip. But don't worry, they're still pumped about hitting that 430 billion ruble target and aren't backing down!

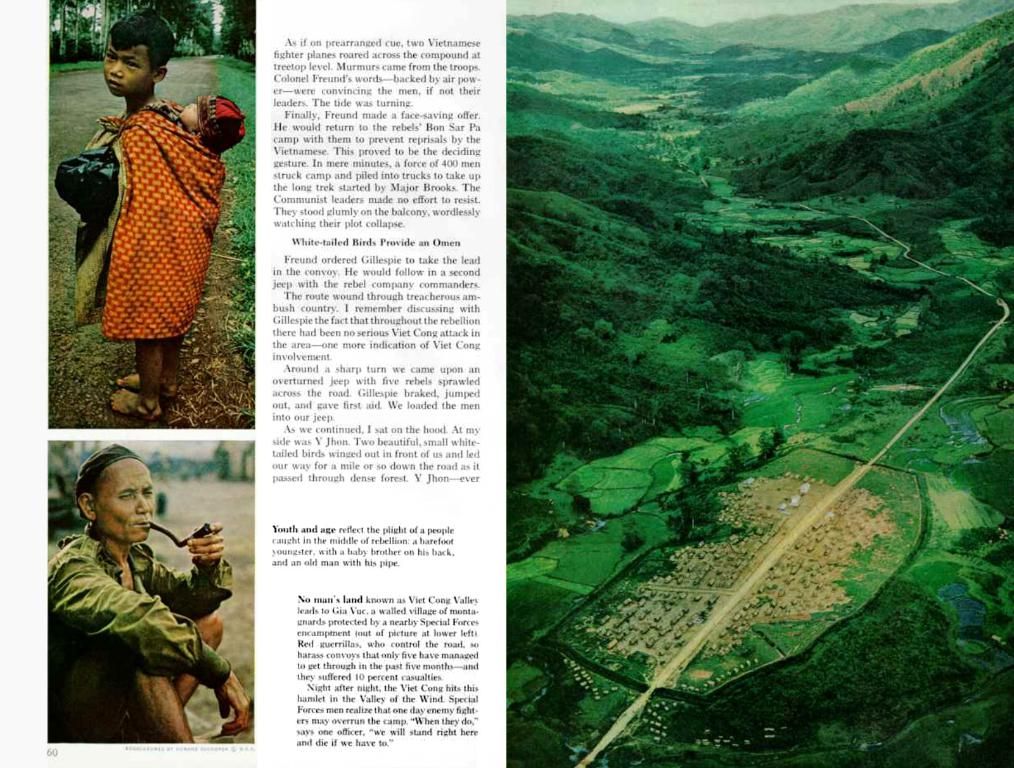

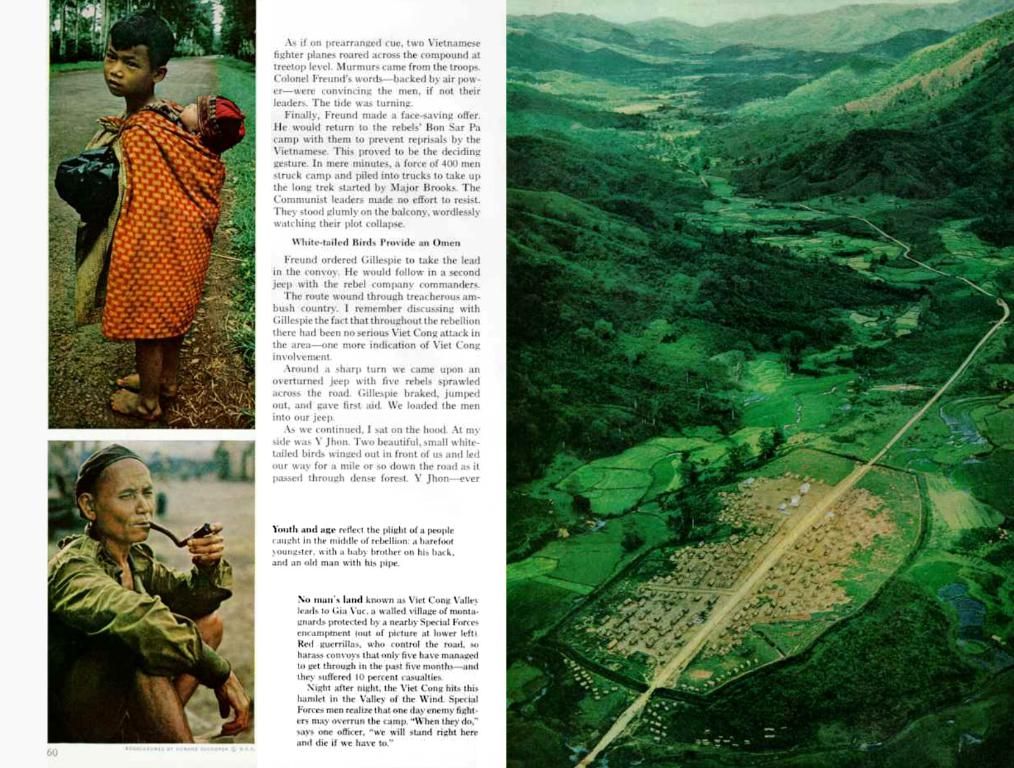

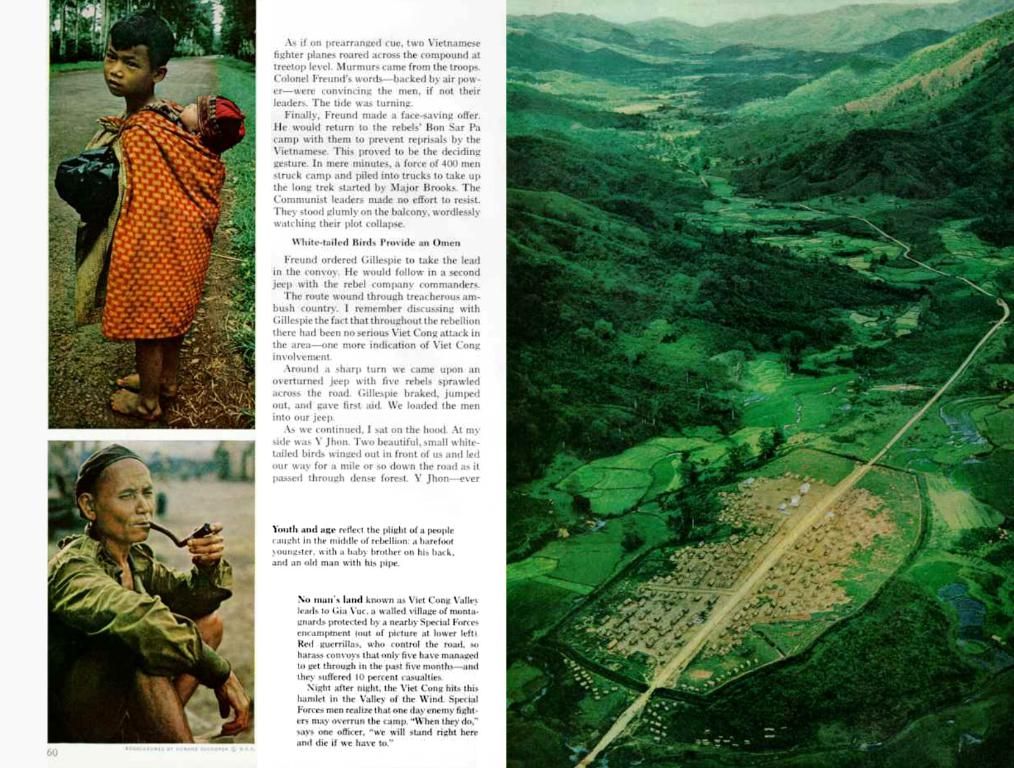

VTB's total credit portfolio increased by 0.6% to 23.9 trillion rubles. While loans to individuals decreased by 2.3% since the start of 2025, loans to legal entities grew by 2.0%, reaching 16.3 trillion rubles. Pyanov explained that they aimed to reduce the credit portfolio in the retail segment while boosting lending to legal entities, just as planned.

Capital adequacy ratios for VTB are looking rock-solid: N20.0 (total) - 9.9%, N20.1 (base) - 6.4%, and N20.2 (core) - 8.1%. Comparing this to the end of 2024, VTB has seen improvements in capital adequacy indicators at both the group and individual levels.

💡 Fun Fact: VTB's recent announcement of paying its first dividend since the Ukraine war isn't only good news for the bank, but also a positive signal for investor confidence in the Russian stock market. Stay tuned for more updates! 💡

📢 Keep up with the latest news on PrimaMedia's VK and Telegram channels, PrimaMedia.Primorye. Get the news faster than anyone else! 📢

- Despite a challenging environment, VTB Group managed to achieve a high level of profitability in Q1 of 2025, with a net profit of 141.2 billion rubles and a return on capital of 20.9%.

- Positive performance in securities operations and the bank's trading strategy on geopolitical resolution contributed significantly to VTB's impressive first-quarter earnings in 2025.

- VTB's First Deputy President, Dmitry Pyanov, stated that the bank made 233 billion rubles on this line, almost tripling the 2024 figure.

- The financial business of VTB Group shows signs of stability, with capital adequacy ratios for VTB improving upon the end of 2024, indicating a solid position for future business operations.

![Rest areas along highways offer minimal room for stationary trucks (Archive Photo) [Image]](/en/img/20250613133936_pexels-search-image-of-headline-text.jpeg)