Warner Bros. makes significant changes: division between streaming service and movie studio, dissociation from cable TV operations.

Facebook Twitter Whatsapp E-Mail Print Copy Link

The media giant Warner Bros Discovery is throwing a wrench into the status quo by separating their streaming service and film studio from the more predictable, yet challenging cable TV division. On Monday, the corporation made the announcement in bold letters, with the pay-TV channels HBO and the news channel CNN included in the mix.

This decision has been driven by a changing tide in the industry, as more people are ditching traditional TV for streaming services. Amidst rising pressure to produce appealing content and boost profits in streaming divisions, CEO David Zaslav will preside over the new streaming and film entity. Meanwhile, Gunnar Wiedenfels, the current CFO, will steer the ship of the cable TV division.

The separation aims to offer each division greater strategic flexibility and focus, allowing them to compete more fiercely in their respective markets. For instance, the "Streaming & Studios" unit, home to Warner Bros. Television, Motion Picture Group, DC Studios, HBO, and HBO Max, can channel its efforts into content creation and streaming growth, unencumbered by the decline of traditional cable networks. On the other hand, the "Global Networks" division, comprising CNN, TNT Sports, Discovery, and Discovery+, can put its energies into its core cable and free-to-air business.

Moreover, the streaming and studios arm is set to speed up investments in original content and technology to give stiff competition to streaming juggernauts like Netflix, Disney+, and Amazon Prime Video. Meanwhile, the Global Networks division may focus on wringing maximum profit from established cable and digital brands, potentially resorting to partnerships, licensing, or even sell-offs if market conditions turn sour.

The move echoes similar restructuring initiatives by rival companies like Comcast, who've separated their cable channels. Investors greeted the news warmly, as WBD shares surged by 8% on the announcement, indicating optimism about the strategic logic behind the split.

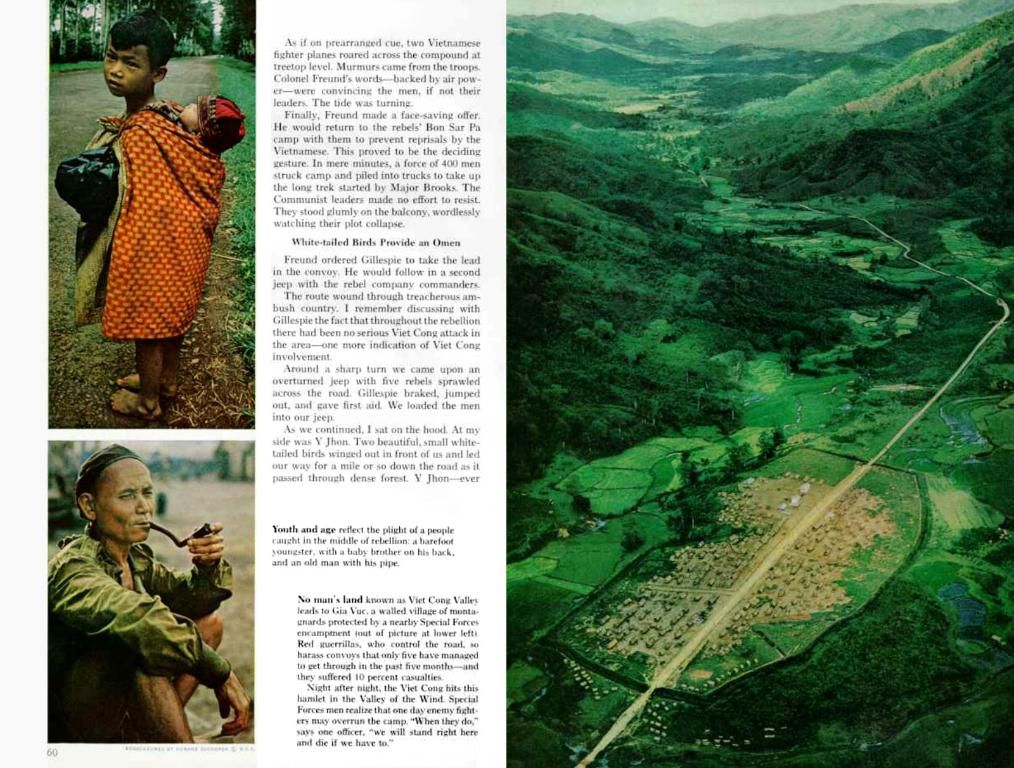

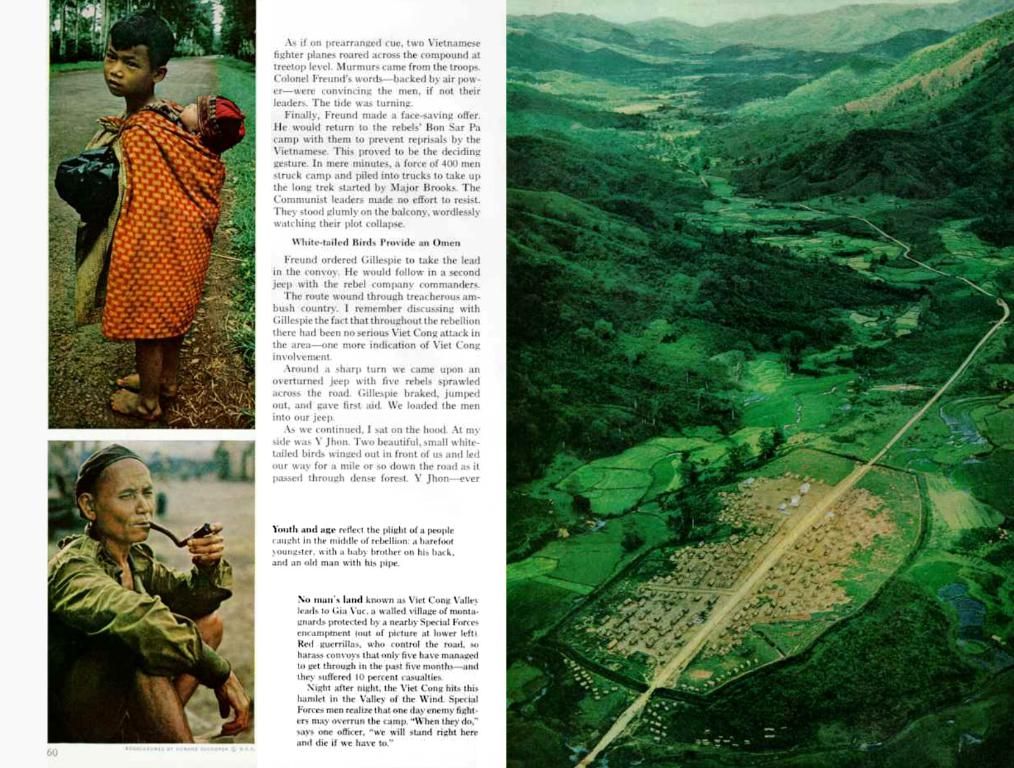

Viewers might see more targeted marketing, exclusive streaming content, or novel subscription options as the streaming arm strives to expand its audience. Cable TV consumers could experience fewer bundling options but may enjoy a more tailored programming lineup, catering to their specific interests. In essence, the restructuring seeks to differentiate premium content (like HBO and Warner Bros. films) from widespread cable and lifestyle programming (such as Discovery).

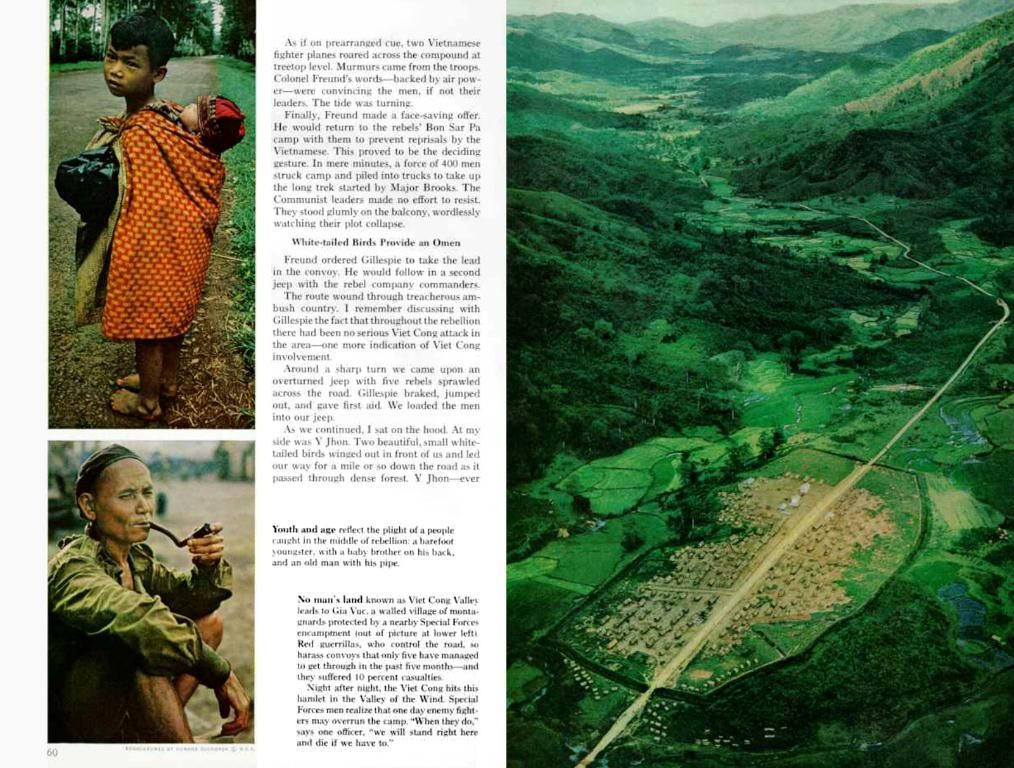

Lastly, Warner Bros. Discovery hopes to complete this tax-free transaction for U.S. federal income tax purposes, preserving value for shareholders and simplifying the transition. Both divisions will ultimately operate independently, opening the door for tailored investment strategies, partnerships, or future sales based on market dynamics.

The Commission, in its examination of the industry, finance, and business landscape, has also pondered the possibility of a reduction in the aid intensity of the aid provided to the streaming and studios division of Warner Bros. Discovery, with the aim of providing each division greater strategic flexibility and focus, allowing them to invest more in original content and technology, compete more fiercely, and achieve growth akin to streaming juggernauts like Netflix, Disney+, and Amazon Prime Video. Gunnar Wiedenfels, the current CFO overseeing the cable TV division, may need to pursue strategic partnerships, licensing, or even sell-offs if market conditions prove challenging, in an effort to wring maximum profit from established cable and digital brands within the Global Networks division.