What constitutes a Business Registration Number and its significance for businesses?

Registering Your Business: Obtaining a Business Registration Number (BRN)

A Business Registration Number (BRN) is a unique identifier assigned to businesses by government agencies, serving as an essential tool for legal, administrative, and tax purposes. Here's a step-by-step guide on how to obtain a BRN in various jurisdictions.

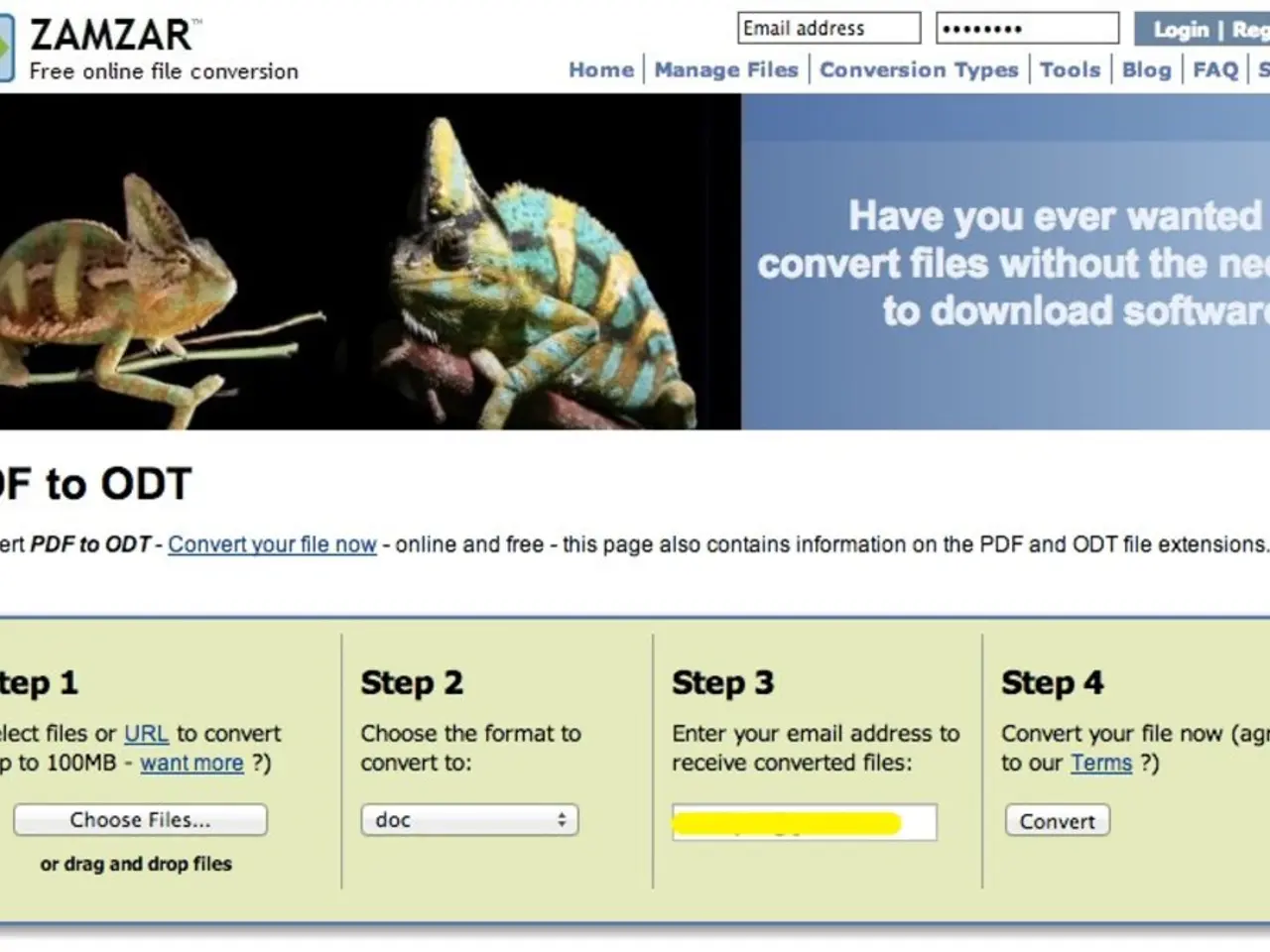

Step 1: Determine the Business Structure

Decide on the legal structure of your business, whether it's a sole proprietorship, partnership, corporation, or another form. Each structure affects the registration process.

Step 2: Prepare and Submit Registration Documents

File the required formation or registration documents with the appropriate government authority. These documents may include incorporation forms, partnership agreements, or sole proprietorship declarations.

Step 3: Pay Registration Fees

Submit any required registration fees, which can vary by jurisdiction and business type.

Step 4: Appoint a Registered Agent (if applicable)

Some regions require designating an agent to receive legal and tax documents on behalf of the business.

Step 5: Receive the Business Registration Number

Upon approval, the government issues the BRN, which is often printed on your Business Registration Certificate or related documents.

Jurisdiction-Specific Details

- Hong Kong: Businesses must register within one month of starting operations, using prescribed forms like Form 1(a) or 1(b), often submitted online via GovHK. The Inland Revenue Department (IRD) issues an 8-digit BRN serving as the company’s Tax Identification Number (TIN).

- United States (General example): Business owners file formation documents (e.g., Articles of Incorporation or LLC Operating Agreement) with their state’s Secretary of State office and pay applicable fees. After approval, the state issues a Business Registration Number (or its equivalent like an Employer Identification Number).

Maintaining Your BRN

A BRN is mandatory if you have employees. Any changes in business details must be notified to the relevant authorities promptly. Business registration isn't the same as forming an LLC. Official correspondence like tax notices often includes the BRN.

Finding Your BRN

To locate your BRN, check the confirmation documents you received after business registration. If you've applied for an EIN, your IRS confirmation letter or tax returns may show the BRN. Many states offer online tools for an Ein Number Search by company name, which can help find the BRN.

BRN vs. EIN

It's important to comprehend the differences between BRN and EIN to manage your business's legal and financial responsibilities effectively. While a BRN serves as an official ID for various legal and financial activities, an EIN is issued by the IRS particularly for tax purposes. A BRN is mandatory, while an EIN is optional for certain businesses.

In summary, obtaining a BRN is a crucial step in registering your business and maintaining its legal and financial standing. By following the steps outlined above and understanding the differences between BRN and EIN, you can ensure your business remains compliant with regulations and can operate smoothly.

- In the world of personal-finance and business, understanding the differences between a Business Registration Number (BRN) and an Employer Identification Number (EIN) is essential for effective financial management, as each serves distinct purposes in legal and financial activities.

- If you're considering venturing into defi, it's crucial to note that registration and obtaining a BRN are necessary for your business to comply with financial regulations, ensuring smooth operation and avoiding potential legal issues.

- The process of registering your business involves several steps, including determining the business structure, preparing and submitting registration documents, paying fees, appointing a registered agent (if applicable), and receiving the BRN, which serves as a vital identifier for tax, legal, and administrative purposes.