Unleashing Your Pension Freedom: Breakdown of Tax-Free Pension Income

- By Nadine Oberhuber

- 2 Min

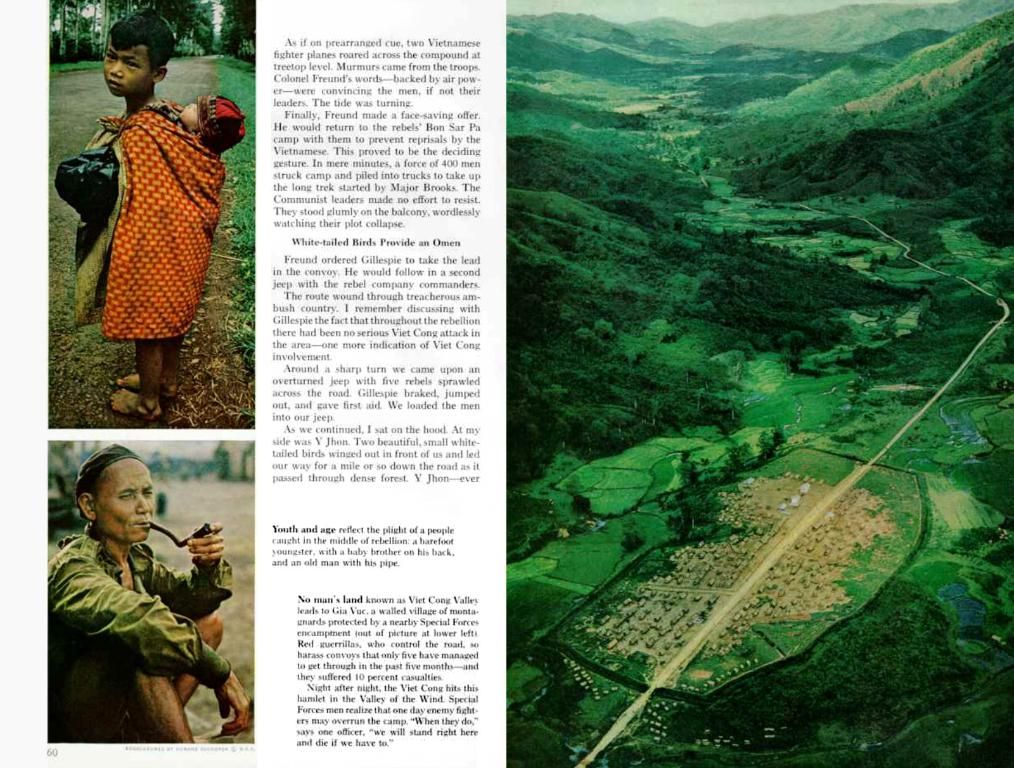

Determining tax-exempt pension amount for you. - What's the pension exemption amount I qualify for?

Step into the world of retirement with us as we delve into the intricacies of tax-free pension income and what you can expect in 2024 and beyond!

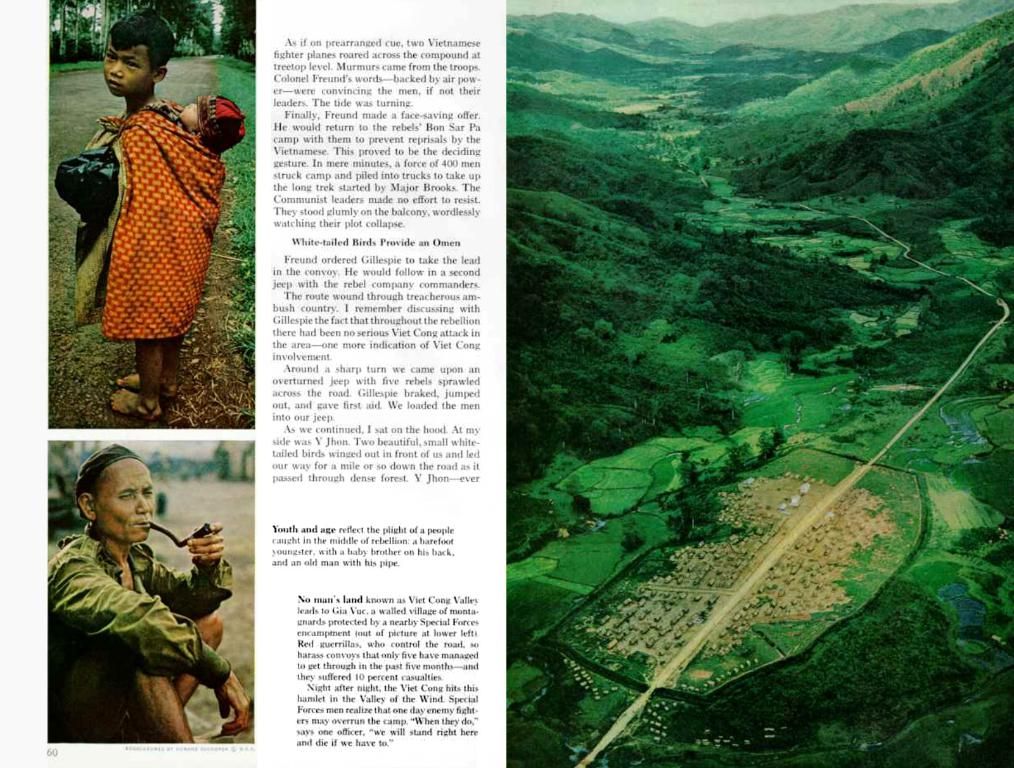

In the upcoming year, new retirees can relish in 16,243 euros in annual tax-free pension income. But where do the numbers stack up for couples? That's right – it's double! However, it's essential to remember that these numbers are subject to annual adjustments due to the evolving pension tax landscape.

Older retirees, those who started receiving their pension in 2005, have even higher tax-free allowances, with up to 19,758 euros exempt from tax. This flexibility is a direct result of gradual adjustments to pension taxation initiated in 2005, with plans to introduce full taxation only in 2058, as per the Growth and Chance Act.

Pension Taxation: Beyond the Basics

Now, you might be wondering, "When do I need to file a tax return?"

Simply put, if your pension income exceeds the annual tax-free allowance, you'll need to pay a visit to the tax office. In 2024, that translates to 11,604 euros, while the current year's threshold is 12,084 euros. Tax rates for pensioners are expected to be lower, offering a potential tax advantage for savers.

Bridging the Gap: Encouraging Private Savings

This regulation aims to level the playing field in retirement savings, motivating younger people to save privately. By setting the stage for tax-exempt contributions during their working years and taxing only the retirement withdrawals, the government hopes to foster a culture of private savings.

Beyond the Basics: Enriched Insights

For new retirees in 2024, it's vital to understand a few key components of their tax-free allowances:

- Tax-Free Lump Sum (PCLS): Up to 25% of a pension pot can be taken as a tax-free lump sum. However, a new overall limit, the Lump Sum Allowance (LSA), takes effect in April 2024 (£268,275).

- Annual Allowance: This is the amount one can contribute towards their pension each year with tax relief, currently £60,000. Exceeding certain thresholds or utilizing flexible access may lower the limit to £10,000.

- Lump Sum and Death Benefit Allowance (LSDBA): This limit caps the total tax-free lump sums (including certain death benefits) at £1,073,100 across all pensions.

Older retirees may have enjoyed different tax-free allowances prior to April 2024. The new LSA and LSDBA limits apply to all retirees but are adjusted based on pre-April 2024 tax-free amounts[5].

The introduction of the LSA and LSDBA in April 2024 will provide a clear framework for new retirees. Older retirees, however, may need to evaluate how their previous withdrawals impact their current tax-free allowances, possibly by seeking a Transitional Tax-Free Amount Certificate (TTFAC)[5].

Stay informed and plan for your golden years with confidence, understanding the nuances of tax-free pension income!

- Tax

- Pension taxation

- New retirees

- BMF

- To ensure a smooth transition into the tax-free pension income landscape for new retirees in 2024, it is crucial to familiarize oneself with community policies, particularly employment policies, that affect personal-finance, such as the introduction of the Lump Sum Allowance (LSA) and the Lump Sum and Death Benefit Allowance (LSDBA) in April 2024.

- In tandem with the intricacies of pension taxation, it is equally important for new retirees to understand the ramifications of the new tax regulations on their employment policies, particularly in regard to the Tax-Free Lump Sum (PCLS), Annual Allowance, and LSDBA limits, as these factors will significantly impact their financial well-being and retirement planning strategies.